Enlarge image

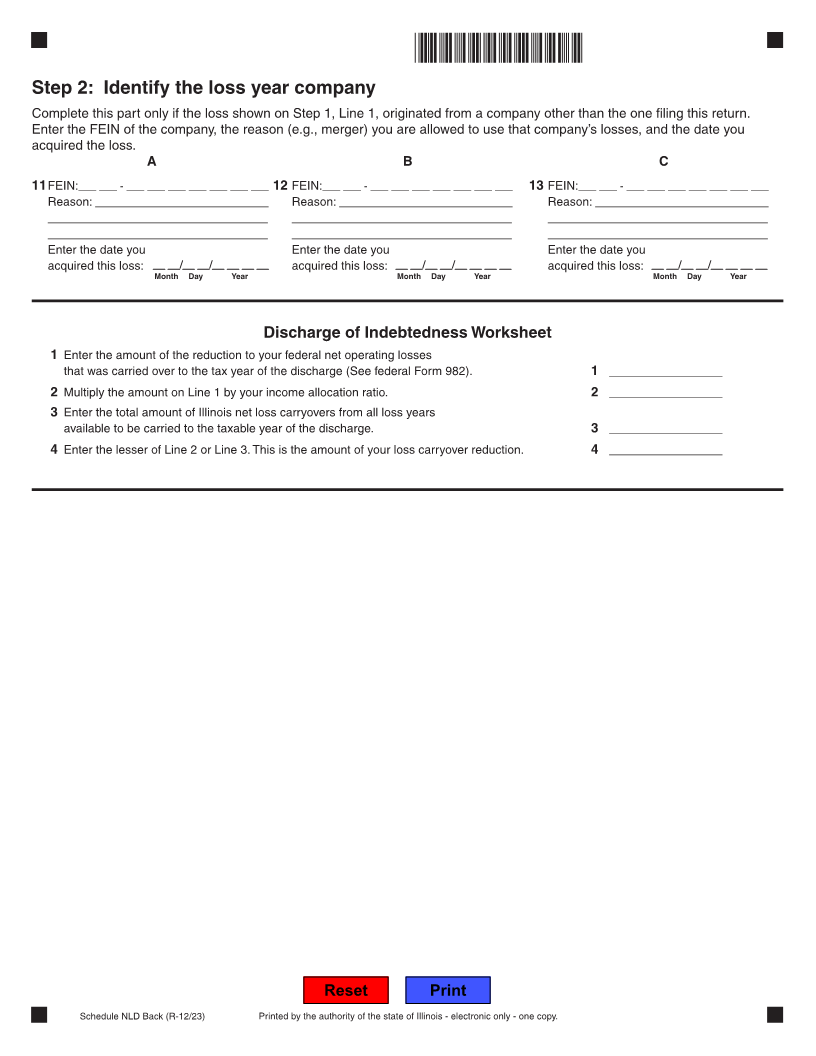

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

*33212231W* Carry year ending

2023 Schedule NLD

Illinois Net Loss Deduction Month Year

For Illinois net losses arising in tax years ending on or after December 31, 1986.

Attach to your Form IL-1120, IL-1120-ST, IL-1041, IL-1065, or corresponding amended return. IL Attachment No. 6

Enter your name as shown on your return. Enter your federal employer identification number (FEIN).

Step 1: Figure your Illinois net loss deduction (NLD)

Read the instructions before completing this schedule.

• “Carry year” is the year to which the loss is being carried.

• Enter all amounts as positive figures.

Loss year A B C

that expires Loss year Loss year

first ending ending

Month Year Month Year Month Year

1 Enter your reported Illinois

net loss. See instructions.

2a Enter the carry year and 2a

the amount of Illinois net Month Year Loss carried Month Year Loss carried Month Year Loss carried

loss previously carried 2b

back or forward. Month Year Loss carried Month Year Loss carried Month Year Loss carried

See instructions. 2c

Month Year Loss carried Month Year Loss carried Month Year Loss carried

2d Add Lines 2a through 2c.

This is your total amount

of loss previously carried. 2d

3 Subtract Line 2d from

Line 1. This is your

remaining Illinois net loss.

4 Enter the Illinois base

income for this carry year.

See instructions.

Enter Line 8 from previous column Enter Line 8 from previous column

5 Column A:

See instructions.

Columns B and C: See

instructions.

Enter Line 9 from previous column Enter Line 9 from previous column

6 Write the lesser of Line 4

or Line 5. This is your

maximum NLD allowed.

7 Write the lesser of Line 3

or Line 6. This is your NLD.

8 Subtract Line 7 from Line 4. Enter the total of

Line 7, Columns A, B,

This is your remaining and C in this box.

income after NLD.

9 Subtract Line 7 from Line 6.

This is your remaining NLD

allowed this carry year.

10 Subtract Line 7 from Line 3.

This is your remaining NLD

for subsequent years.

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

Schedule NLD Front (R-12/23) information is REQUIRED. Failure to provide information could result in a penalty.