- 5 -

Enlarge image

|

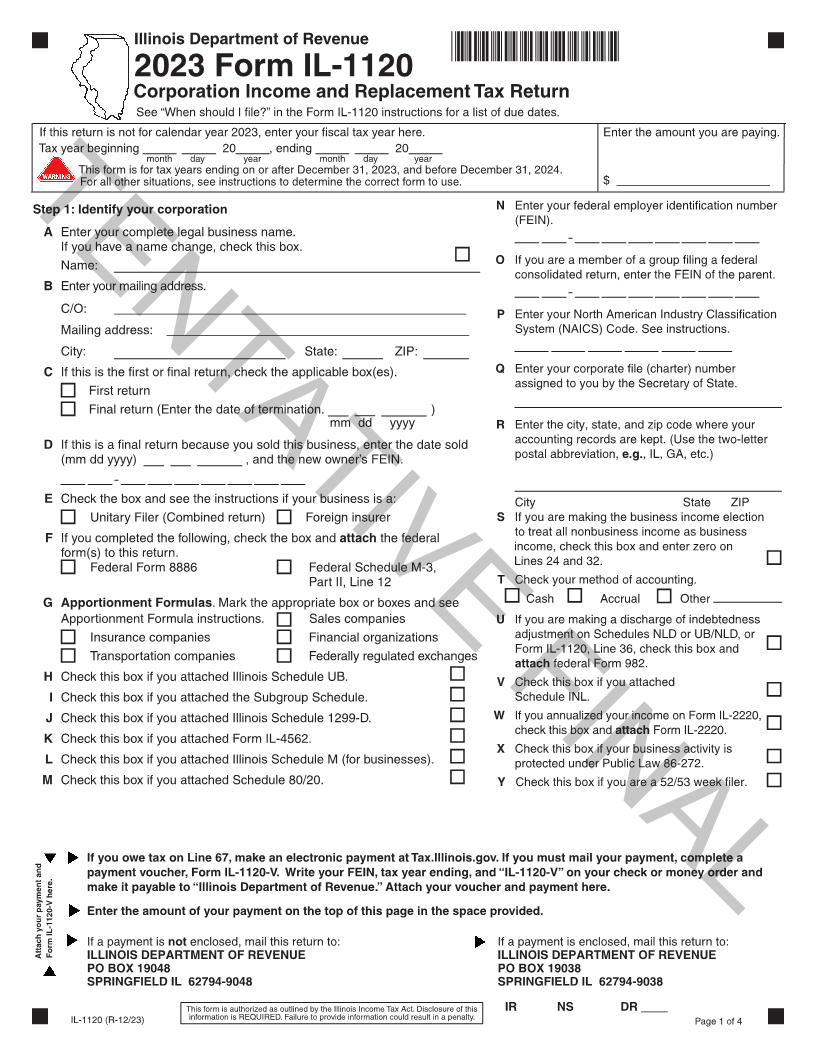

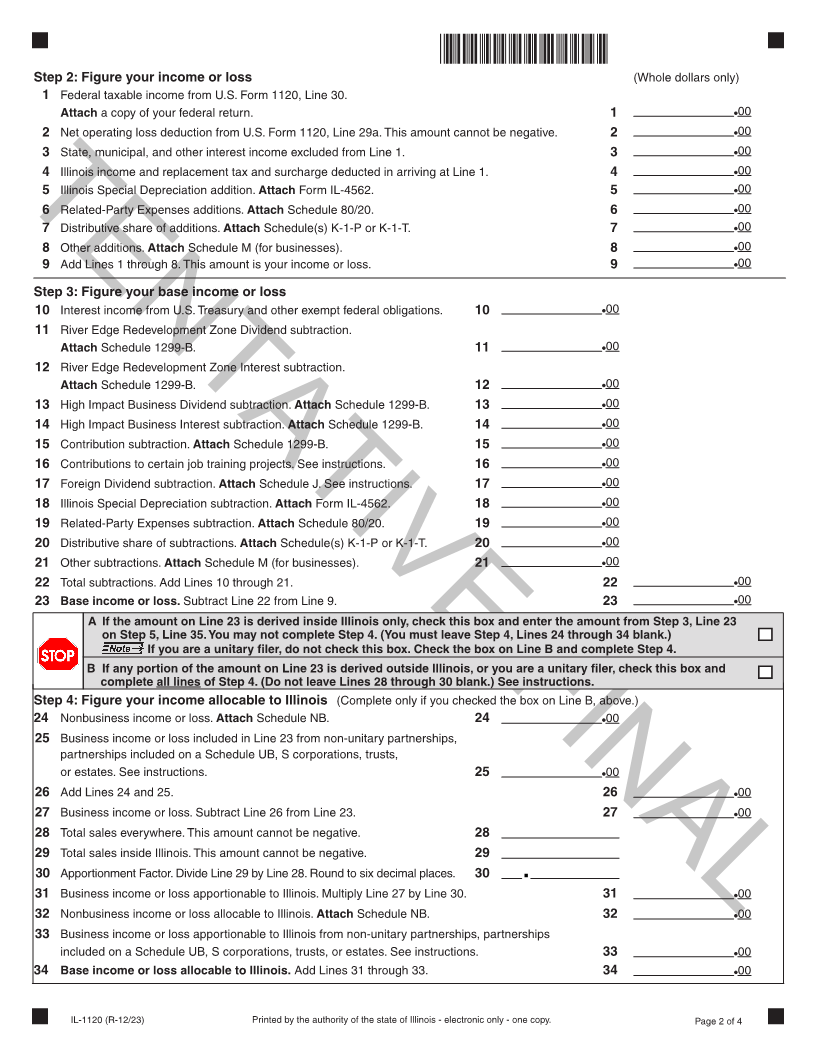

Attach supporting documents to your Form IL-1120. *ZZZZZZZZZ*

If you completed: Attach:

Form IL-1120 U.S. 1120, Pages 1 through 6, or equivalent

Step 1, Line E (unitary) only Schedule UB/Subgroup Schedule

Check the box on Form IL-1120, Step 1, Line H or Line I

Step 1, Line E (foreign insurer) only Schedule INS

Step 1, Line E (unitary) and (foreign insurer) Schedule UB/Subgroup Schedule and Schedule UB/INS

Check the box on Form IL-1120, Step 1, Line H or Line I

Step 1, Line F Federal Form 8886 or Federal Schedule M-3 (as applicable)

TENTATIVEStep 1, Line U Federal Form 982 FINAL

Step 1, Line V Schedule INL

Step 1, Line W Form IL-2220

Lines 5 and 18 Form IL-4562

Special Depreciation addition Check the box on Form IL-1120, Step 1, Line K

Special Depreciation subtraction

Lines 6 and 19 Schedule 80/20

Related-Party Expenses addition Check the box on Form IL-1120, Step 1, Line M

Related-Party Expenses subtraction

Lines 7 and 20 Schedule(s) K-1-P or K-1-T

Distributive share of additions

Distributive share of subtractions

Lines 8 and 21 Schedule M and any required support listed on Schedule M

Other additions Check the box on Form IL-1120, Step 1, Line L

Other subtractions

Lines 11 through 15 Schedule 1299-B and any required support listed on Schedule

River Edge Redevelopment Zone 1299-B

Dividend subtraction

River Edge Redevelopment Zone

Interest subtraction

High Impact Business Dividend subtraction

High Impact Business Interest subtraction

Contribution subtraction

Line 17 Foreign Dividend Subtraction Illinois Schedule J, and U.S. 1120, Schedule C or equivalent

Lines 24 and 32 Schedule NB

Nonbusiness income or loss

Nonbusiness income or loss allocable to Illinois

Lines 25 and 33 Schedule(s) K-1-P or K-1-T

Business income or loss from non-unitary

partnerships, partnerships included on a Schedule UB, Failure to attach the required

S corporations, trusts, or estates documents may result in the

Business income or loss apportionable to Illinois from disallowance of the

non-unitary partnerships, partnerships included on a corresponding line item.

Schedule UB, S corporations, trusts, or estates

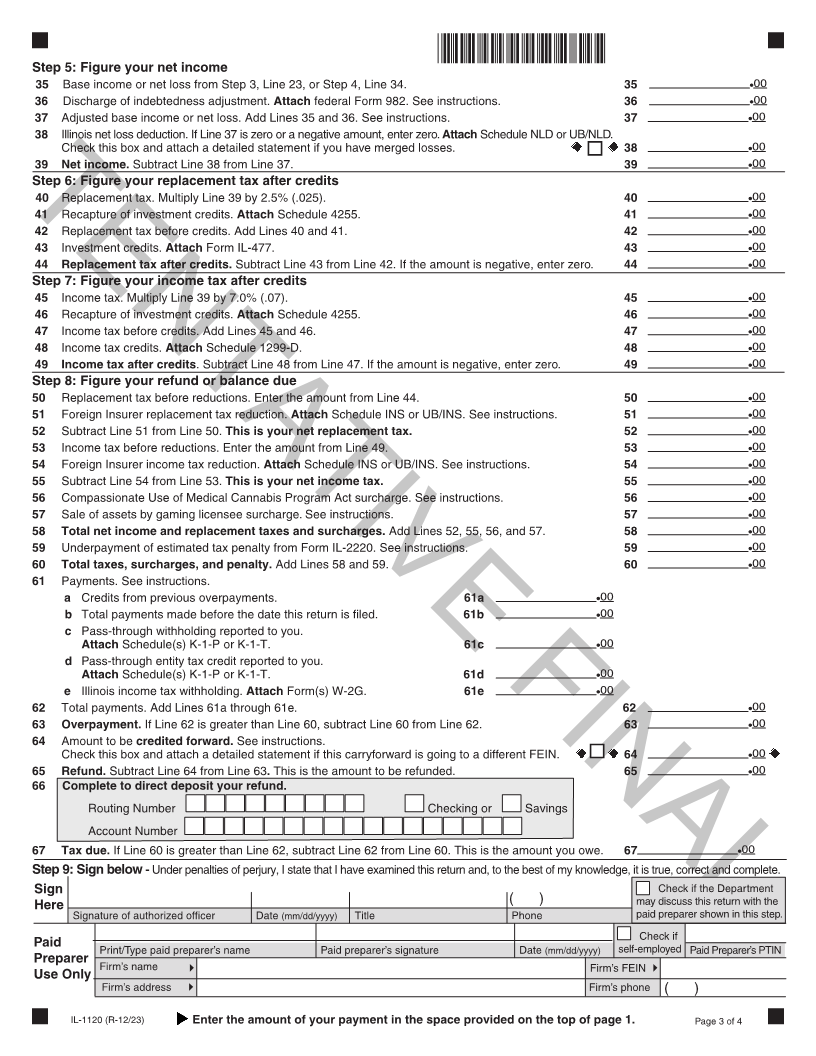

Line 36 Discharge of indebtedness adjustment Federal Form 982

Check the box on Form IL-1120, Step 1, Line U

Line 38 Illinois net loss deduction Schedule NLD or UB/NLD (for unitary filers)

Lines 41 and 46 Recapture of investment credits Schedule 4255

Line 43 Investment credits Form IL-477 and any required support listed on Form IL-477

Line 48 Income tax credits Schedule 1299-D and any required support listed in the

Schedule 1299-D instructions or Schedule 1299-I

Check the box on Form IL-1120, Step 1, Line J

Lines 51 and 54 Foreign Insurer tax reduction Schedule INS or Schedule UB/INS (for unitary filers)

Check the box on Form IL-1120, Step 1, Line E

Line 59 Underpayment of estimated tax penalty Form IL-2220

If you annualized your income on Form IL-2220, Step 6,

check the box on Form IL-1120, Step 1, Line W

Line 61c Pass-through withholding reported All Schedules K-1-P and K-1-T you received showing

to you pass-through withholding

Line 61d Pass-through entity tax credit All Schedules K-1-P and K-1-T you received showing

reported to you pass-through entity tax credit

Line 61e Illinois income tax withholding Copies of all Forms W-2G

IL-1120 (R-12/23) Page 4 of 4

|