Enlarge image

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

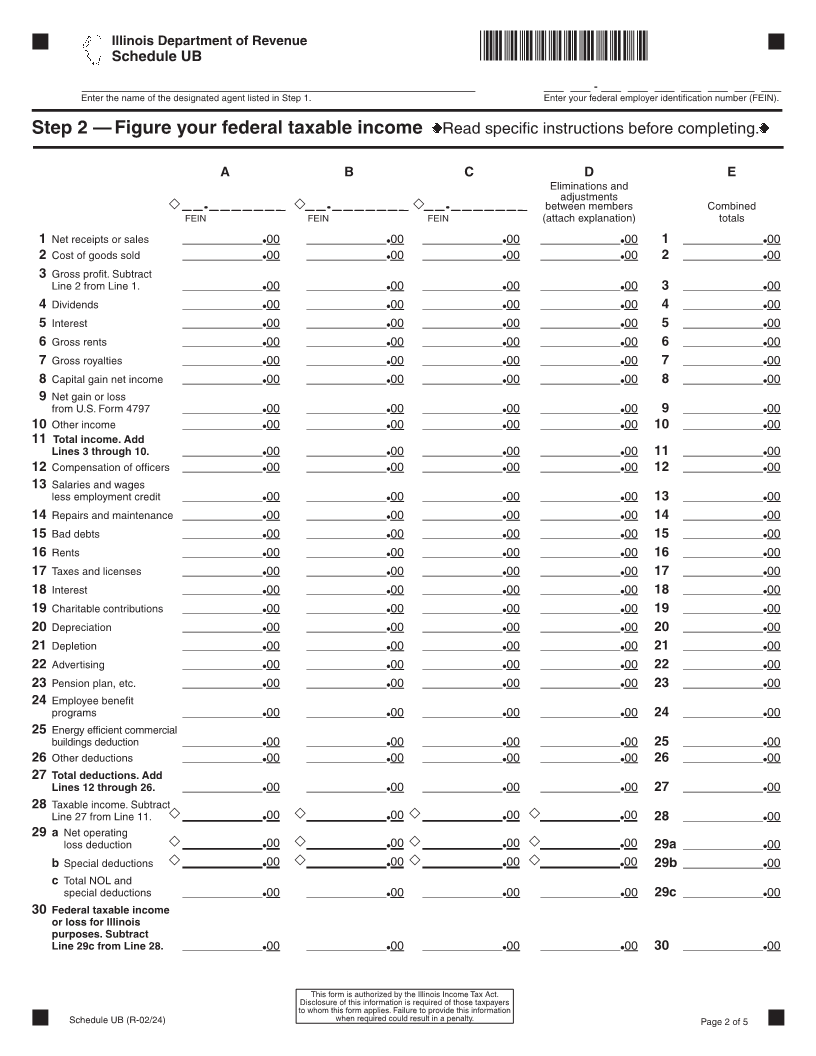

Illinois Department of Revenue

*33312231W* Common year ending for

2023 Schedule UB

the unitary business group

Combined Apportionment for Unitary Business Group _____ ____

For tax years ending on or after December 31, 2023. Month Year

Attach to your Form IL-1120, Form IL-1120-ST, or Form IL-1065. IL Attachment No. 5

Step 1 — Provide Your Membership Information

_______________________________________________________________________ _______________________________________________________________________ ___ ___ ______ -- ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

Enter the name of the designated agent (see general instructions). Enter the federal employer identification number (FEIN).

______________________________________________________________________________________________________________________________________________ ___ ___ ______ -- ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

Enter the name of the designated agent last year, if it is different than above. Enter the FEIN, if it is different than above.

______________________________________________________________________________________________________________________________________________ ___ ___ ______ -- ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

Enter the name of the controlling corporation (see general instructions). Enter the FEIN, if it is different than above.

If the controlling corporation is a member of this unitary group, check the box.

Section A — List all members. See Specific Instructions.

A B C D E F G H I

Year Appor-

ending Protected by New Inactive Holding tionment Member

Name FEIN (MM//YYYY) P.L. 86-272 member member company method Type

1____________________________________________________________________________________ ____ ____ -- ____ ____ ____ ____ ____ ____ ____ __ __ / __ __ __ __ __ __ _____ _____/ __ _______ _______ __ _____ _____ __________ _____ _____ __________

2____________________________________________________________________________________ ____ ____ -- ____ ____ ____ ____ ____ ____ ____ __ __ / __ __ __ __ __ __ _____ _____/ __ _______ _______ __ _____ _____ __________ _____ _____ __________

3____________________________________________________________________________________ ____ ____ -- ____ ____ ____ ____ ____ ____ ____ __ __ / __ __ __ __ __ __ _____ _____/ __ _______ _______ __ _____ _____ __________ _____ _____ __________

4 ____________________________________________________________________________________ __ __ - __ __ __ __ __ __ __ __ __ - __ __ __ __ __ __ __ __ __ / __ __ __ __ __ __ / __ __ __ __ _____ _____ _____ _____ __________ _____ _____ _____ _____ __________

5 ____________________________________________________________________________________ __ __ - __ __ __ __ __ __ __ __ __ - __ __ __ __ __ __ __ __ __ / __ __ __ ____ __ / __ __ __ __ _____ _____ _____ _____ _____ _____ __________ __________ __________

6____________________________________________________________________________________ ____ ____ -- ____ ____ ____ ____ ____ ____ ____ __ __ / __ __ __ __ __ __ _____ _____/ __ _______ _______ __ _____ _____ __________ _____ _____ __________

7____________________________________________________________________________________ ____ ____ -- ____ ____ ____ ____ ____ ____ __ __ __ __ / __ __ __ ___ _____ __ __ _____ _____/ __ __ _______ ________ _______________ __________ __________

8____________________________________________________________________________________ ____ ____ -- ____ ____ ____ ____ ____ ____ ____ __ __ / __ __ __ __ __ __ _____ _____/ __ _______ _______ __ __________ __________ _____ _____ __________

9____________________________________________________________________________________ ____ ____ -- ____ ____ ____ ____ ____ ____ __ __ __ __ / __ __ __ ___ _____ __ __ _____ _____/ __ __ _______ ________ _______________ __________ __________

10____________________________________________________________________________________ ____ ____ -- ____ ____ ____ ____ ____ ____ ____ __ __ / __ __ __ __ __ __ _____ _____/ __ ____________ __ __ __________ __________ _____ _____ __________

Section B — List any mergers with members listed in Section A. See Specific Instructions.

A B

Person who has merged with member Member listed in Section A

1 ________/________/ / / ________________

Name FEIN Name FEIN Date of merger

2 ________/________/ / / ________________

Name FEIN Name FEIN Date of merger

3 ________/________/ / / ________________

Name FEIN Name FEIN Date of merger

Section C — List all members who left the group during this tax year. See Specific Instructions.

A B

Member who was sold Entity to which member in Column A was sold

1 ________/________/ / / ________________

Name FEIN Name FEIN Date of sale

2 ________/________/ / / ________________

Name FEIN Name FEIN Date of sale

3 ________/________/ / / ________________

Name FEIN Name FEIN Date of sale

Section D — Provide information about your excluded members

See Specific Instructions and complete Step 5 if the answer below is 1 or greater.

1 Enter the total number of members excluded. ______ ______

Schedule UB (R-02/24) Page 1 of 5