Enlarge image

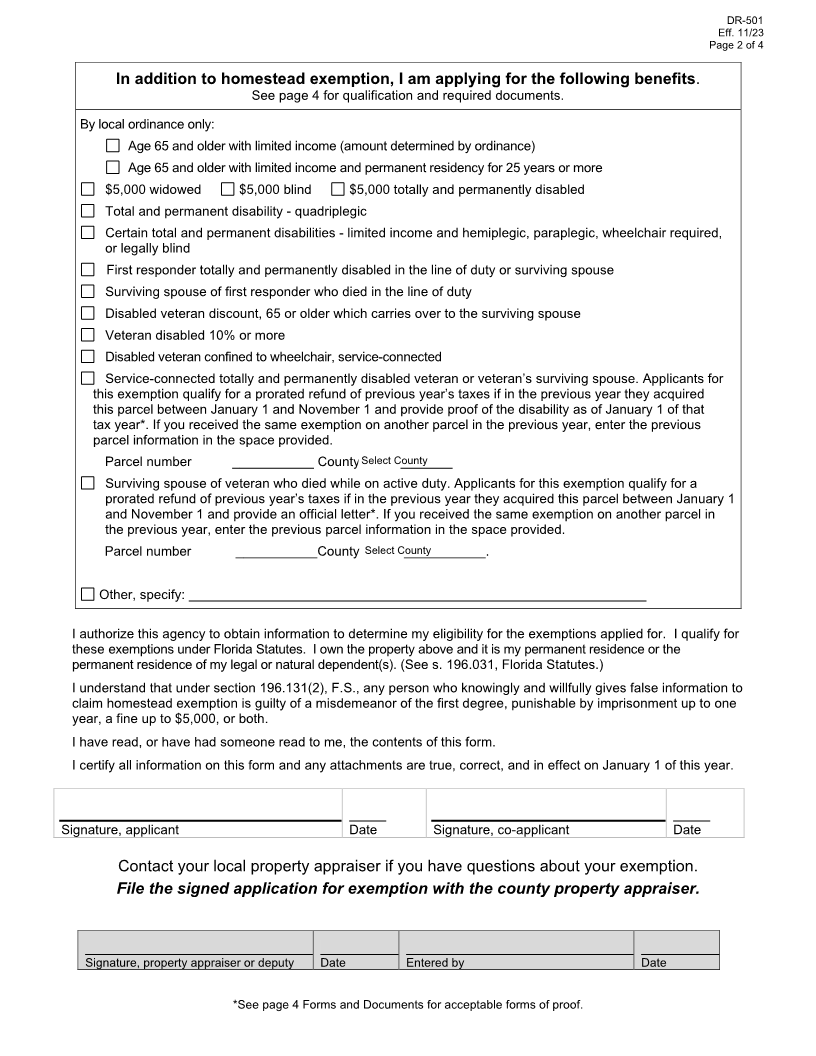

DR-501

Rule 12D-16.002,

ORIGINAL APPLICATION FOR HOMESTEAD F.A.C.

Effective 11/23

AND RELATED TAX EXEMPTIONS Page 1 of 4

Permanent Florida residency required on January 1.

Application due to property appraiser by March 1.

County Select County Tax Year

I am applying for homestead exemption New Change

Do you claim residency in another county or state? Applicant? Yes No Co-applicant? Yes No

Applicant Co-applicant/Spouse

Name

*Social Security #

Immigration #

Date of birth

% of ownership

Date of permanent

residency

Marital status Single Married Divorced Widowed

Homestead address Mailing address, if different

Parcel identification number or legal description Applicant Phone

Co-applicant Phone

Type of deed Date of deed

Recorded: Book Page Date or Instrument number

Did any applicant receive or file for exemptions last year? Yes No

Previous address:

Please provide as much information as possible. Your county property appraiser will make the final determination.

Proof of Residence Applicant Co-applicant/Spouse

Previous residency outside Florida

date date

and date terminated

FL driver license or ID card number date date

Evidence of relinquishing driver

license from other state

Florida vehicle tag number

Florida voter registration number (if

date date

US citizen)

Declaration of domicile, enter date date date

Current employer

Address on your last IRS return

School location of dependent children

Bank statement and checking

account mailing address

Proof of payment of utilities at

Yes No Yes No

homestead address

Name and address of any owners not residing on the property

*Disclosure of your social security number is mandatory. It is required by section 196.011(1)(b), Florida Statutes. The social security

number will be used to verify taxpayer identity and homestead exemption information submitted to property appraisers.

Continued on page 2