- 5 -

Enlarge image

|

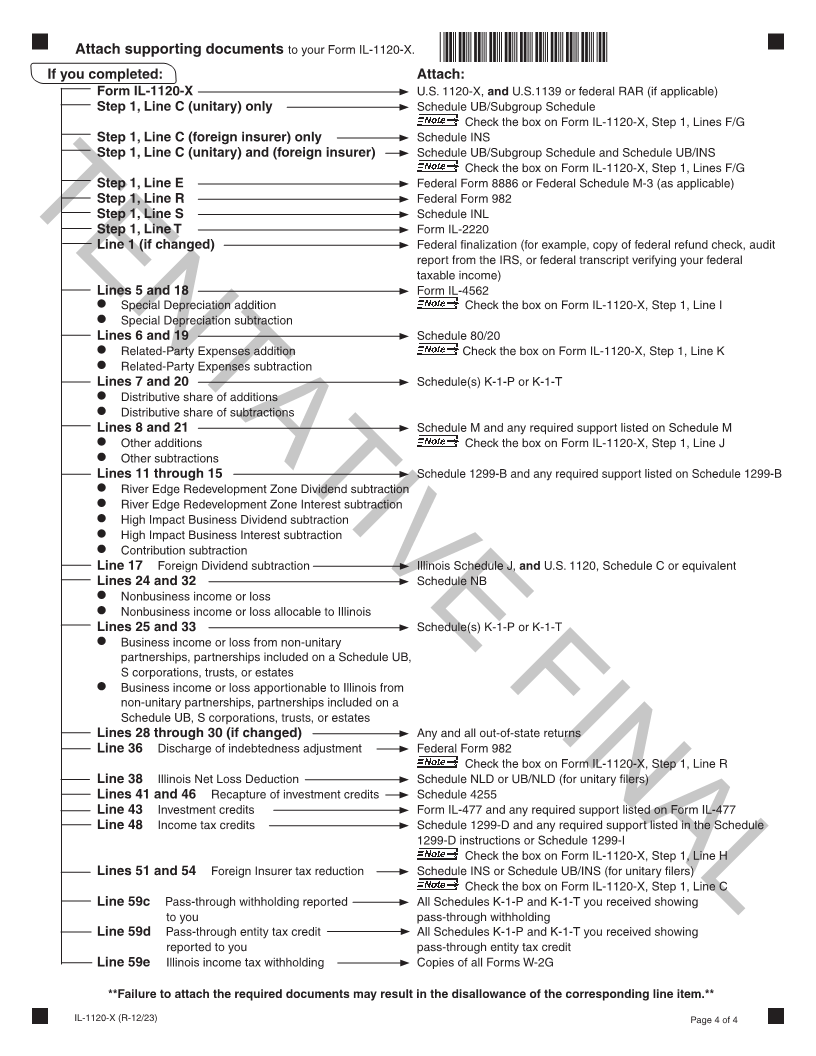

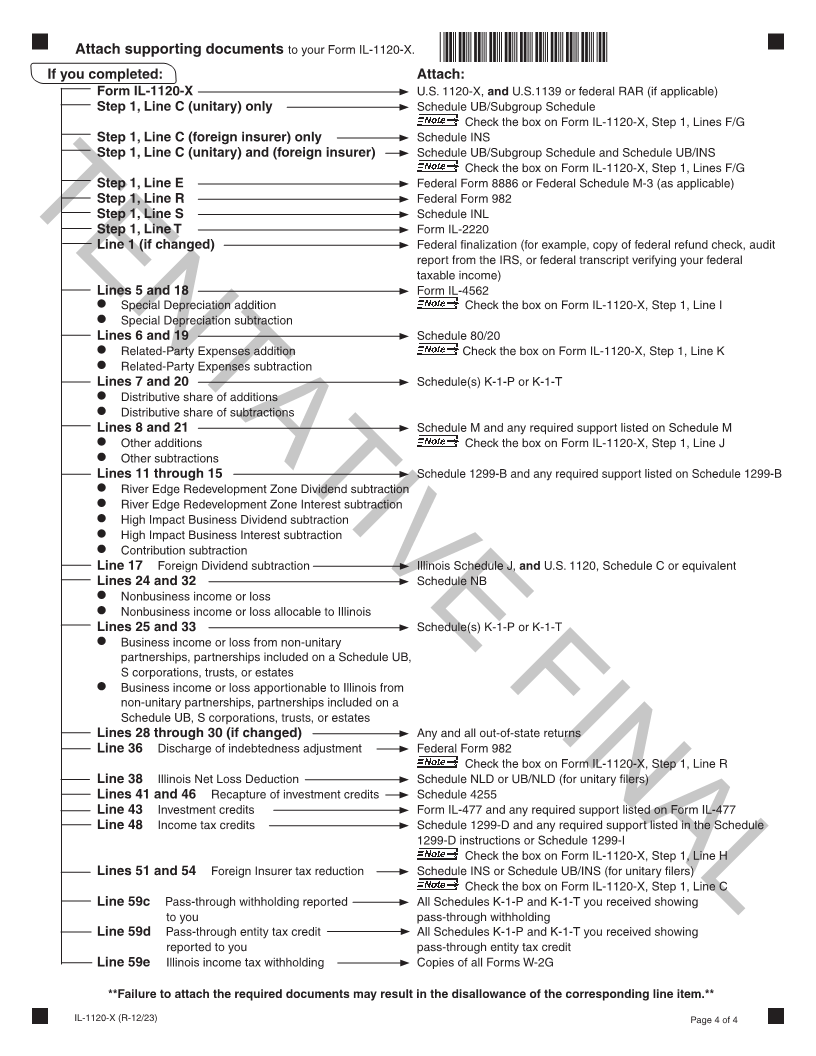

Attach supporting documents to your Form IL-1120-X. *ZZZZZZZZZ*

If you completed: Attach:

Form IL-1120-X U.S. 1120-X, and U.S.1139 or federal RAR (if applicable)

Step 1, Line C (unitary) only Schedule UB/Subgroup Schedule

Check the box on Form IL-1120-X, Step 1, Lines F/G

Step 1, Line C (foreign insurer) only Schedule INS

Step 1, Line C (unitary) and (foreign insurer) Schedule UB/Subgroup Schedule and Schedule UB/INS

Check the box on Form IL-1120-X, Step 1, Lines F/G

Step 1, Line E Federal Form 8886 or Federal Schedule M-3 (as applicable)

Step 1, Line R Federal Form 982

TENTATIVEStep 1, Line S Schedule INL FINAL

Step 1, Line T Form IL-2220

Line 1 (if changed) Federal finalization (for example, copy of federal refund check, audit

report from the IRS, or federal transcript verifying your federal

taxable income)

Lines 5 and 18 Form IL-4562

Special Depreciation addition Check the box on Form IL-1120-X, Step 1, Line I

•

Special Depreciation subtraction

•

Lines 6 and 19 Schedule 80/20

Related-Party Expenses addition Check the box on Form IL-1120-X, Step 1, Line K

•

Related-Party Expenses subtraction

•

Lines 7 and 20 Schedule(s) K-1-P or K-1-T

Distributive share of additions

•

Distributive share of subtractions

•

Lines 8 and 21 Schedule M and any required support listed on Schedule M

Other additions Check the box on Form IL-1120-X, Step 1, Line J

•

Other subtractions

•

Lines 11 through 15 Schedule 1299-B and any required support listed on Schedule 1299-B

River Edge Redevelopment Zone Dividend subtraction

•

River Edge Redevelopment Zone Interest subtraction

•

High Impact Business Dividend subtraction

•

High Impact Business Interest subtraction

•

Contribution subtraction

•

Line 17 Foreign Dividend subtraction Illinois Schedule J, and U.S. 1120, Schedule C or equivalent

Lines 24 and 32 Schedule NB

Nonbusiness income or loss

•

Nonbusiness income or loss allocable to Illinois

•

Lines 25 and 33 Schedule(s) K-1-P or K-1-T

Business income or loss from non-unitary

•

partnerships, partnerships included on a Schedule UB,

S corporations, trusts, or estates

Business income or loss apportionable to Illinois from

•

non-unitary partnerships, partnerships included on a

Schedule UB, S corporations, trusts, or estates

Lines 28 through 30 (if changed) Any and all out-of-state returns

Line 36 Discharge of indebtedness adjustment Federal Form 982

Check the box on Form IL-1120-X, Step 1, Line R

Line 38 Illinois Net Loss Deduction Schedule NLD or UB/NLD (for unitary filers)

Lines 41 and 46 Recapture of investment credits Schedule 4255

Line 43 Investment credits Form IL-477 and any required support listed on Form IL-477

Line 48 Income tax credits Schedule 1299-D and any required support listed in the Schedule

1299-D instructions or Schedule 1299-I

Check the box on Form IL-1120-X, Step 1, Line H

Lines 51 and 54 Foreign Insurer tax reduction Schedule INS or Schedule UB/INS (for unitary filers)

Check the box on Form IL-1120-X, Step 1, Line C

Line 59c Pass-through withholding reported All Schedules K-1-P and K-1-T you received showing

to you pass-through withholding

Line 59d Pass-through entity tax credit All Schedules K-1-P and K-1-T you received showing

reported to you pass-through entity tax credit

Line 59e Illinois income tax withholding Copies of all Forms W-2G

**Failure to attach the required documents may result in the disallowance of the corresponding line item.**

IL-1120-X (R-12/23) Page 4 of 4

|