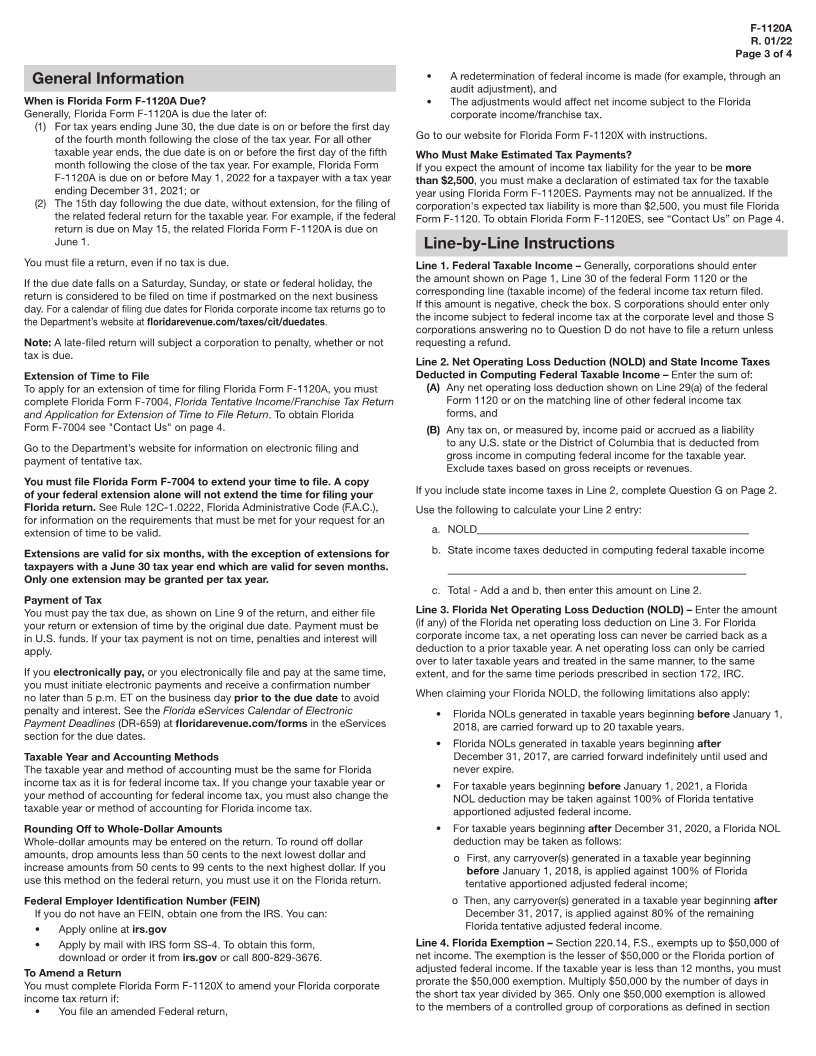

Enlarge image

F-1120A

Florida Corporate Short Form R. 01/22

Rule 12C-1.051, F.A.C.

Income Tax Return Effective 01/22

Page 1 of 4

For tax year beginning on

or after January 1, 2022 Where to Send Payments and Returns

FEIN:

Make check payable to and mail with return to:

Taxable Year End: Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0135

If you are requesting a refund (Line 9b), send your

return to:

Florida Department of Revenue

PO Box 6440

Tallahassee FL 32314-6440

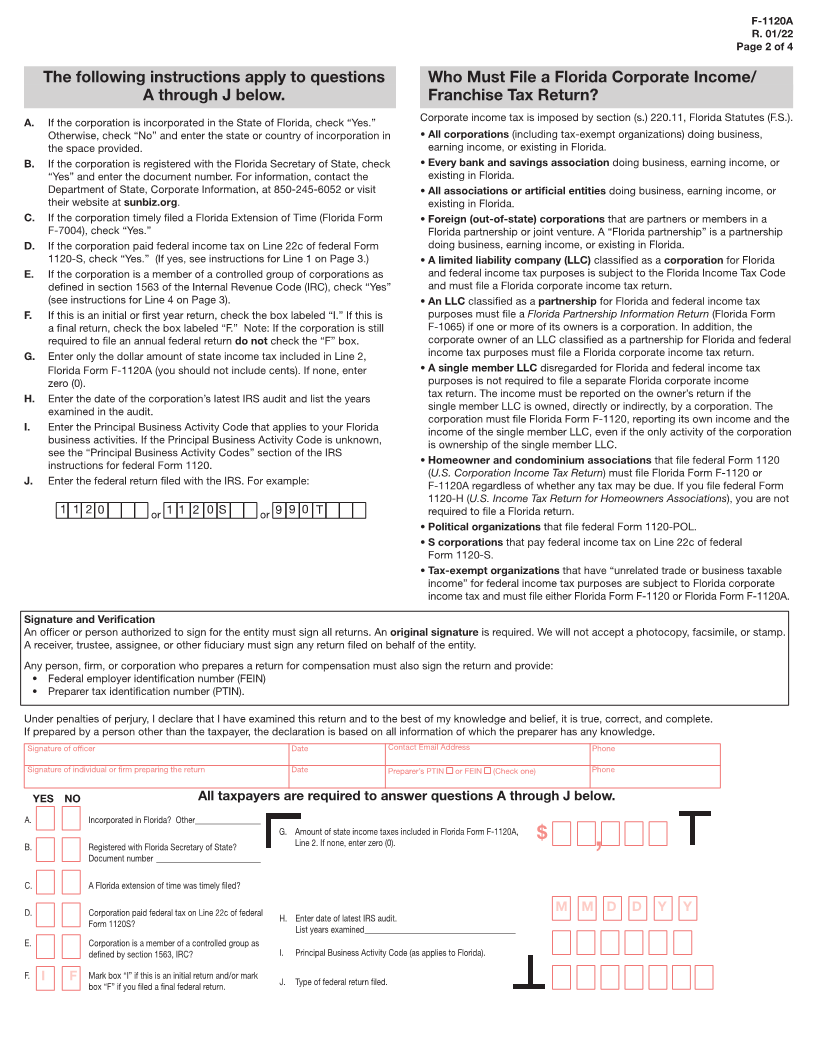

Online Filing Application for Florida Form F-1120A Who May File a Florida Corporate Short Form

(Florida Form F-1120A)?

We encourage Florida Corporate Short Form (Florida

Corporations or other entities subject to Florida corporate income tax must file a

Form F-1120A) filers to use the Department’s online Florida Corporate Income/Franchise Tax Return (Florida Form F-1120) unless they

filing application. The software application will guide you qualify to file a Florida Corporate Short Form Income Tax Return (Florida Form

through the process. Go to the Department's website at F-1120A).

A corporation qualifies to file Florida Form F-1120A if it meets ALL of the following

floridarevenue.com for more information, to register, and criteria:

to enroll for e-Services. • It has Florida net income of $45,000 or less.

• It conducts 100% of its business in Florida.

• It does not report any additions to and/or subtractions from federal taxable

income other than a net operating loss deduction and/or state income taxes,

if any.

• It is not included in a Florida or federal consolidated corporate income tax return.

• It claims no tax credits other than tentative tax payments or estimated tax

payments.

Florida Form F-1120A is a machine-readable form. Please follow the instructions. Use black ink.

If hand printing this document, print your numbers as shown If typing this document, type through the boxes and type all

and write one number per box. Write within the boxes. 0 1 2 3 4 5 6 7 8 9 of your numbers together. 0123456789

U.S. DOLLARS CENTS

Check here if negative Florida Corporate Short Form F-1120A

1. Federal

taxable Income Tax Return R. 01/22

income , , Mail coupon only.

2. Plus (+) Federal Keep top portion for your records.

NOLD + state

income tax , ,

3. Less (-)

Florida NOLD

, , Name

4. Less (-) Florida exemption Address

City/St/ZIP

Check here if negative ,

5. Equals (=)

Florida net If Line 5 is zero “0” or DOR USE ONLY

income , , less, enter “0” on Line 6.

6. Tax due: If this amount is $2,500 or greater,

3.535% of Line 5 , you cannot file Form F-1120A.

7. Less (-)

Payment credits FEIN

,

8. Plus (+) Taxable Year Beginning Taxable Year End

Penalty and interest (See instructions)

Check here if negative , M M D D Y Y M M D D Y Y

9. Total amount due or overpayment

(Complete Line 9a or 9b for overpayments)

, REMEMBER TO COMPLETE THE BACK OF THE FORM

9a CREDIT 9b REFUND

9100 0 20229999 0002005043 2 3999999999 0000 2