Enlarge image

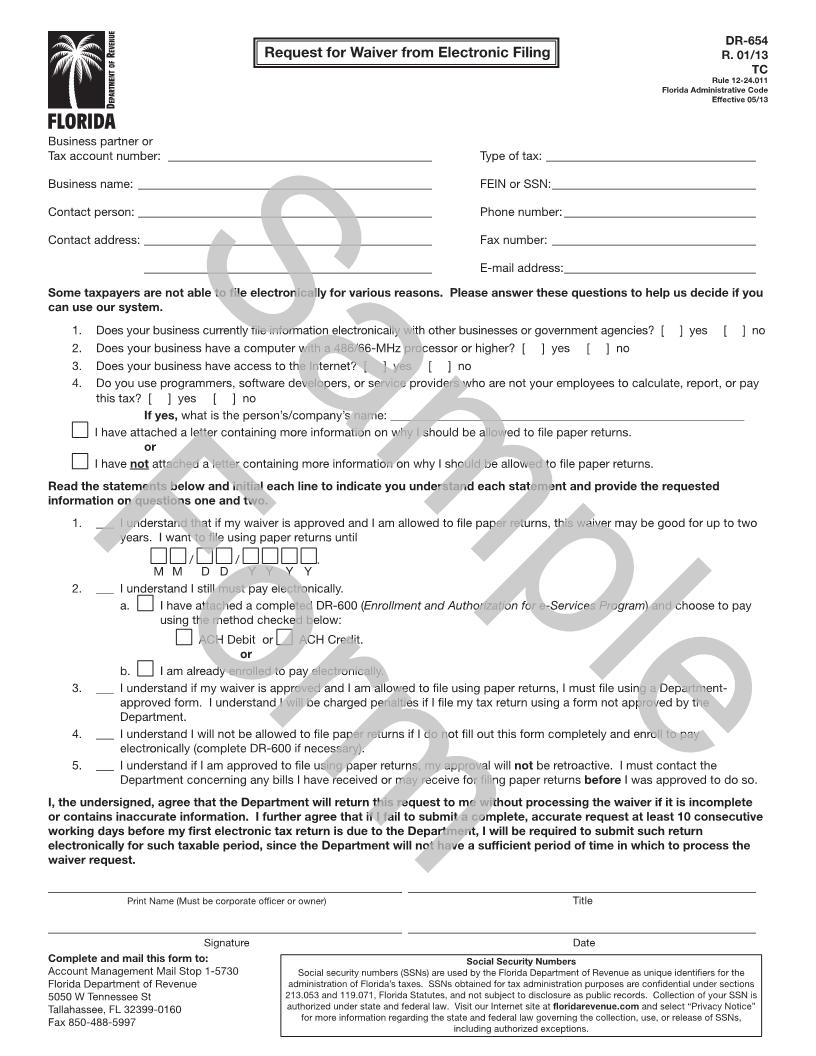

DR-654

Request for Waiver from Electronic Filing R. 01/13

TC

Rule 12-24.011

Florida Administrative Code

Effective 05/13

Business partner or

Tax account number: ____________________________________________ Type of tax: ___________________________________

Business name: _________________________________________________ FEIN or SSN: __________________________________

Contact person: _________________________________________________ Phone number: ________________________________

Contact address: ________________________________________________ Fax number: __________________________________

________________________________________________ E-mail address: ________________________________

Some taxpayers are not able to file electronically for various reasons. Please answer these questions to help us decide if you

Sample

can use our system.

1. Does your business currently file information electronically with other businesses or government agencies? [ ] yes [ ] no

2. Does your business have a computer with a 486/66-MHz processor or higher? [ ] yes [ ] no

3. Does your business have access to the Internet? [ ] yes [ ] no

4. Do you use programmers, software developers, or service providers who are not your employees to calculate, report, or pay

this tax? [ ] yes [ ] no

If yes, what is the person’s/company’s name: ___________________________________________________________

I have attached a letter containing more information on why I should be allowed to file paper returns.

or

I have not attached a letter containing more information on why I should be allowed to file paper returns.

Read Formthe statements below and initial each line to indicate you understand each statement and provide the requested

information on questions one and two.

1. ___ I understand that if my waiver is approved and I am allowed to file paper returns, this waiver may be good for up to two

years. I want to file using paper returns until

/ / .

M M D D Y Y Y Y

2. ___ I understand I still must pay electronically.

a. I have attached a completed DR-600 (Enrollment and Authorization for e-Services Program) and choose to pay

using the method checked below:

ACH Debit or ACH Credit.

or

b. I am already enrolled to pay electronically.

3. ___ I understand if my waiver is approved and I am allowed to file using paper returns, I must file using a Department-

approved form. I understand I will be charged penalties if I file my tax return using a form not approved by the

Department.

4. ___ I understand I will not be allowed to file paper returns if I do not fill out this form completely and enroll to pay

electronically (complete DR-600 if necessary).

5. ___ I understand if I am approved to file using paper returns, my approval will not be retroactive. I must contact the

Department concerning any bills I have received or may receive for filing paper returns before I was approved to do so.

I, the undersigned, agree that the Department will return this request to me without processing the waiver if it is incomplete

or contains inaccurate information. I further agree that if I fail to submit a complete, accurate request at least 10 consecutive

working days before my first electronic tax return is due to the Department, I will be required to submit such return

electronically for such taxable period, since the Department will not have a sufficient period of time in which to process the

waiver request.

___________________________________________________________ __________________________________________________________

Print Name (Must be corporate officer or owner) Title

___________________________________________________________ __________________________________________________________

Signature Date

Complete and mail this form to: Social Security Numbers

Account Management Mail Stop 1-5730 Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the

Florida Department of Revenue administration of Florida’s taxes. SSNs obtained for tax administration purposes are confidential under sections

5050 W Tennessee St 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is

Tallahassee, FL 32399-0160 authorized under state and federal law. Visit our Internet site at floridarevenue.com and select “Privacy Notice”

Fax 850-488-5997 for more information regarding the state and federal law governing the collection, use, or release of SSNs,

including authorized exceptions.