- 4 -

Enlarge image

|

*33512233V*

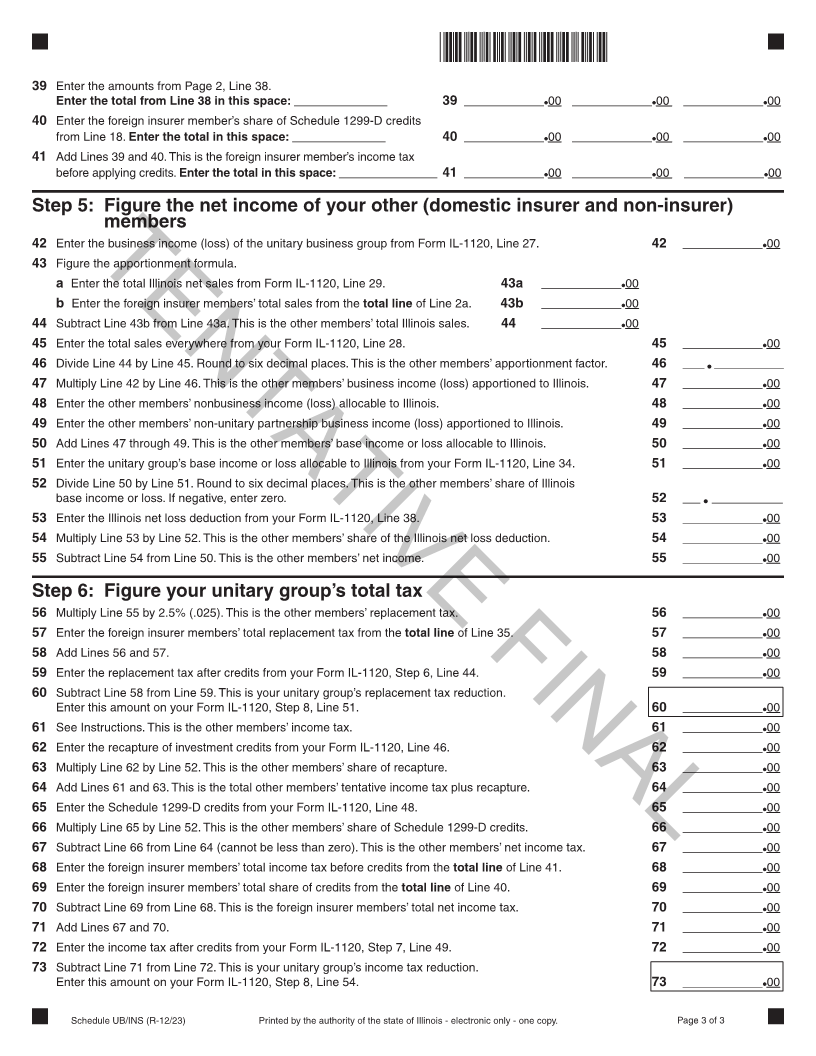

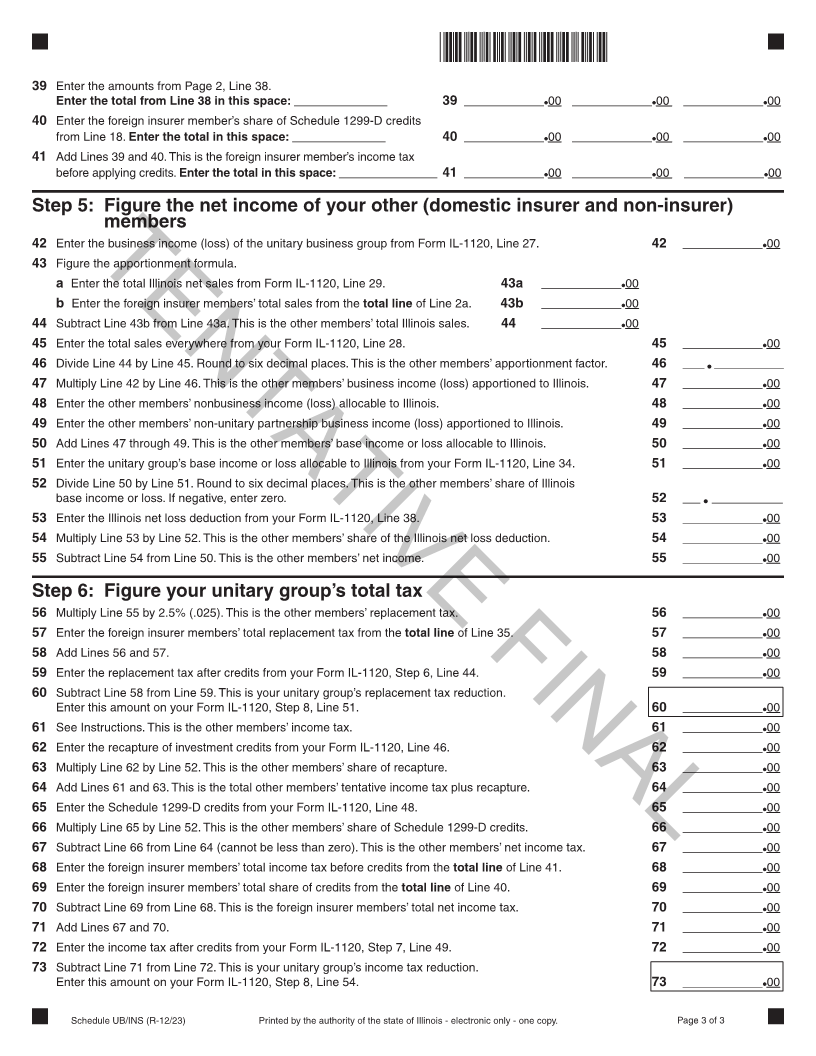

39 Enter the amounts from Page 2, Line 38.

Enter the total from Line 38 in this space: ______________ 39 ____________ 00 ____________ 00 ____________ 00

40 Enter the foreign insurer member’s share of Schedule 1299-D credits

from Line 18. Enter the total in this space: ______________ 40 ____________ 00 ____________ 00 ____________ 00

41 Add Lines 39 and 40. This is the foreign insurer member’s income tax

before applying credits.Enter the total in this space: _______________ 41 ____________ 00 ____________ 00 ____________ 00

Step 5: Figure the net income of your other (domestic insurer and non-insurer)

members

42 Enter the business income (loss) of the unitary business group from Form IL-1120, Line 27. 42 ____________ 00

43 Figure the apportionment formula.

TENTATIVE FINAL

a Enter the total Illinois net sales from Form IL-1120, Line 29. 43a ____________ 00

b Enter the foreign insurer members’ total sales from the total line of Line 2a. 43b ____________ 00

44 Subtract Line 43b from Line 43a. This is the other members’ total Illinois sales. 44 ____________ 00

45 Enter the total sales everywhere from your Form IL-1120, Line 28. 45 ____________ 00

46 Divide Line 44 by Line 45. Round to six decimal places. This is the other members’ apportionment factor. 46 ___ • ____________

47 Multiply Line 42 by Line 46. This is the other members’ business income (loss) apportioned to Illinois. 47 ____________ 00

48 Enter the other members’ nonbusiness income (loss) allocable to Illinois. 48 ____________ 00

49 Enter the other members’ non-unitary partnership business income (loss) apportioned to Illinois. 49 ____________ 00

50 Add Lines 47 through 49. This is the other members’ base income or loss allocable to Illinois. 50 ____________ 00

51 Enter the unitary group’s base income or loss allocable to Illinois from your Form IL-1120, Line 34. 51 ____________ 00

52 Divide Line 50 by Line 51. Round to six decimal places. This is the other members’ share of Illinois

base income or loss. If negative, enter zero. 52 ___ • ____________

53 Enter the Illinois net loss deduction from your Form IL-1120, Line 38. 53 ____________ 00

54 Multiply Line 53 by Line 52. This is the other members’ share of the Illinois net loss deduction. 54 ____________ 00

55 Subtract Line 54 from Line 50. This is the other members’ net income. 55 ____________ 00

Step 6: Figure your unitary group’s total tax

56 Multiply Line 55 by 2.5% (.025). This is the other members’ replacement tax. 56 ____________ 00

57 Enter the foreign insurer members’ total replacement tax from the total line of Line 35. 57 ____________ 00

58 Add Lines 56 and 57. 58 ____________ 00

59 Enter the replacement tax after credits from your Form IL-1120, Step 6, Line 44. 59 ____________ 00

60 Subtract Line 58 from Line 59. This is your unitary group’s replacement tax reduction.

Enter this amount on your Form IL-1120, Step 8, Line 51. 60 ____________ 00

61 See Instructions. This is the other members’ income tax. 61 ____________ 00

62 Enter the recapture of investment credits from your Form IL-1120, Line 46. 62 ____________ 00

63 Multiply Line 62 by Line 52. This is the other members’ share of recapture. 63 ____________ 00

64 Add Lines 61 and 63. This is the total other members’ tentative income tax plus recapture. 64 ____________ 00

65 Enter the Schedule 1299-D credits from your Form IL-1120, Line 48. 65 ____________ 00

66 Multiply Line 65 by Line 52. This is the other members’ share of Schedule 1299-D credits. 66 ____________ 00

67 Subtract Line 66 from Line 64 (cannot be less than zero). This is the other members’ net income tax. 67 ____________ 00

68 Enter the foreign insurer members’ total income tax before credits from the total line of Line 41. 68 ____________ 00

69 Enter the foreign insurer members’ total share of credits from the total line of Line 40. 69 ____________ 00

70 Subtract Line 69 from Line 68. This is the foreign insurer members’ total net income tax. 70 ____________ 00

71 Add Lines 67 and 70. 71 ____________ 00

72 Enter the income tax after credits from your Form IL-1120, Step 7, Line 49. 72 ____________ 00

73 Subtract Line 71 from Line 72. This is your unitary group’s income tax reduction.

Enter this amount on your Form IL-1120, Step 8, Line 54. 73 ____________ 00

Schedule UB/INS (R-12/23) Printed by the authority of the state of Illinois - electronic only - one copy. Page 3 of 3

|