- 2 -

Enlarge image

|

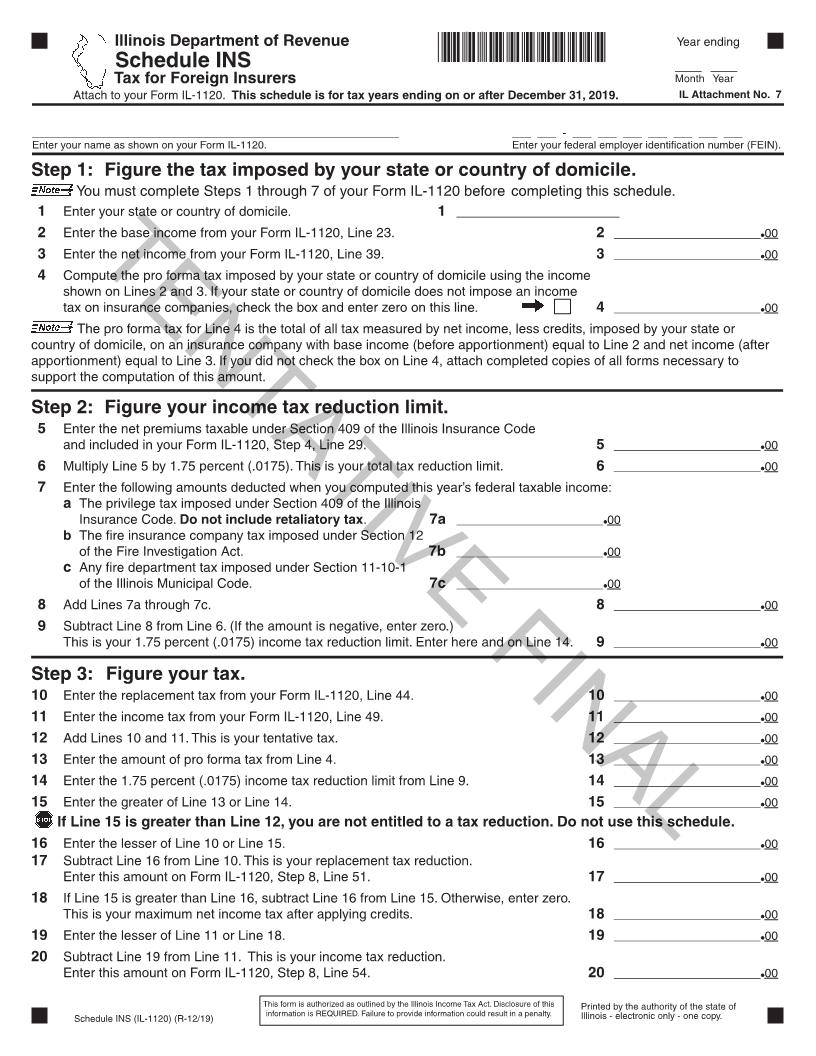

Illinois Department of Revenue Year ending

*33412191V*

Schedule INS ___ ___

Tax for Foreign Insurers Month Year

Attach to your Form IL-1120. This schedule is for tax years ending on or after December 31, 2019. IL Attachment No. 7

_______________________________________________________ ___ ___ - ___ ___ ___ ___ ___ ___ ___

Enter your name as shown on your Form IL-1120. Enter your federal employer identification number (FEIN).

Step 1: Figure the tax imposed by your state or country of domicile.

You must complete Steps 1 through 7 of your Form IL-1120 before completing this schedule.

1 Enter your state or country of domicile. 1 ______________________

2 Enter the base income from your Form IL-1120, Line 23. 2 ______________________ 00

3 Enter the net income from your Form IL-1120, Line 39. 3 ______________________ 00

4 Compute the pro forma tax imposed by your state or country of domicile using the income TENTATIVE FINAL

shown on Lines 2 and 3. If your state or country of domicile does not impose an income

tax on insurance companies, check the box and enter zero on this line. 4 ______________________ 00

The pro forma tax for Line 4 is the total of all tax measured by net income, less credits, imposed by your state or

country of domicile, on an insurance company with base income (before apportionment) equal to Line 2 and net income (after

apportionment) equal to Line 3. If you did not check the box on Line 4, attach completed copies of all forms necessary to

support the computation of this amount.

Step 2: Figure your income tax reduction limit.

5 Enter the net premiums taxable under Section 409 of the Illinois Insurance Code

and included in your Form IL-1120, Step 4, Line 29. 5 ______________________ 00

6 Multiply Line 5 by 1.75 percent (.0175). This is your total tax reduction limit. 6 ______________________ 00

7 Enter the following amounts deducted when you computed this year’s federal taxable income:

a The privilege tax imposed under Section 409 of the Illinois

Insurance Code. Do not include retaliatory tax. 7a ______________________ 00

b The fire insurance company tax imposed under Section 12

of the Fire Investigation Act. 7b ______________________ 00

c Any fire department tax imposed under Section 11-10-1

of the Illinois Municipal Code. 7c ______________________ 00

8 Add Lines 7a through 7c. 8 ______________________ 00

9 Subtract Line 8 from Line 6. (If the amount is negative, enter zero.)

This is your 1.75 percent (.0175) income tax reduction limit. Enter here and on Line 14. 9 ______________________ 00

Step 3: Figure your tax.

10 Enter the replacement tax from your Form IL-1120, Line 44. 10 ______________________ 00

11Enter the income tax from your Form IL-1120, Line 49. 11 ______________________ 00

12Add Lines 10 and 11. This is your tentative tax. 12 ______________________ 00

13 Enter the amount of pro forma tax from Line 4. 13 ______________________ 00

14 Enter the 1.75 percent (.0175) income tax reduction limit from Line 9. 14 ______________________ 00

15Enter the greater of Line 13 or Line 14. 15 ______________________ 00

If Line 15 is greater than Line 12, you are not entitled to a tax reduction. Do not use this schedule.

16 Enter the lesser of Line 10 or Line 15. 16 ______________________ 00

17 Subtract Line 16 from Line 10. This is your replacement tax reduction.

Enter this amount on Form IL-1120, Step 8, Line 51. 17 ______________________ 00

18 If Line 15 is greater than Line 16, subtract Line 16 from Line 15. Otherwise, enter zero.

This is your maximum net income tax after applying credits. 18 ______________________ 00

19 Enter the lesser of Line 11 or Line 18. 19 ______________________ 00

20 Subtract Line 19 from Line 11. This is your income tax reduction.

Enter this amount on Form IL-1120, Step 8, Line 54. 20 ______________________ 00

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

Schedule INS (IL-1120) (R-12/19) information is REQUIRED. Failure to provide information could result in a penalty. Printed by the authority of the state of

Illinois - electronic only - one copy.

|