Enlarge image

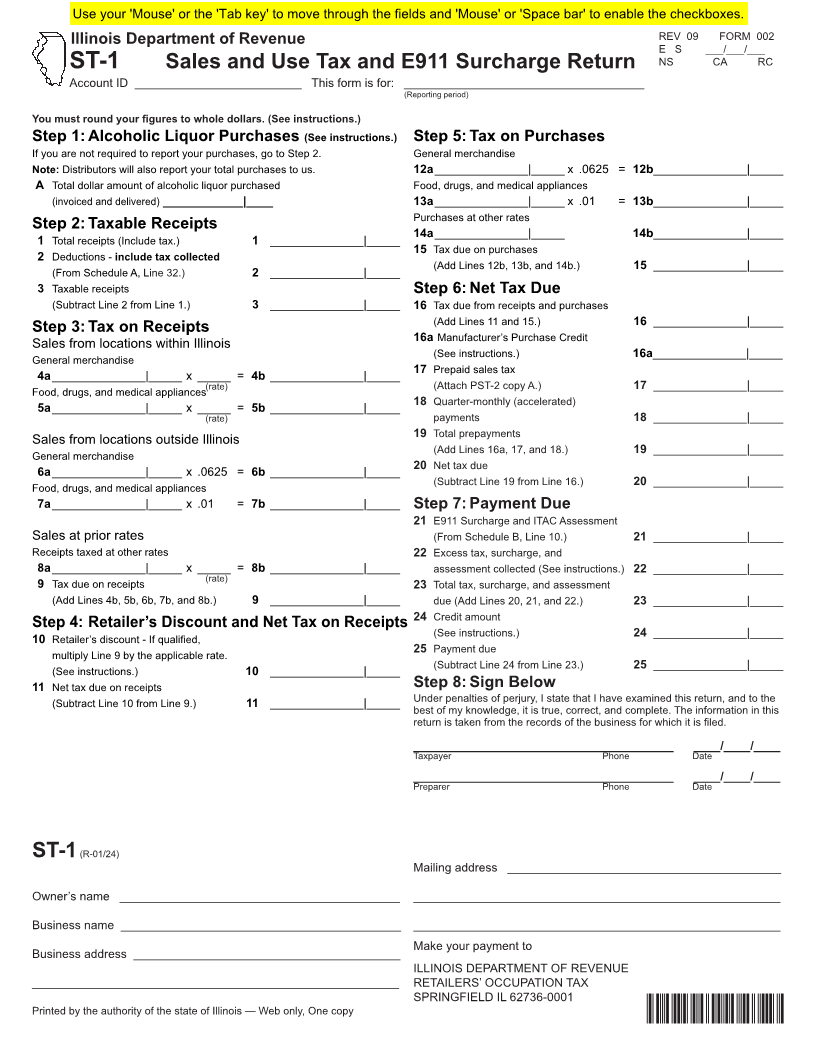

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue REV 09 FORM 002

E S ___/___/___

NS CA RC

ST-1 Sales and Use Tax and E911 Surcharge Return

Account ID _________________________ This form is for: ____________________________________

(Reporting period)

You must round your figures to whole dollars. (See instructions.)

Step 1: Alcoholic Liquor Purchases (See instructions.) Step 5: Tax on Purchases

If you are not required to report your purchases, go to Step 2. General merchandise

Note: Distributors will also report your total purchases to us. 12a ______________|_____ x .0625 = 12b ______________|_____

A Total dollar amount of alcoholic liquor purchased Food, drugs, and medical appliances

(invoiced and delivered) ____________|____ 13a ______________|_____ x .01 = 13b ______________|_____

Purchases at other rates

Step 2: Taxable Receipts ______________|_____ 14b ______________|_____

14a

1 Total receipts (Include tax.) 1 ______________|_____

15 Tax due on purchases

2 Deductions - include tax collected

(Add Lines 12b, 13b, and 14b.) 15 ______________|_____

(From Schedule A, Line 32.) 2 ______________|_____

3 Taxable receipts Step 6: Net Tax Due

(Subtract Line 2 from Line 1.) 3 ______________|_____ 16 Tax due from receipts and purchases

(Add Lines 11 and 15.) 16 ______________|_____

Step 3: Tax on Receipts

Sales from locations within Illinois 16a Manufacturer’s Purchase Credit

(See instructions.)

General merchandise 16a ______________|_____

4a ______________|_____ x _____ = 4b ______________|_____ 17 Prepaid sales tax

(Attach PST-2 copy A.)

Food, drugs, and medical appliances(rate) 17 ______________|_____

5a ______________|_____ x _____ = 5b ______________|_____ 18 Quarter-monthly (accelerated)

(rate) payments 18 ______________|_____

Sales from locations outside Illinois 19 Total prepayments

(Add Lines 16a, 17, and 18.)

General merchandise 19 ______________|_____

6a ______________|_____ x .0625 = 6b ______________|_____ 20 Net tax due

(Subtract Line 19 from Line 16.)

Food, drugs, and medical appliances 20 ______________|_____

7a ______________|_____ x .01 = 7b ______________|_____ Step 7: Payment Due

21 E911 Surcharge and ITAC Assessment

Sales at prior rates (From Schedule B, Line 10.) 21 ______________|_____

Receipts taxed at other rates 22 Excess tax, surcharge, and

8a ______________|_____ x _____ = 8b ______________|_____ assessment collected (See instructions.) 22 ______________|_____

9

Tax due on receipts (rate) 23 Total tax, surcharge, and assessment

(Add Lines 4b, 5b, 6b, 7b, and 8b.) 9 ______________|_____ due (Add Lines 20, 21, and 22.) 23 ______________|_____

24 Credit amount

Step 4: Retailer’s Discount and Net Tax on Receipts

(See instructions.)

10 Retailer’s discount - If qualified, 24 ______________|_____

multiply Line 9 by the applicable rate. 25 Payment due

(Subtract Line 24 from Line 23.)

(See instructions.) 10 ______________|_____ 25 ______________|_____

11 Net tax due on receipts Step 8: Sign Below

(Subtract Line 10 from Line 9.) 11 ______________|_____ Under penalties of perjury, I state that I have examined this return, and to the

best of my knowledge, it is true, correct, and complete. The information in this

return is taken from the records of the business for which it is filed.

_______________________________________ ____/____/____

Taxpayer Phone Date

_______________________________________ ____/____/____

Preparer Phone Date

ST-1 (R-01/24)

Mailing address _________________________________________

Owner’s name __________________________________________ _______________________________________________________

Business name __________________________________________ _______________________________________________________

Make your payment to

Business address ________________________________________

ILLINOIS DEPARTMENT OF REVENUE

_______________________________________________________ RETAILERS’ OCCUPATION TAX

SPRINGFIELD IL 62736-0001

Printed by the authority of the state of Illinois — Web only, One copy IDOR ST-1