Enlarge image

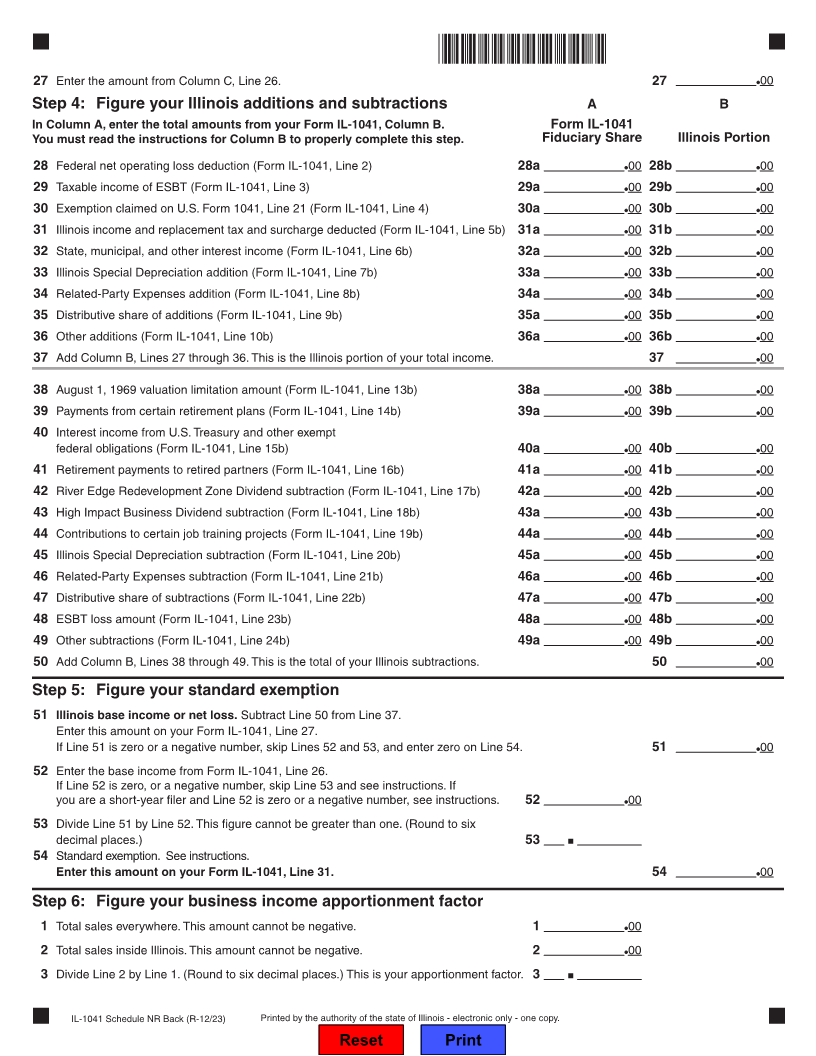

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

*63812231W* Year ending

2023 Schedule NR

_____ _____

Nonresident Computation of Fiduciary Income

Month Year

For tax years ending on or after December 31, 2023. Attach to your Form IL-1041. IL Attachment No. 2

Step 1: Provide the following information

Enter your name as shown on your Form IL-1041. Enter your federal employer identification number (FEIN).

Step 2: Complete Form IL-1041

Complete Lines 1 through 26 of your Form IL-1041, Fiduciary Income and Replacement Tax Return, as if you were an Illinois

resident. Then, complete the remainder of this schedule. Attach Schedule NR to your Form IL-1041.

Step 3: Figure the Illinois portion of your federal taxable income

See instructions for Columns A, B, and C for each line item.

Check the box if you are making the A B C

Business Income Election. See instructions. U.S. Form 1041 Fiduciary’s Share Illinois Portion

1 Interest income 1a 00 1b 00 1c 00

2 Dividends 2a 00 2b 00 2c 00

3 Business income or loss 3a 00 3b 00 3c 00

4 Gain or loss on sales and exchanges 4a 00 4b 00 4c 00

5 Net rent and royalty income 5a 00 5b 00 5c 00

6 Income from partnerships and subchapter S corps 6a 00 6b 00 6c 00

7 Income from trusts and estates 7a 00 7b 00 7c 00

8 Real Estate Mortgage Investment Conduits (REMIC) 8a 00 8b 00 8c 00

9 Net farm income or loss 9a 00 9b 00 9c 00

10 Business property 10a 00 10b 00 10c 00

11 Other income 11a 00 11b 00 11c 00

12 Total income. Add Lines 1 through 11. 12a 00 12b 00 12c 00

13 Interest expense 13a 00 13b 00 13c 00

14 Taxes 14a 00 14b 00 14c 00

15 Fiduciary fees 15a 00 15b 00 15c 00

16 Charitable deduction 16a 00 16b 00 16c 00

17 Attorney, accountant, and preparer fees 17a 00 17b 00 17c 00

18 Other deductions (including taxes) 18a 00 18b 00 18c 00

19 Add Lines 13 through 18. 19a 00 19b 00 19c 00

20 Subtract Line 19 from Line 12. Adjusted total income or loss. 20a 00 20b 00 20c 00

21 Income distribution deduction 21a 00

22 Subtract Line 21a from Line 20a. See instructions. 22a 00 22b 00 22c 00

23 Federal estate tax/Qualified business income deduction 23b 00 23c 00

24 Exemption 24b 00 24c 00

25 Add Lines 23 and 24. 25b 00 25c 00

26 Subtract Line 25 from Line 22. This is your taxable income. 26b 00 26c 00

Column B, Line 26, is your federal taxable income as shown on your federal Form 1041, Line 23.

Column C, Line 26, is your Illinois portion of your federal taxable income.

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

IL-1041 Schedule NR Front (R-12/23) information is REQUIRED. Failure to provide information could result in a penalty.