Enlarge image

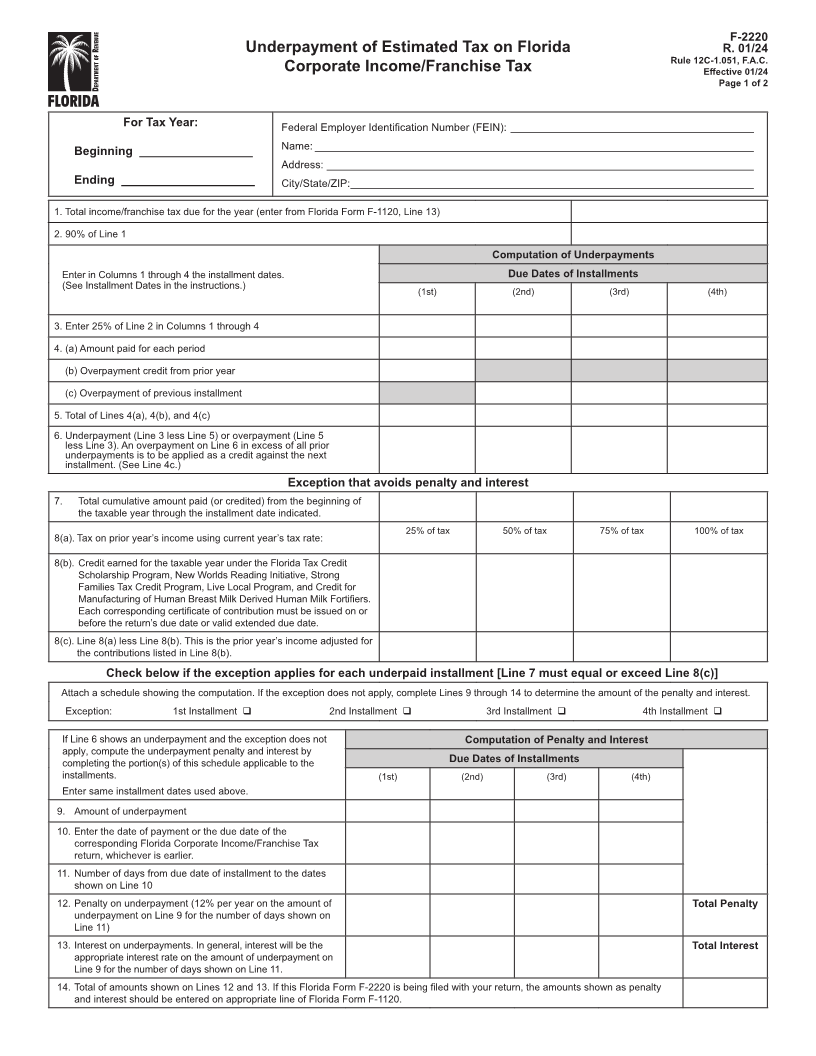

F-2220

Underpayment of Estimated Tax on Florida R. 01/24

Rule 12C-1.051, F.A.C.

Corporate Income/Franchise Tax Effective 01/24

Page 1 of 2

For Tax Year: Federal Employer Identification Number (FEIN): _________________________________________

Beginning _________________ Name: __________________________________________________________________________

Address: ________________________________________________________________________

Ending ____________________ City/State/ZIP: ____________________________________________________________________

1. Total income/franchise tax due for the year (enter from Florida Form F-1120, Line 13)

2. 90% of Line 1

Computation of Underpayments

Enter in Columns 1 through 4 the installment dates. Due Dates of Installments

(See Installment Dates in the instructions.) (1st) (2nd) (3rd) (4th)

3. Enter 25% of Line 2 in Columns 1 through 4

4. (a) Amount paid for each period

(b) Overpayment credit from prior year

(c) Overpayment of previous installment

5. Total of Lines 4(a), 4(b), and 4(c)

6. Underpayment (Line 3 less Line 5) or overpayment (Line 5

less Line 3). An overpayment on Line 6 in excess of all prior

underpayments is to be applied as a credit against the next

installment. (See Line 4c.)

Exception that avoids penalty and interest

7. Total cumulative amount paid (or credited) from the beginning of

the taxable year through the installment date indicated.

25% of tax 50% of tax 75% of tax 100% of tax

8(a). Tax on prior year’s income using current year’s tax rate:

8(b). Credit earned for the taxable year under the Florida Tax Credit

Scholarship Program, New Worlds Reading Initiative, Strong

Families Tax Credit Program, Live Local Program, and Credit for

Manufacturing of Human Breast Milk Derived Human Milk Fortifiers.

Each corresponding certificate of contribution must be issued on or

before the return’s due date or valid extended due date.

8(c). Line 8(a) less Line 8(b). This is the prior year’s income adjusted for

the contributions listed in Line 8(b).

Check below if the exception applies for each underpaid installment [Line 7 must equal or exceed Line 8(c)]

Attach a schedule showing the computation. If the exception does not apply, complete Lines 9 through 14 to determine the amount of the penalty and interest.

Exception: 1st Installment q 2nd Installment q 3rd Installment q 4th Installment q

If Line 6 shows an underpayment and the exception does not Computation of Penalty and Interest

apply, compute the underpayment penalty and interest by

completing the portion(s) of this schedule applicable to the Due Dates of Installments

installments. (1st) (2nd) (3rd) (4th)

Enter same installment dates used above.

9. Amount of underpayment

10. Enter the date of payment or the due date of the

corresponding Florida Corporate Income/Franchise Tax

return, whichever is earlier.

11. Number of days from due date of installment to the dates

shown on Line 10

12. Penalty on underpayment (12% per year on the amount of Total Penalty

underpayment on Line 9 for the number of days shown on

Line 11)

13. Interest on underpayments. In general, interest will be the Total Interest

appropriate interest rate on the amount of underpayment on

Line 9 for the number of days shown on Line 11.

14. Total of amounts shown on Lines 12 and 13. If this Florida Form F-2220 is being filed with your return, the amounts shown as penalty

and interest should be entered on appropriate line of Florida Form F-1120.