Enlarge image

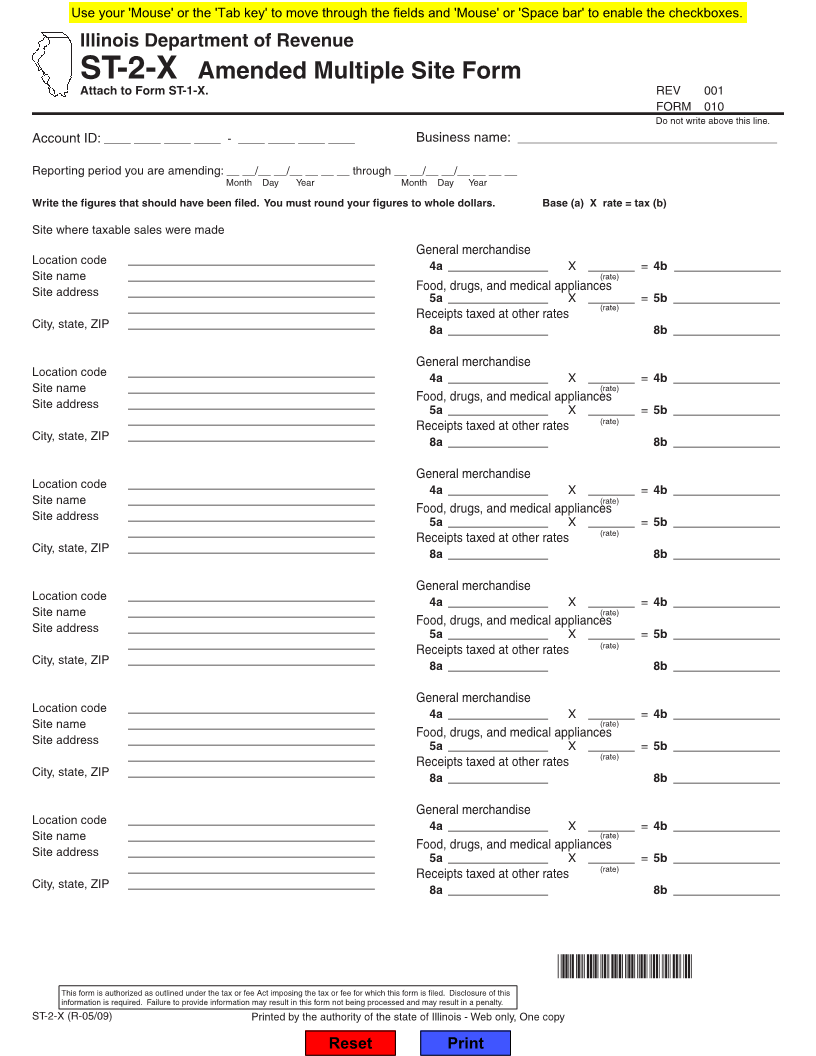

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

ST-2-X Amended Multiple Site Form

Attach to Form ST-1-X. REV 001

FORM 010

Do not write above this line.

Account ID: ____ ____ ____ ____ - ____ ____ ____ ____ Business name: ___________________________________

Reporting period you are amending: __ __/__ __/__ __ __ __ through __ __/__ __/__ __ __ __

Month Day Year Month Day Year

Write the figures that should have been filed. You must round your figures to whole dollars. Base (a) X rate = tax (b)

Site where taxable sales were made

General merchandise

Location code _____________________________________ 4a _______________ X _______ = 4b ________________

Site name _____________________________________ (rate)

Site address _____________________________________ Food, drugs, and medical appliances

5a _______________ X _______ = 5b ________________

(rate)

_____________________________________ Receipts taxed at other rates

City, state, ZIP _____________________________________ 8a _______________ 8b ________________

General merchandise

Location code _____________________________________ 4a _______________ X _______ = 4b ________________

Site name _____________________________________ (rate)

Food, drugs, and medical appliances

Site address _____________________________________ 5a _______________ X _______ = 5b ________________

(rate)

_____________________________________ Receipts taxed at other rates

City, state, ZIP _____________________________________ 8a _______________ 8b ________________

General merchandise

Location code _____________________________________ 4a _______________ X _______ = 4b ________________

Site name _____________________________________ (rate)

Food, drugs, and medical appliances

Site address _____________________________________ 5a _______________ X _______ = 5b ________________

(rate)

_____________________________________ Receipts taxed at other rates

City, state, ZIP _____________________________________ 8a _______________ 8b ________________

General merchandise

Location code _____________________________________ 4a _______________ X _______ = 4b ________________

Site name _____________________________________ (rate)

Food, drugs, and medical appliances

Site address _____________________________________ 5a _______________ X _______ = 5b ________________

(rate)

_____________________________________ Receipts taxed at other rates

City, state, ZIP _____________________________________ 8a _______________ 8b ________________

General merchandise

Location code _____________________________________ 4a _______________ X _______ = 4b ________________

Site name _____________________________________ (rate)

Food, drugs, and medical appliances

Site address _____________________________________ 5a _______________ X _______ = 5b ________________

(rate)

_____________________________________ Receipts taxed at other rates

City, state, ZIP _____________________________________ 8a _______________ 8b ________________

General merchandise

Location code _____________________________________ 4a _______________ X _______ = 4b ________________

Site name _____________________________________ (rate)

Food, drugs, and medical appliances

Site address _____________________________________ 5a _______________ X _______ = 5b ________________

(rate)

_____________________________________ Receipts taxed at other rates

City, state, ZIP _____________________________________ 8a _______________ 8b ________________

*901011110*

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

ST-2-X (R-05/09) Printed by the authority of the state of Illinois - Web only, One copy

Reset Print