Enlarge image

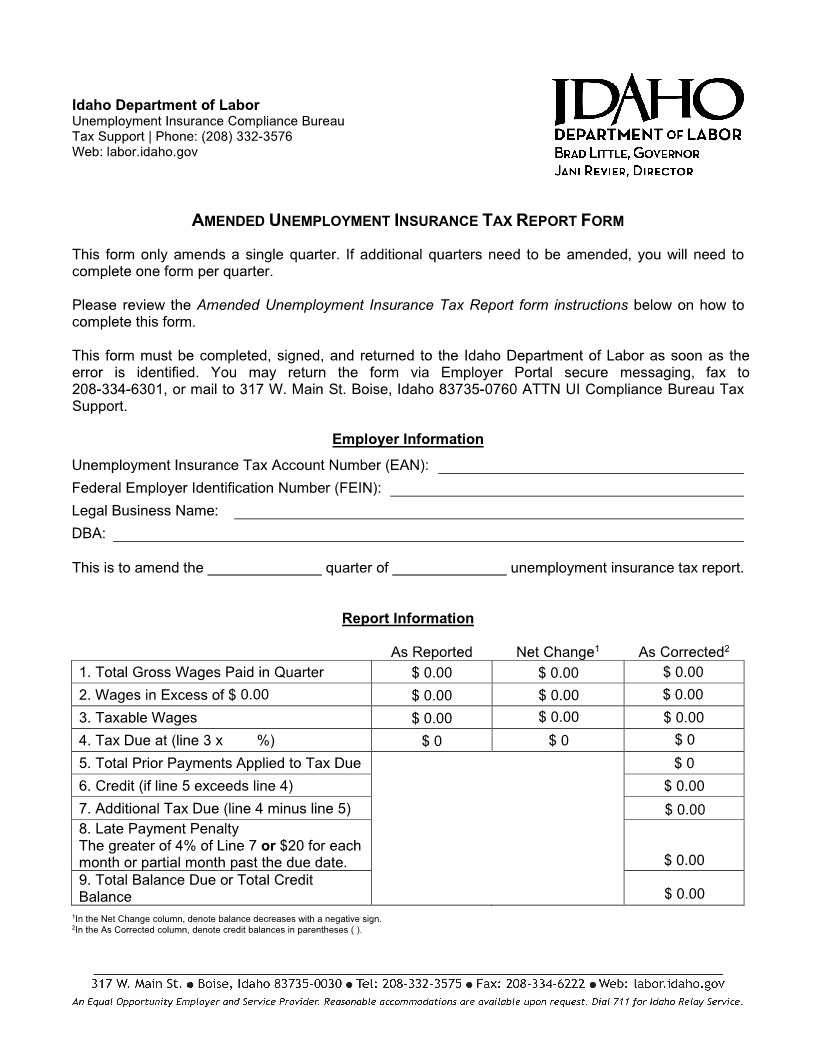

Idaho Department of Labor

Unemployment Insurance Compliance Bureau

Tax Support | Phone: (208) 332-3576

Web: labor.idaho.gov

AMENDED UNEMPLOYMENT NSURANCE I AX T EPORT R ORMF

This form only amends a single quarter. If additional quarters need to be amended, you will need to

complete one form per quarter.

Please review the Amended Unemployment Insurance Tax Report form instructions below on how to

complete this form.

This form must be completed, signed, and returned to the Idaho Department of Labor as soon as the

error is identified. You may return the form via Employer Portal secure messaging, fax to

208-334-6301, or mail to 317 W. Main St. Boise, Idaho 83735-0760 ATTN UI Compliance Bureau Tax

Support.

Employer Information

Unemployment Insurance Tax Account Number (EAN):

Federal Employer Identification Number (FEIN):

Legal Business Name:

DBA:

This is to amend the ______________ quarter of ______________ unemployment insurance tax report.

Report Information

1 2

As Reported Net Change As Corrected

1. Total Gross Wages Paid in Quarter $ 0.00 $ 0.00 $ 0.00

2. Wages in Excess of $ 0.00 $ 0.00 $ 0.00 $ 0.00

3. Taxable Wages $ 0.00 $ 0.00 $ 0.00

4. Tax Due at (line 3 x % ) $ 0 $ 0 $ 0

5. Total Prior Payments Applied to Tax Due $ 0

6. Credit (if line 5 exceeds line 4) $ 0.00

7. Additional Tax Due (line 4 minus line 5) $ 0.00

8. Late Payment Penalty

The greater of 4% of Line 7 or$20 for each

month or partial month past the due date. $ 0.00

9. Total Balance Due or Total Credit

Balance $ 0.00

12In the Net Change column, denote balance decreases In the As Corrected column, denote credit balances in parentheses ( ). with a negative sign.