Enlarge image

2023

Important Notice Regarding Illinois Estate Tax and Fact Sheet

For decedents dying prior to 2023, see the Instruction Fact Sheets previously posted on the

Attorney General’s website covering the specific year of death.

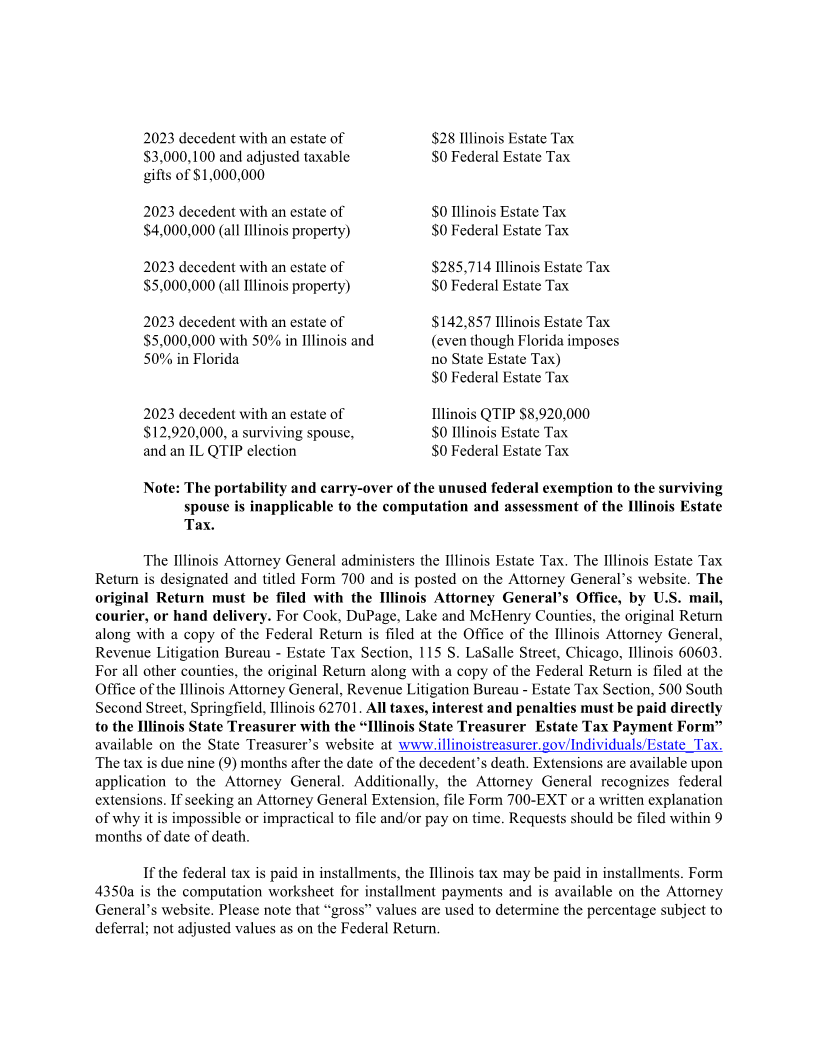

For persons dying in 2023, the federal exemption for Federal Estate Tax purposes is

$12,920,000. The exclusion amount for Illinois Estate Tax purposes is $4,000,000. The exclusion

amount is a taxable threshold and not a credit against tax. If an estate’s gross value exceeds

$4,000,000 after inclusion of adjusted taxable gifts, an Illinois Form 700 must be filed, whether or

not a Federal Return is required by the Internal Revenue Service.The estate representative should

prepare and submit the Illinois Form 700 with a Federal Form 706, including all schedules,

appraisals, wills, trusts, attachments, etc. If an estate is not federally taxable and does not wish to

submit a Form 706, the information may be presented in an alternate format as long as all necessary

information is included. (See Ill. Admin. Code tit. 86, § 2000.110). The Illinois Estate Tax will be

determined using an interrelated calculation for 2023 decedents. The calculator at the Illinois

Attorney General’s website (www.illinoisattorneygeneral.gov) may be used for this computation.

To determine tax due, insert the amounts from Lines 3 and 5 of Schedule A or B, Form 700. Please

note that the calculator will not perform the computation unless amounts are entered into both

fields.

For both resident and non-resident decedents, a preliminary tax amount should be calculated

assuming all assets are located within Illinois. (Line 6, Schedule A or B, Form 700). The

apportioned tax can then be determined by multiplying that figure by the ratio of Illinois assets to

total assets.

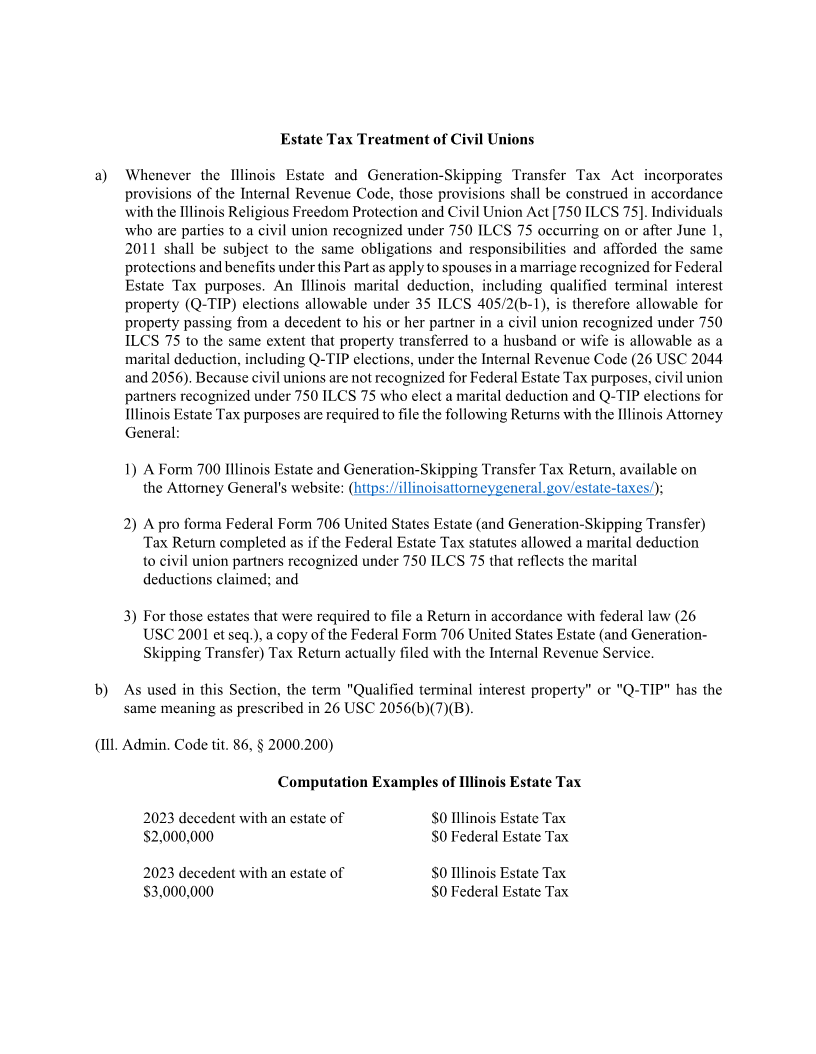

Illinois QTIP Election (Qualified Terminable Interest Property)

For persons dying January 1, 2009 and after, the estate may make a QTIP election for

Illinois purposes in addition to any federal QTIP election. The Illinois QTIP must be elected on a

timely filed Illinois Return by checking the election box (pg. 2, box 4), inserting the dollar amount

of the QTIP election, and providing the social security number of the surviving spouse. A list of

Illinois QTIP property should be submitted with the Return. This may include trust property where

an undivided percentage is part of the QTIP, in which case the numeric percentage of trust property

included in the QTIP should be listed. An affidavit by the Trustee as to what is included in the

QTIP amount will suffice. The Illinois QTIP election will follow federal statutes and rules for

treatment of elected property passing to the surviving spouse and inclusion on the Return of the

surviving spouse, except as to the application of the Illinois Religious Freedom Protection and Civil

Union Act to parties of a civil union for Illinois Estate Tax purposes.