Enlarge image

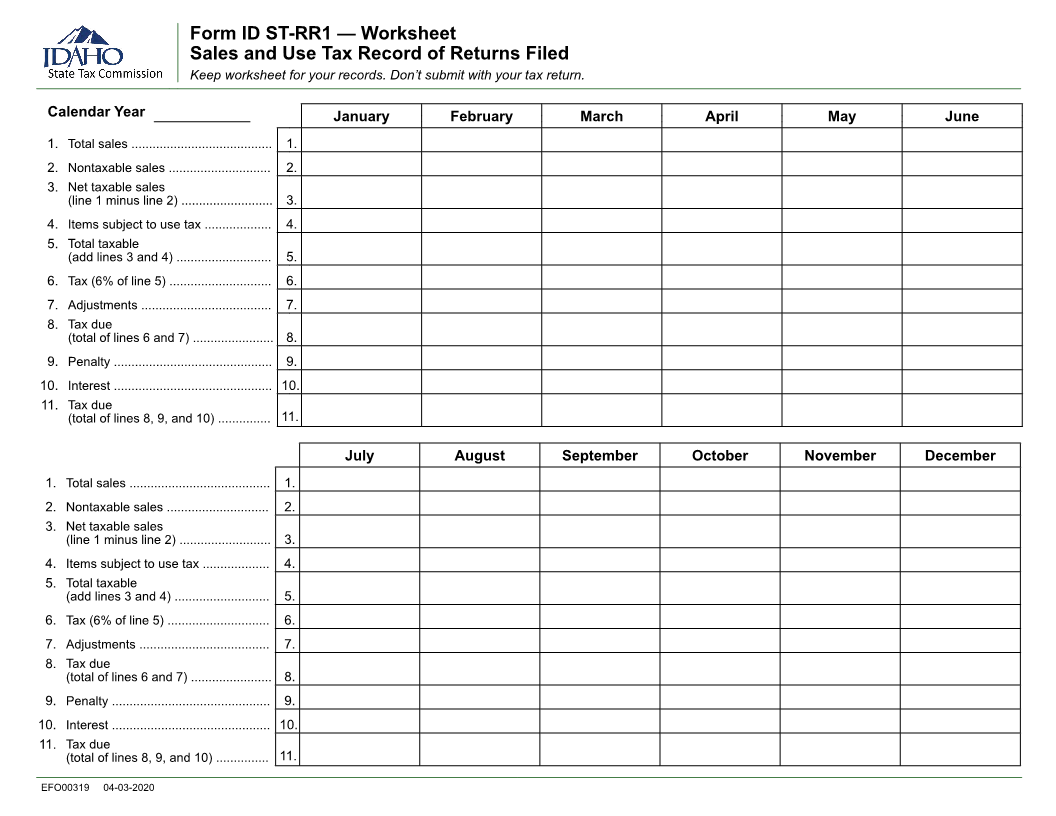

Form ID ST-RR1 — Worksheet

Sales and Use Tax Record of Returns Filed

Keep worksheet for your records. Don’t submit with your tax return.

Calendar Year January February March April May June

1. Total sales ........................................ 1.

2. Nontaxable sales ............................. 2.

3. Net taxable sales

(line 1 minus line 2) .......................... 3.

4. Items subject to use tax ................... 4.

5. Total taxable

(add lines 3 and 4) ........................... 5.

6. Tax (6% of line 5) ............................. 6.

7. Adjustments ..................................... 7.

8. Tax due

(total of lines 6 and 7) ....................... 8.

9. Penalty ............................................. 9.

10. Interest ............................................. 10.

11. Tax due

(total of lines 8, 9, and 10) ............... 11.

July August September October November December

1. Total sales ........................................ 1.

2. Nontaxable sales ............................. 2.

3. Net taxable sales

(line 1 minus line 2) .......................... 3.

4. Items subject to use tax ................... 4.

5. Total taxable

(add lines 3 and 4) ........................... 5.

6. Tax (6% of line 5) ............................. 6.

7. Adjustments ..................................... 7.

8. Tax due

(total of lines 6 and 7) ....................... 8.

9. Penalty ............................................. 9.

10. Interest ............................................. 10.

11. Tax due

(total of lines 8, 9, and 10) ............... 11.

EFO00319 04-03-2020