- 2 -

Enlarge image

|

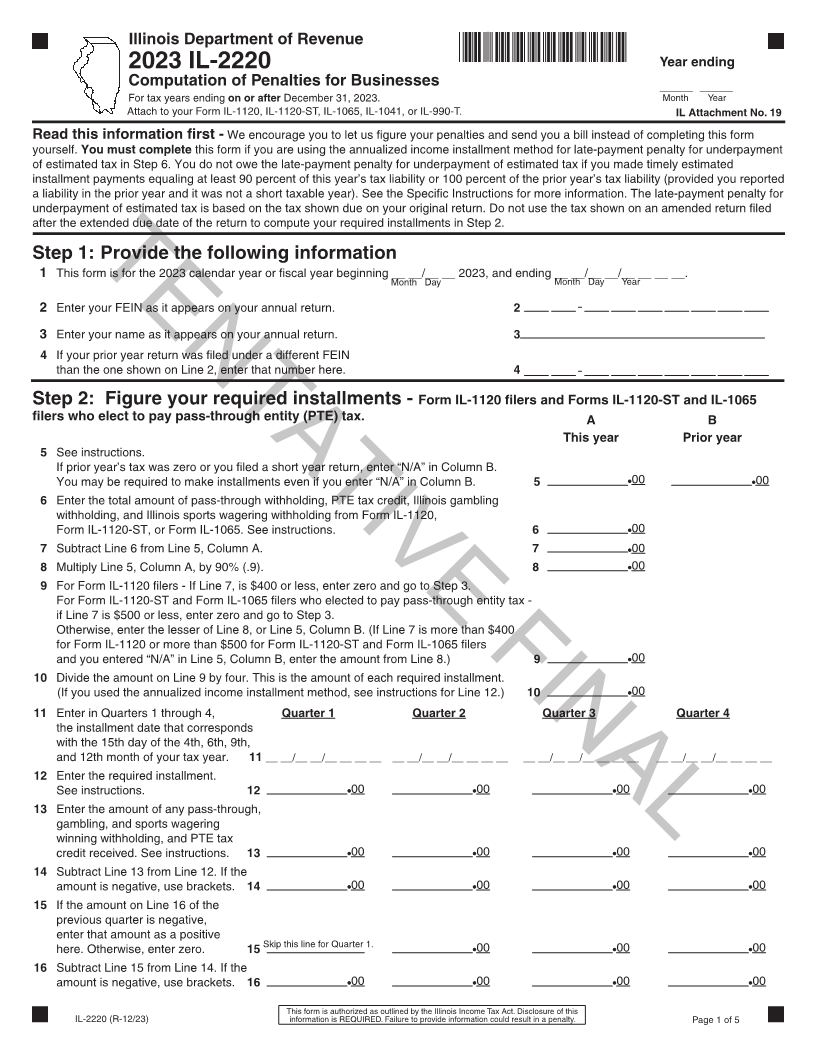

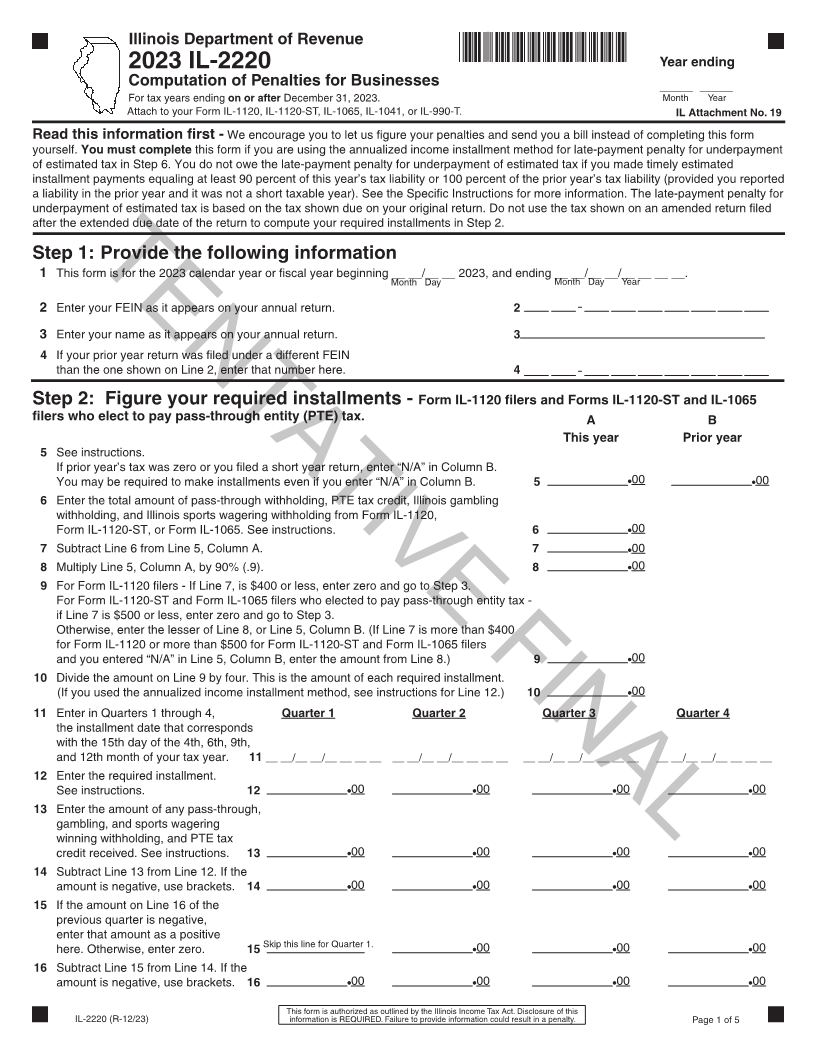

Illinois Department of Revenue

*34212231V*

Year ending

2023 IL-2220

Computation of Penalties for Businesses _____ _____

For tax years ending on or after December 31, 2023. Month Year

Attach to your Form IL-1120, IL-1120-ST, IL-1065, IL-1041, or IL-990-T. IL Attachment No. 19

Read this information first - We encourage you to let us figure your penalties and send you a bill instead of completing this form

yourself. You must complete this form if you are using the annualized income installment method for late-payment penalty for underpayment

of estimated tax in Step 6. You do not owe the late-payment penalty for underpayment of estimated tax if you made timely estimated

installment payments equaling at least 90 percent of this year’s tax liability or 100 percent of the prior year’s tax liability (provided you reported

a liability in the prior year and it was not a short taxable year). See the Specific Instructions for more information. The late-payment penalty for

underpayment of estimated tax is based on the tax shown due on your original return. Do not use the tax shown on an amended return filed

after the extended due date of the return to compute your required installments in Step 2.

Step 1: Provide the following information

__.__ __ form 1 This TENTATIVE FINAL yearis__/__ fiscal2023 calendar 2023, andor ending__ yearfor__/__ the __ beginning__/__ __

Month Day Month Day Year

2 Enter your FEIN as it appears on your annual return. 2

3 Enter your name as it appears on your annual return. 3

4 If your prior year return was filed under a different FEIN

than the one shown on Line 2, enter that number here. 4

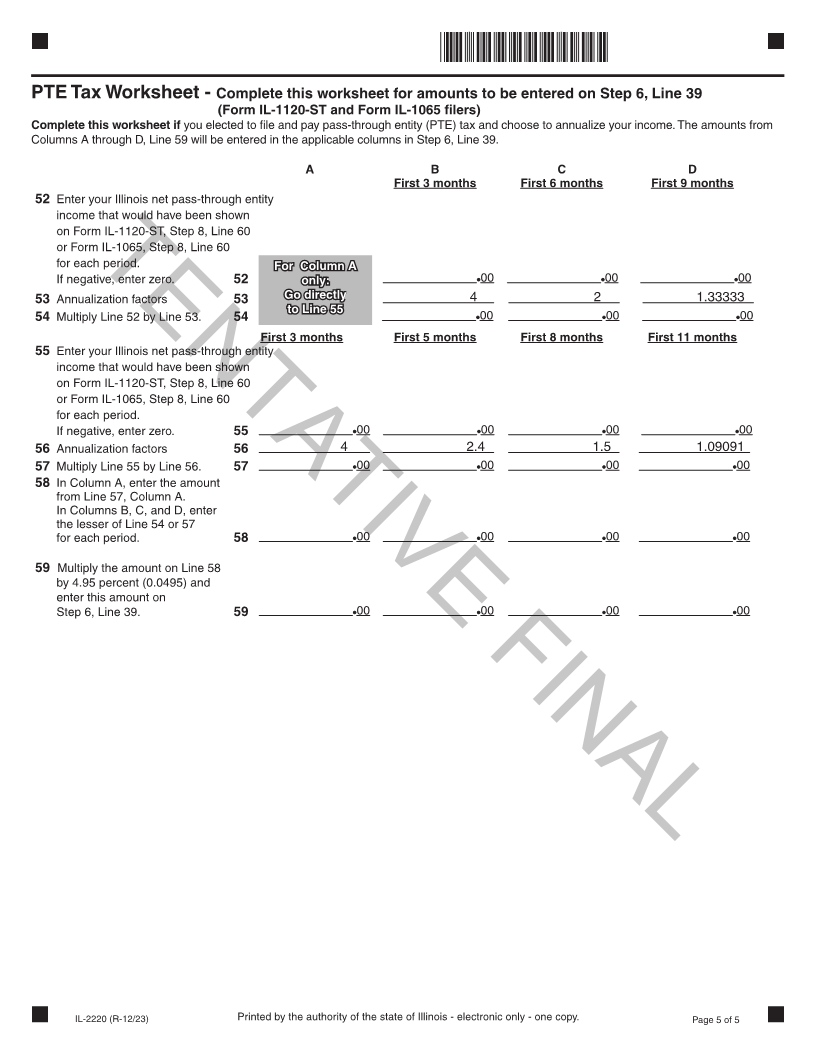

Step 2: Figure your required installments - Form IL-1120 filers and Forms IL-1120-ST and IL-1065

filers who elect to pay pass-through entity (PTE) tax. A B

This year Prior year

5 See instructions.

If prior year’s tax was zero or you filed a short year return, enter “N/A” in Column B.

You may be required to make installments even if you enter “N/A” in Column B. 5 00 00

6 Enter the total amount of pass-through withholding, PTE tax credit, Illinois gambling

withholding, and Illinois sports wagering withholding from Form IL-1120,

Form IL-1120-ST, or Form IL-1065. See instructions. 6 00

7 Subtract Line 6 from Line 5, Column A. 7 00

8 Multiply Line 5, Column A, by 90% (.9). 8 00

9 For Form IL-1120 filers - If Line 7, is $400 or less, enter zero and go to Step 3.

For Form IL-1120-ST and Form IL-1065 filers who elected to pay pass-through entity tax -

if Line 7 is $500 or less, enter zero and go to Step 3.

Otherwise, enter the lesser of Line 8, or Line 5, Column B. (If Line 7 is more than $400

for Form IL-1120 or more than $500 for Form IL-1120-ST and Form IL-1065 filers

and you entered “N/A” in Line 5, Column B, enter the amount from Line 8.) 9 00

10 Divide the amount on Line 9 by four. This is the amount of each required installment.

(If you used the annualized income installment method, see instructions for Line 12.) 10 00

11 Enter in Quarters 1 through 4, Quarter 1 Quarter 2 Quarter 3 Quarter 4

the installment date that corresponds

with the 15th day of the 4th, 6th, 9th,

and 12th month of your tax year. 11 __ __/__ __/__ __ __ __ __ __/__ __/__ __ __ __ __ __/__ __/__ __ __ __ __ __/__ __/__ __ __ __

12 Enter the required installment.

See instructions. 12 00 00 00 00

13 Enter the amount of any pass-through,

gambling, and sports wagering

winning withholding, and PTE tax

credit received. See instructions. 13 00 00 00 00

14 Subtract Line 13 from Line 12. If the

amount is negative, use brackets. 14 00 00 00 00

15 If the amount on Line 16 of the

previous quarter is negative,

enter that amount as a positive

zero.enter Otherwise, line here. 15Skip 00 00 00 1. this for Quarter

16 Subtract Line 15 from Line 14. If the

amount is negative, use brackets. 16 00 00 00 00

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

IL-2220 (R-12/23) information is REQUIRED. Failure to provide information could result in a penalty. Page 1 of 5

|