Enlarge image

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

Amended Sales and Use Tax and E911 Surcharge Return

ST-1-X

REV 09 FORM 003 Station 820, 833

E S ____/___/____

NS DP CA RC

Do not write above this line.

General Information

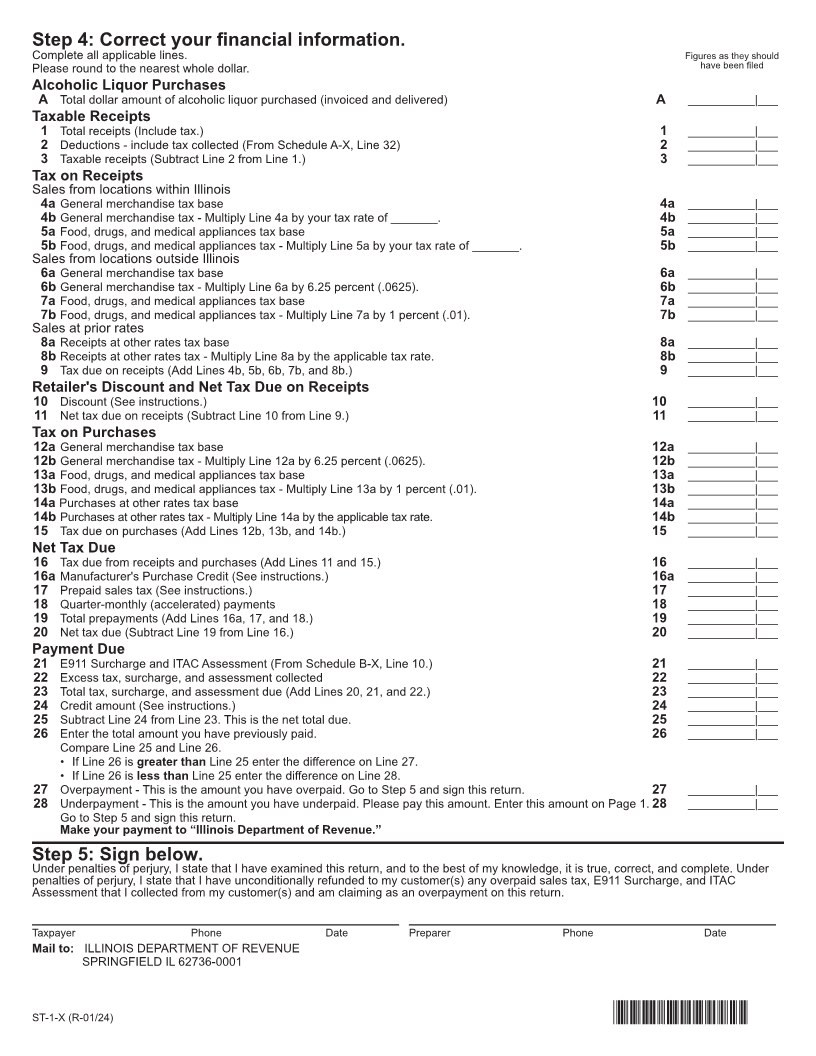

Everyone must complete Steps 1, 2, 4, and 5. Amount you are paying: $

You must also complete Step 3 if you believe that you have overpaid. Make your check payable to "Illinois Department of Revenue."

Step 1: Identify your business.

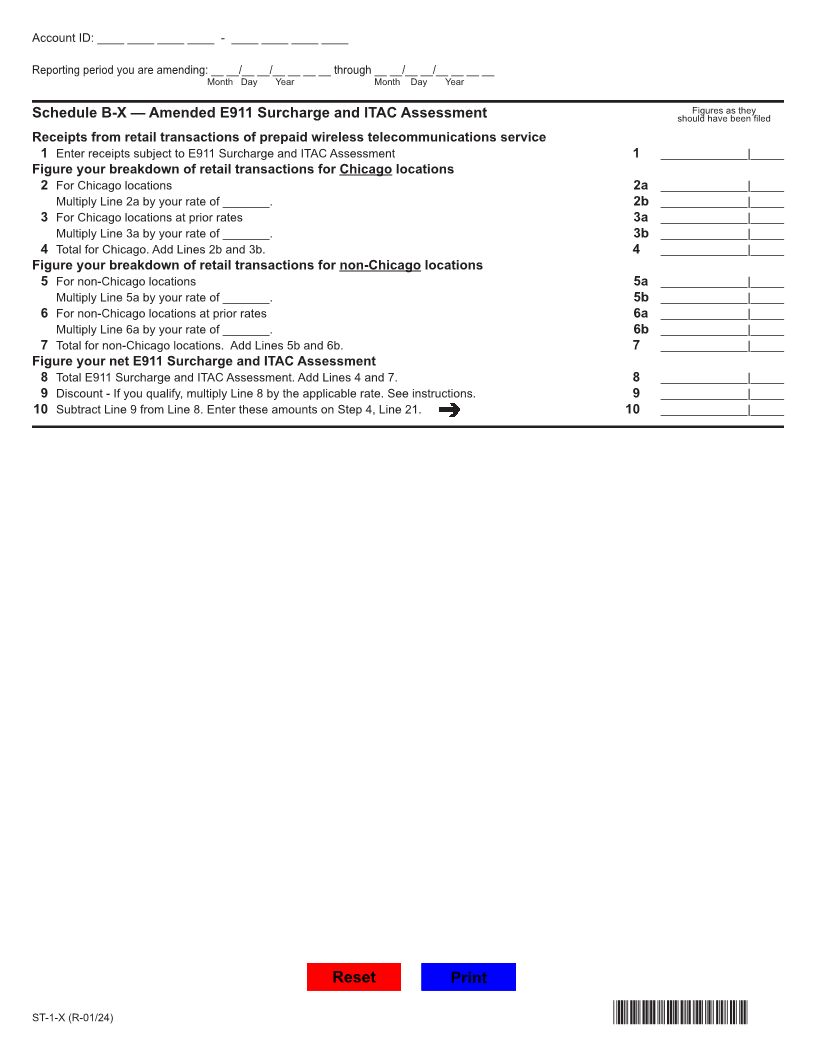

1 Account ID: ____ ____ ____ ____ - ____ ____ ____ ____ 3 Business name: _________________________________

2 Reporting period you are amending: __ __/__ __/__ __ __ __ through __ __/__ __/__ __ __ __

Month Day Year Month Day Year

Step 2: Mark the reason why you are filing an amended return.

1____ Overpaid (Complete Step 3) 3____ Response to notice or bill

2____ Underpaid 4____ Corrections to line items but no additional tax due

Step 3: Mark the reason(s) why you have overpaid your return.

If you collected the overpaid Sales Tax, E911 Surcharge, or ITAC Assessment from your

customer(s), you must have unconditionally refunded the overpaid amount to your customer(s)

before you file a claim for credit.

1 ___I am decreasing Line 1 or I am increasing Line 2 because 4 ___I used the wrong tax rate.

I sold merchandise 5 ___The tax base is correct but I put it on the wrong tax line.

a ___to another Illinois business for resale. List the account 6 ___I made a math error calculating Lines 9,11,15, 20, 23, or 25.

ID(s) on Schedule RE and attach to Form ST-1-X. 7 ___I failed to take the discount or made a math error calculating

b ___to an out-of-state customer and it was delivered to a the discount.

location outside Illinois. 8 ___I made errors completing Form ST-2, Multiple Site Form.

c ___to an exempt organization. List the tax exempt (E) 9___I am a retailer who is exchanging Manufacturer's Purchase

number(s) on Schedule RE and attach to Form ST-1-X. Credit from a customer for cash previously paid.

d ___that qualifies for a tax exemption for machinery or 10 ___I overpaid use tax because I failed to use Manufacturer's

equipment used in manufacturing, farming, or graphic

Purchase Credit to pay use tax.

arts.

11 ___I overpaid use tax because the item

e ___that qualifies for an enterprise zone exemption.

a ___qualifies for a tax exemption for machinery or equipment

f ___that was returned by my customer.

used in manufacturing, farming, or graphic arts.

g ___and paid tax that is represented by amounts that have

b ___qualifies for an enterprise zone exemption.

become worthless as uncollectible debt.

c___was shipped to and used at a site outside Illinois.

2 ___I included receipts from prior month(s) or used the wrong

month's receipts. d___was returned to my supplier.

3 ___I failed to include tax collected in Line 2.

Turn page to complete Steps 4 and 5.

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

ST-1-X (R-01/24) Printed by the authority of the state of Illinois - Web only, One copy *00305211G*