Enlarge image

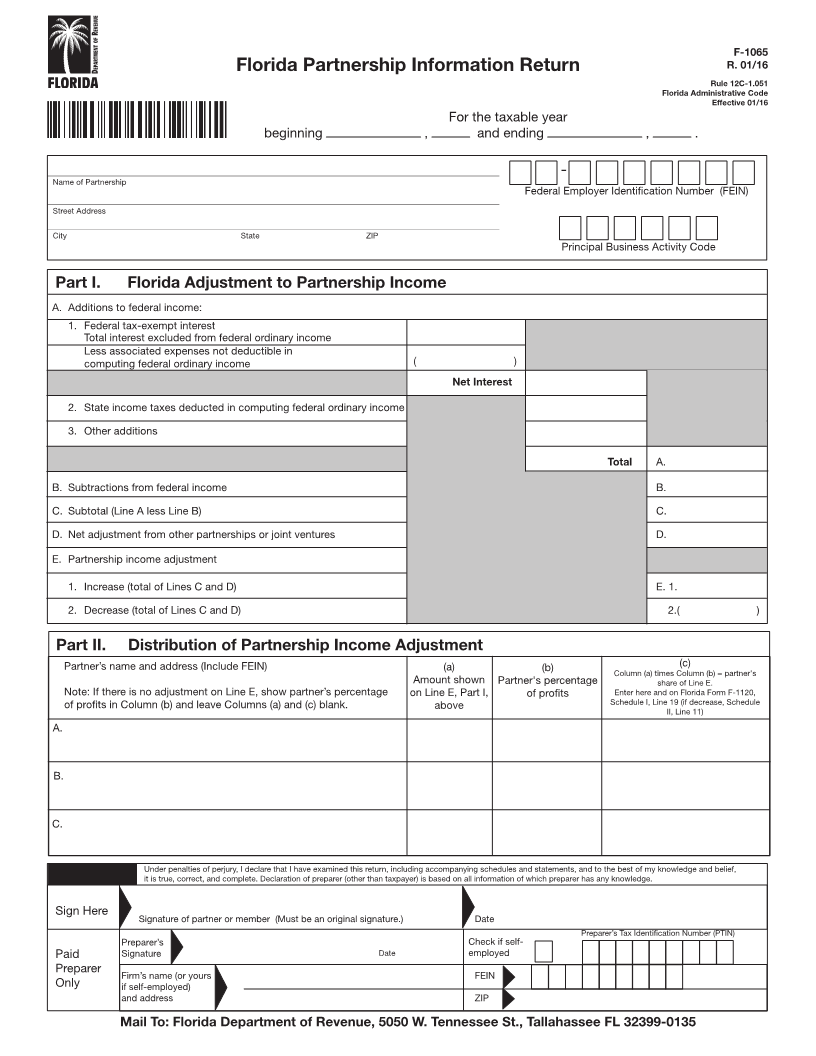

F-1065

Florida Partnership Information Return R. 01/16

Rule 12C-1.051

Florida Administrative Code

Effective 01/16

For the taxable year

beginning , and ending , .

_________________________________________________________________________________________________________________ -

Name of Partnership

Federal Employer Identification Number (FEIN)

_________________________________________________________________________________________________________________

Street Address

_________________________________________________________________________________________________________________

City State ZIP

Principal Business Activity Code

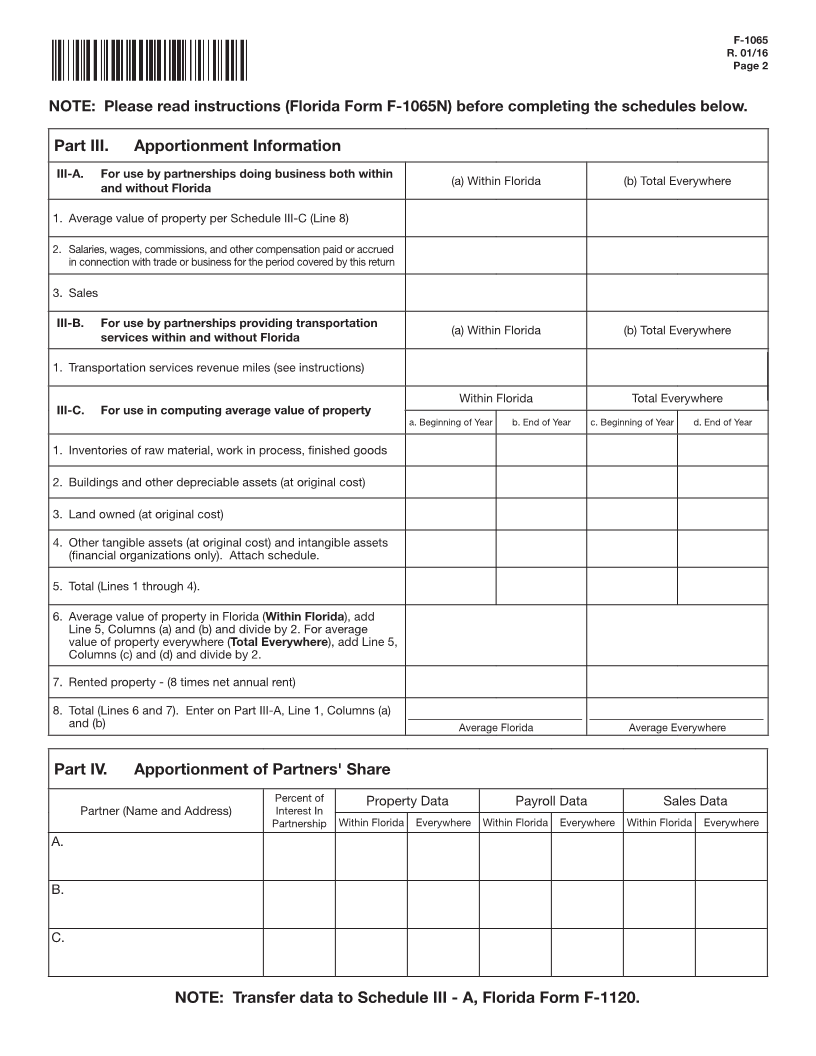

Part I. Florida Adjustment to Partnership Income

A. Additions to federal income:

1. Federal tax-exempt interest

Total interest excluded from federal ordinary income

Less associated expenses not deductible in

computing federal ordinary income ( )

Net Interest

2. State income taxes deducted in computing federal ordinary income

3. Other additions

Total A.

B. Subtractions from federal income B.

C. Subtotal (Line A less Line B) C.

D. Net adjustment from other partnerships or joint ventures D.

E. Partnership income adjustment

1. Increase (total of Lines C and D) E. 1.

2. Decrease (total of Lines C and D) 2.( )

Part II. Distribution of Partnership Income Adjustment

Partner’s name and address (Include FEIN) (a) (b) (c)

Column (a) times Column (b) = partner's

Amount shown Partner's percentage share of Line E.

Note: If there is no adjustment on Line E, show partner’s percentage on Line E, Part I, of profits Enter here and on Florida Form F-1120,

of profits in Column (b) and leave Columns (a) and (c) blank. above Schedule I, Line 19 (if decrease, Schedule

II, Line 11)

A.

B.

C.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief,

it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign Here

Signature of partner or member (Must be an original signature.) Date

Preparer’s Tax Identification Number (PTIN)

Preparer’s Check if self-

Paid Signature Date employed

Preparer Firm’s name (or yours FEIN

Only if self-employed)

and address ZIP

Mail To: Florida Department of Revenue, 5050 W. Tennessee St., Tallahassee FL 32399-0135