Enlarge image

Illinois Department of Revenue

Schedule K-1-P(2) Partner’s and Shareholder’s Instructions

What’s New for 2023?

• Investment partnerships are required to withhold an amount on behalf of their nonresident partners. As a result, Schedule

K-1-P(4), Investment Partnership Withholding Calculation for Nonresident Partners, has been created to calculate

investment partnership withholding for each of the investment partnership’s nonresident partners. Schedule K-1-P, Step 7,

Line 55, is now used to report both pass-through withholding and investment partnership withholding.

General Information

What is the purpose of Schedule K-1-P?

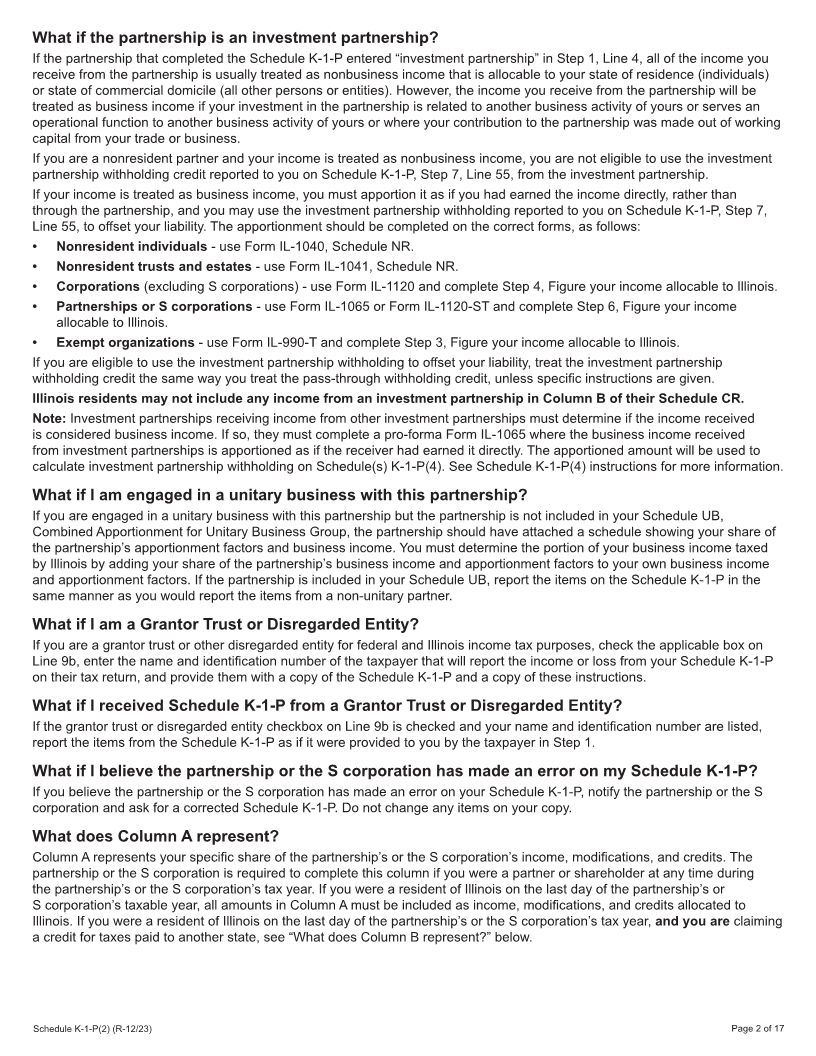

The partnership or the S corporation listed on the front of Schedule K-1-P has completed and provided you with the schedule

to reflect your specific share of the partnership’s or the S corporation’s income, modifications, and credits. Use the completed

schedule and these instructions to help you report the items shown on Schedule K-1-P on your Illinois Income Tax return.

What must I attach?

You must attach a copy of any Schedule K-1-P you receive from partnerships and S corporations to your tax return. You

should also keep a copy for your records.

If you receive a Schedule K-1-P that has “the following information is included in the Schedule K-1-P from _______” (the name

of the partnership or S corporation) written at the top, it is a pro forma Schedule K-1-P. The pro forma Schedule K-1-P has been

included to aid you in the completion of your return and should not be submitted with your tax return.

Definitions

• Pass-through entity - the partnership or S corporation that sent you Schedule K-1-P is a pass-through entity.

• Pass-through entity income is the income reported on your Schedule K-1-P.

• Pass-through withholding is the amount paid by the pass-through entity on your behalf. This amount is listed on Line

55 of your Schedule K-1-P. Not everyone who receives a Schedule K-1-P will have pass-through withholding reported. If

you are a resident of Illinois or if you submitted Form IL-1000-E, Certificate of Exemption for Pass-through Withholding

Payments, to the pass-through entity, then you will not have pass-through withholding reported on your Schedule K-1-P. In

this case, you will be responsible for reporting and paying Illinois Income tax on the pass-through income.

• Pass-through Entity (PTE) tax is an amount equal to 4.95 percent (.0495) of the taxpayer’s calculated net income for the

taxable year paid by a partnership (other than a publicly traded partnership under Section 7704 of the Internal Revenue

Code) or subchapter S corporation who elects to pay the tax for taxable years ending on or after December 31, 2021, and

beginning prior to January 1, 2026.

• PTE tax credit is the amount distributed to partners or shareholders by a partnership or S corporation if the election to pay

PTE tax was made. This amount is reported on Schedule K-1-P.

If a PTE made the election to pay PTE tax, then it passed through to its members both

• the credit for PTE tax it paid and

• each member’s distributive share of the PTE tax credit it received from electing pass-through entities in which it is a

member.

Note: Investment partnerships may use the PTE tax credit to offset their investment partnership liability, to the extent that

such credit would otherwise be distributable to its nonresident partners. See the Form IL-1065 and Schedule K-1-P(4)

Instructions for more information.

A nonresident individual member of a partnership or S corporation for a taxable year in which the election to pay PTE tax

was made shall not be required to file an income tax return under the Illinois Income Tax Act (IITA) for such taxable year if

the only source of net income of the individual (or the individual and the individual’s spouse in the case of a joint return) is

from an entity making the PTE election and the credit allowed to the member equals or exceeds the individual’s liability for

the tax imposed under subsections (a) and (b) of Section 201 of the IITA for the taxable year.

When is pass-through entity income earned?

Pass-through entity income is considered earned on the last day of the pass-through entity’s taxable year. Pass-through entity

income is not considered received equally throughout the year. The pass-through entity’s tax year ending date is listed in the

upper right corner of the Schedule K-1-P you received.

Schedule K-1-P(2) (R-12/23) Printed by the authority of the state of Illinois - electronic only - one copy. Page 1 of 17