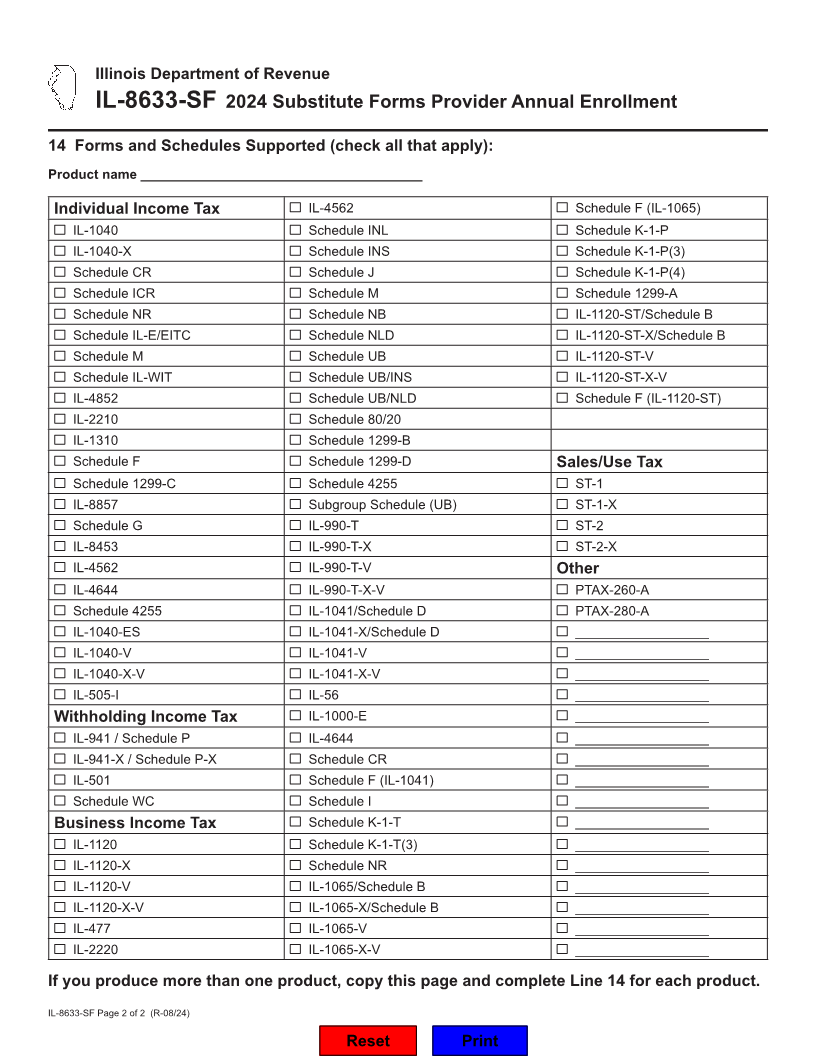

Enlarge image

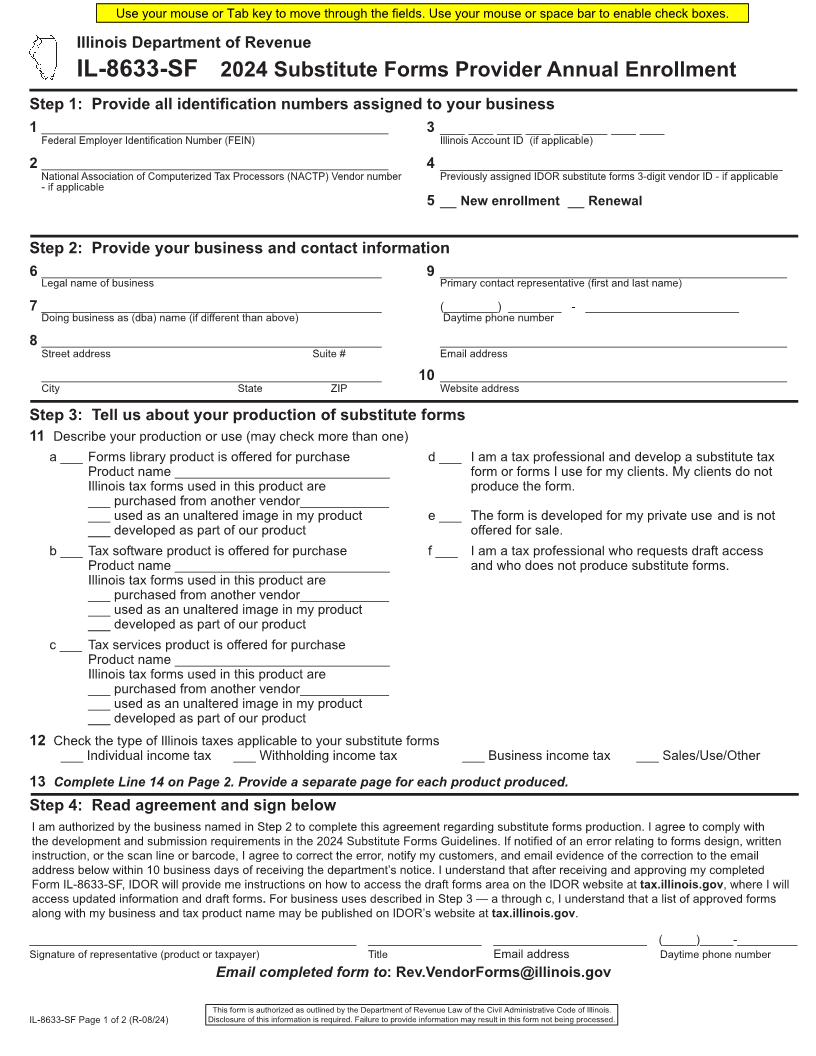

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

IL-8633-SF 2024 Substitute Forms Provider Annual Enrollment

Step 1: Provide all identification numbers assigned to your business

1 ____________________________________________________ 3 ___ ___ ___ ___ ___ ___ ___ ___

Federal Employer Identification Number (FEIN) Illinois Account ID (if applicable)

2 ____________________________________________________ 4 __________________________________________

National Association of Computerized Tax Processors (NACTP) Vendor number Previously assigned IDOR substitute forms 3-digit vendor ID - if applicable

- if applicable

5 __ New enrollment __ Renewal

Step 2: Provide your business and contact information

6 ___________________________________________________ ____________________________________________________9

Legal name of business Primary contact representative (first and last name)

7 ___________________________________________________ (________) ________ - _______________________

Doing business as (dba) name (if different than above) Daytime phone number

8 ___________________________________________________ ____________________________________________________

Street address Suite # Email address

___________________________________________________ 10 ____________________________________________________

City State ZIP Website address

Step 3: Tell us about your production of substitute forms

11 Describe your production or use (may check more than one)

a ___ Forms library product is offered for purchase d ___ I am a tax professional and develop a substitute tax

Product name _____________________________ form or forms I use for my clients. My clients do not

Illinois tax forms used in this product are produce the form.

___ purchased from another vendor____________

___ used as an unaltered image in my product e ___ The form is developed for my private use and is not

___ developed as part of our product offered for sale.

b ___ Tax software product is offered for purchase f ___ I am a tax professional who requests draft access

Product name _____________________________ and who does not produce substitute forms.

Illinois tax forms used in this product are

___ purchased from another vendor____________

___ used as an unaltered image in my product

___ developed as part of our product

c ___ Tax services product is offered for purchase

Product name _____________________________

Illinois tax forms used in this product are

___ purchased from another vendor____________

___ used as an unaltered image in my product

___ developed as part of our product

12 Check the type of Illinois taxes applicable to your substitute forms

___ Individual income tax ___ Withholding income tax ___ Business income tax ___ Sales/Use/Other

13 Complete Line 14 on Page 2. Provide a separate page for each product produced.

Step 4: Read agreement and sign below

I am authorized by the business named in Step 2 to complete this agreement regarding substitute forms production. I agree to comply with

the development and submission requirements in the 2024 Substitute Forms Guidelines. If notified of an error relating to forms design, written

instruction, or the scan line or barcode, I agree to correct the error, notify my customers, and email evidence of the correction to the email

address below within 10 business days of receiving the department’s notice. I understand that after receiving and approving my completed

Form IL-8633-SF, IDOR will provide me instructions on how to access the draft forms area on the IDOR website at tax.illinois.gov, where I will

access updated information and draft forms. For business uses described in Step 3 — a through c, I understand that a list of approved forms

along with my business and tax product name may be published on IDOR’s website at tax.illinois.gov.

_________________________________________________ _________________ _______________________ (_____)_____-_________

Signature of representative (product or taxpayer) Title Email address Daytime phone number

Email completed form to: Rev.VendorForms@illinois.gov

This form is authorized as outlined by the Department of Revenue Law of the Civil Administrative Code of Illinois.

IL-8633-SF Page 1 of 2 (R-08/24) Disclosure of this information is required. Failure to provide information may result in this form not being processed.