Enlarge image

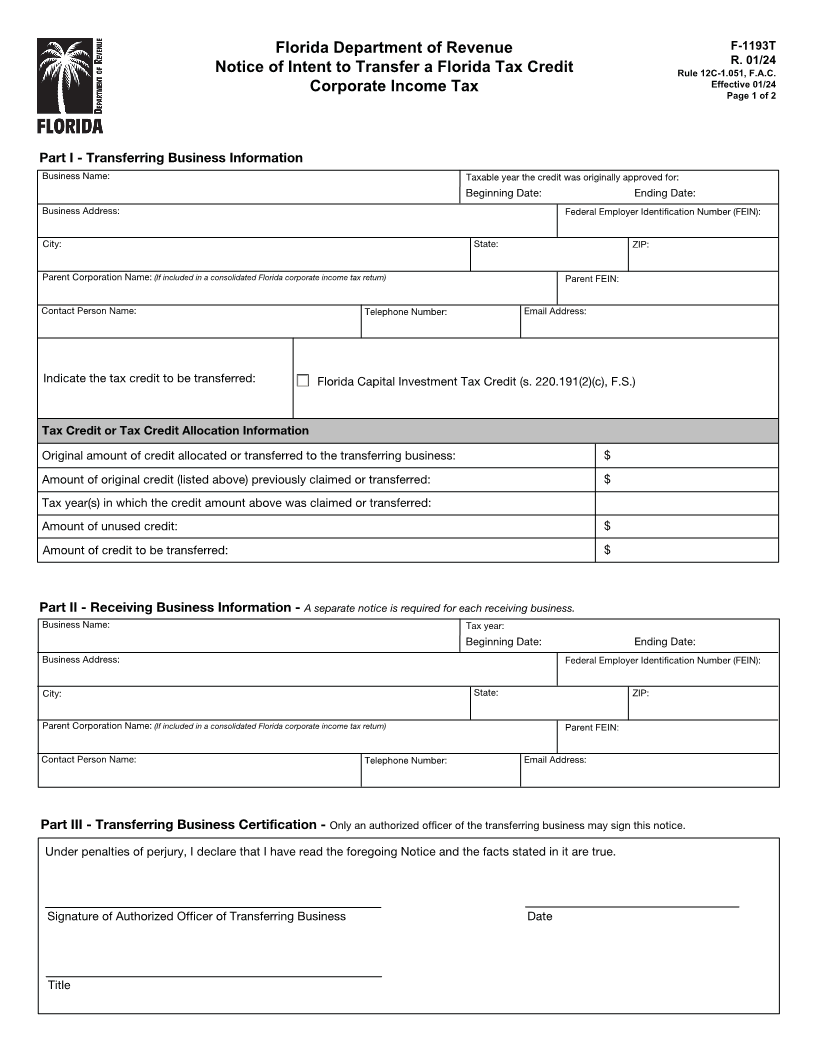

Florida Department of Revenue F-1193T

R. 01/24

Notice of Intent to Transfer a Florida Tax Credit Rule 12C-1.051, F.A.C.

Corporate Income Tax Effective 01/24

Page 1 of 2

Part I - Transferring Business Information

Business Name: Taxable year the credit was originally approved for:

Beginning Date: Ending Date:

Business Address: Federal Employer Identification Number (FEIN):

City: State: ZIP:

Parent Corporation Name: (If included in a consolidated Florida corporate income tax return) Parent FEIN:

Contact Person Name: Telephone Number: Email Address:

Indicate the tax credit to be transferred: Florida Capital Investment Tax Credit (s. 220.191(2)(c), F.S.)

Tax Credit or Tax Credit Allocation Information

Original amount of credit allocated or transferred to the transferring business: $

Amount of original credit (listed above) previously claimed or transferred: $

Tax year(s) in which the credit amount above was claimed or transferred:

Amount of unused credit: $

Amount of credit to be transferred: $

Part II - Receiving Business Information - A separate notice is required for each receiving business.

Business Name: Tax year:

Beginning Date: Ending Date:

Business Address: Federal Employer Identification Number (FEIN):

City: State: ZIP:

Parent Corporation Name: (If included in a consolidated Florida corporate income tax return) Parent FEIN:

Contact Person Name: Telephone Number: Email Address:

Part III - Transferring Business Certification - Only an authorized officer of the transferring business may sign this notice.

Under penalties of perjury, I declare that I have read the foregoing Notice and the facts stated in it are true.

Signature of Authorized Officer of Transferring Business Date

Title