Enlarge image

DR-15N

R. 01/24

Instructions for Rule 12A-1.097, F.A.C.

Effective 01/24

Page 1 of 8

DR-15

Sales and Use Tax Returns

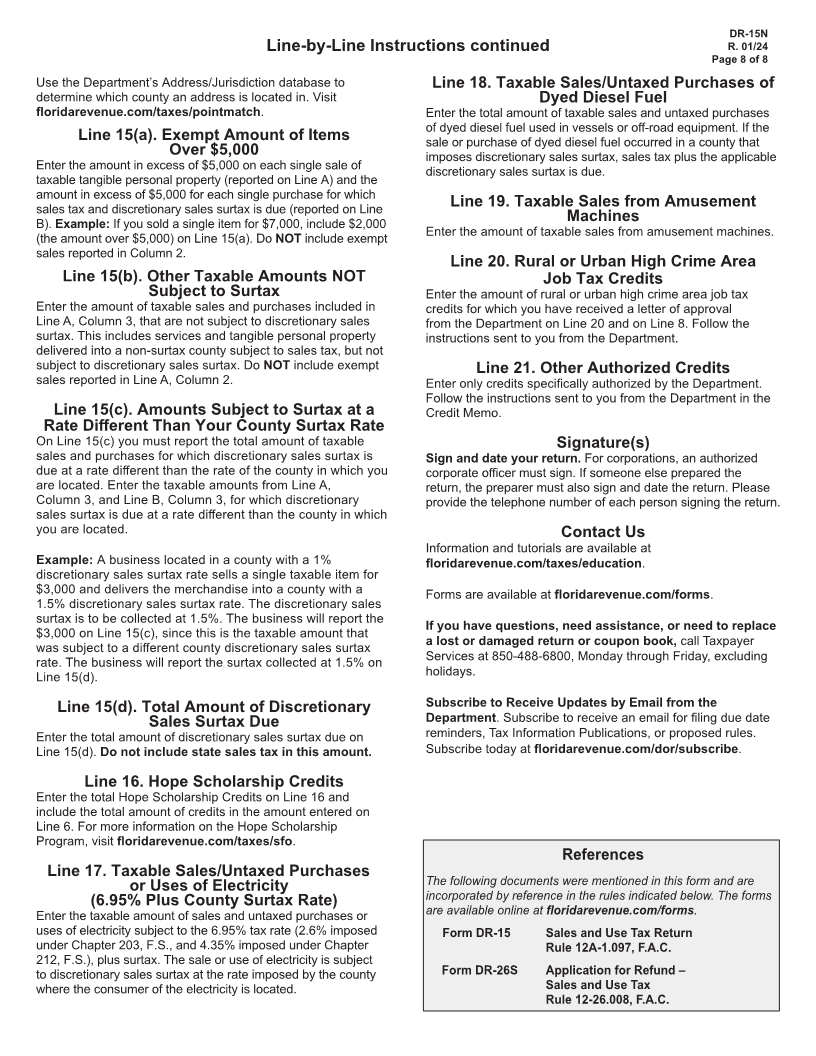

DOR credit memos and estimated tax (Line 8)

Lawful deductions (Line 6) cannot cannot be more than net tax due (Line 7).

be more than tax due (Line 5).

Certificate Number: Sales and Use Tax Return HD/PM Date: / / DR-15

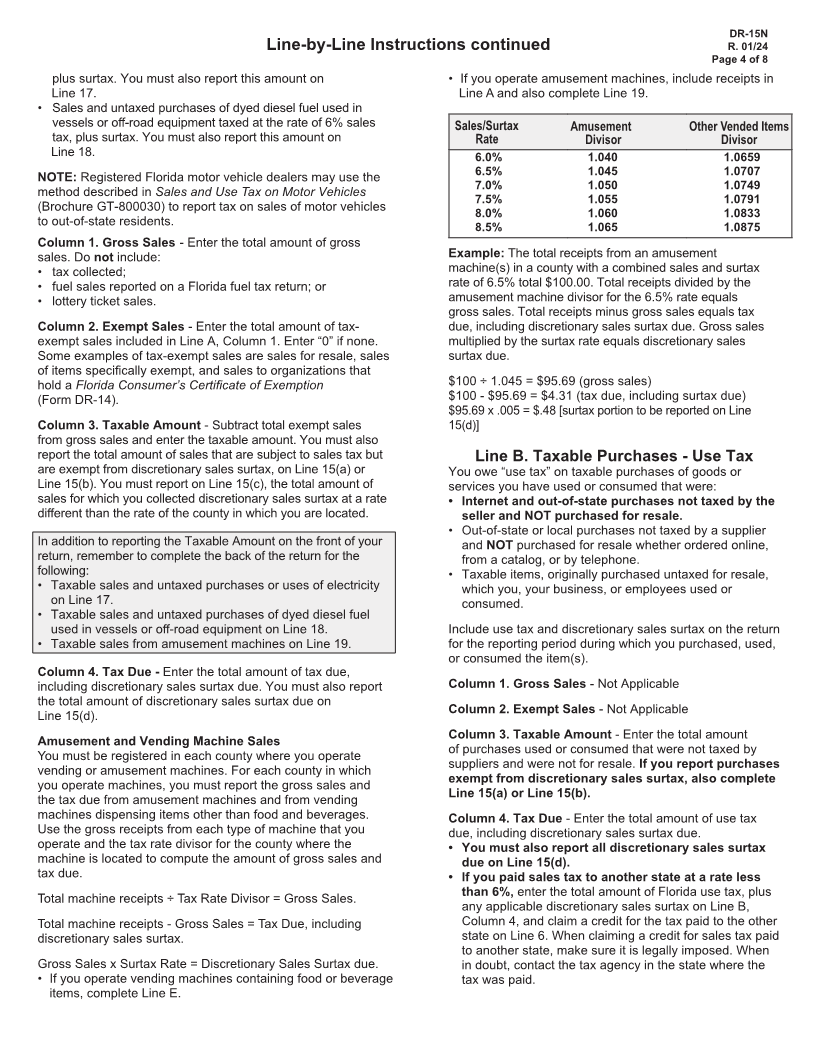

Florida 1. Gross Sales 2. Exempt Sales 3. Taxable Amount 4. Tax Due

A. Sales/Services/Electricity . . . .

B. Taxable Purchases Include use tax on Internet / out-of-state untaxed purchases . .

C. Commercial Rentals . . . .

D. Transient Rentals . . . .

E. Food & Beverage Vending . . . .

Surtax Rate: Reporting Period 5. Total Amount of Tax Due .

6. Less Lawful Deductions .

7. Net Tax Due .

Be sure to use the correct tax 8. Less Est Tax Pd / DOR Cr Memo .

9. Plus Est Tax Due Current Month .

return for each reporting period. 10. Amount Due .

FLORIDA DEPARTMENT OF REVENUE 11. Less Collection Allowance E-file/E-pay Only

5050 W TENNESSEE ST 12. Plus Penalty .

TALLAHASSEE FL 32399-0120 13. Plus Interest .

14. Amount Due with Return .

Due:

Late After:

File and pay electronically and on time

to receive a collection allowance.

Under penalties of perjury, I declare that I have read this return and the facts stated in it are true.

Signature of Taxpayer Date Signature of Preparer Date

( ___________ ) _____________________________________ ( ___________ ) ______________________________________

Telephone Number Telephone Number Be sure to complete Lines

15(a) through 15(d).

Discretionary Sales Surtax - Lines 15(a) through 15(d)

15(a). Exempt Amount of Items Over $5,000 (included in Column 3) ...................................................................................15(a). __________________________

15(b). Other Taxable Amounts NOT Subject to Surtax (included in Column 3) ......................................................................15(b). __________________________

15(c). Amounts Subject to Surtax at a Rate Different Than Your County Surtax Rate (included in Column 3) ......................15(c). __________________________

15(d). Total Amount of Discretionary Sales Surtax Due (included in Column 4) ...............................................................15(d). __________________________

16. Hope Scholarship Credits (included in Line 6) .............................................................................................................. 16. __________________________

17. Taxable Sales/Untaxed Purchases or Uses of Electricity (included in Line A) ............................................................... 17. __________________________

18. Taxable Sales/Untaxed Purchases of Dyed Diesel Fuel (included in Line A) ................................................................. 18. __________________________

19. Taxable Sales from Amusement Machines (included in Line A) ................................................................................... 19. __________________________

20. Rural or Urban High Crime Area Job Tax Credits ............................................................................................................ 20. __________________________

21. Other Authorized Credits ..................................................................................................................................................21. __________________________