- 4 -

Enlarge image

|

*32412233V*

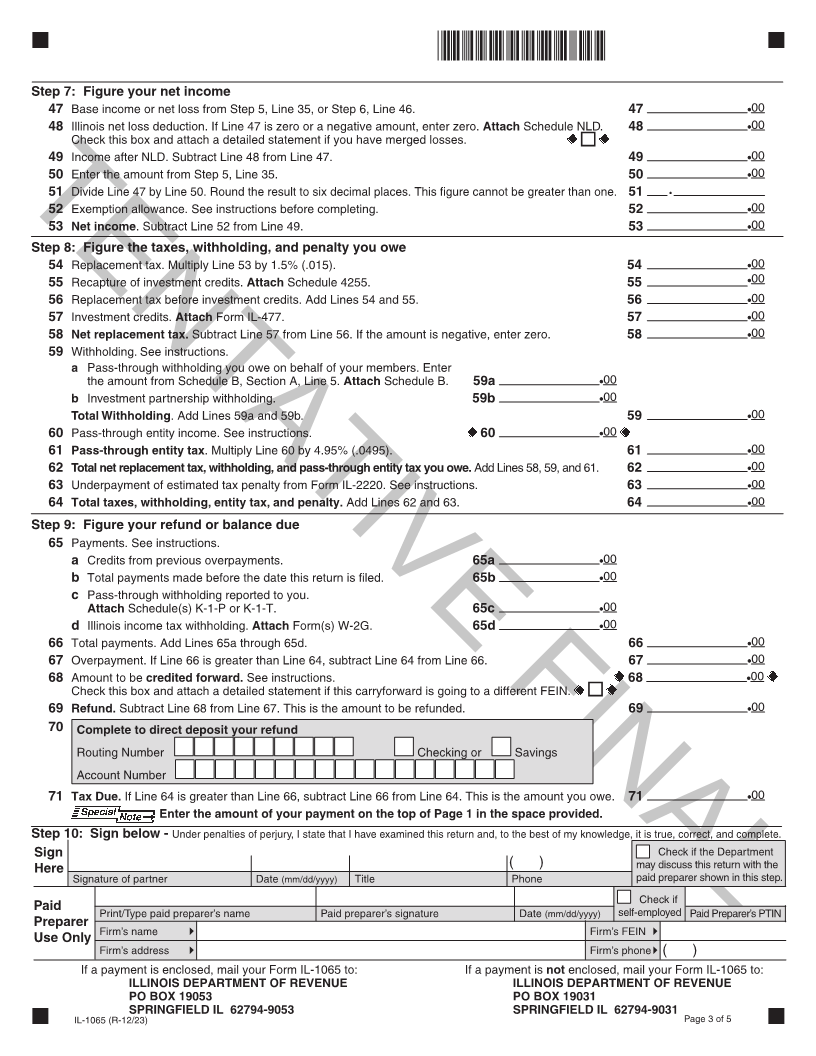

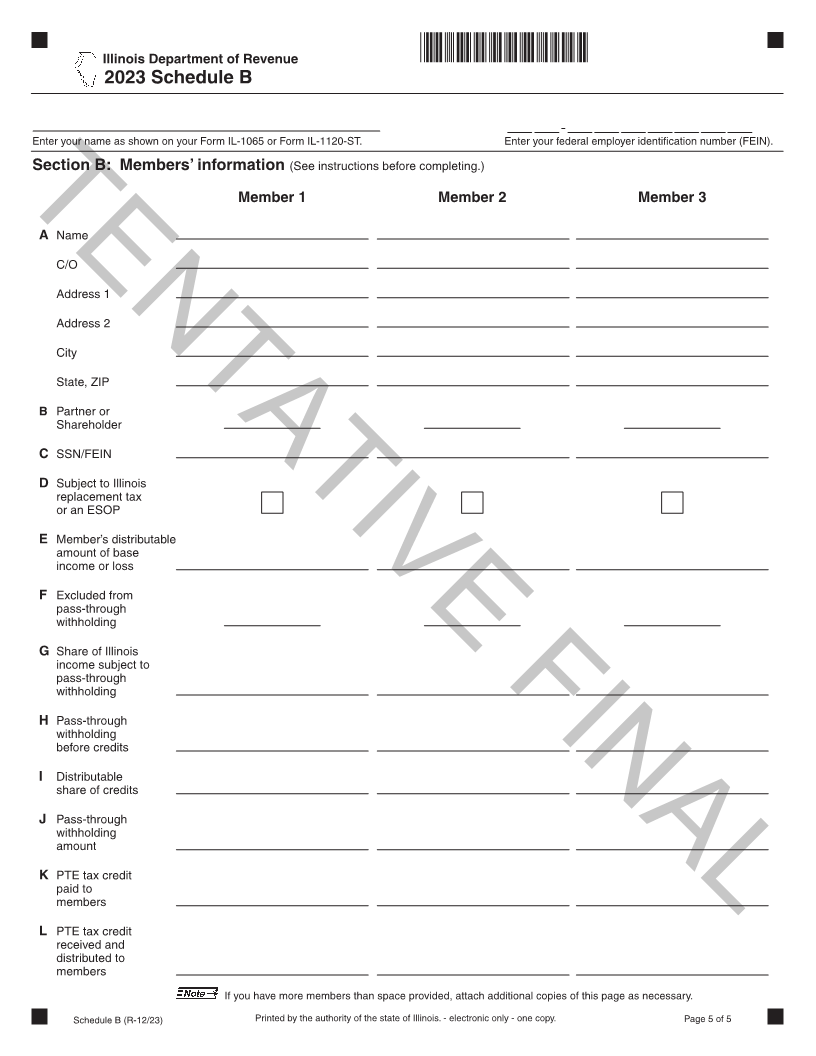

Step 7: Figure your net income

47 Base income or net loss from Step 5, Line 35, or Step 6, Line 46. 47 00

48 Illinois net loss deduction. If Line 47 is zero or a negative amount, enter zero. Attach Schedule NLD. 48 00

Check this box and attach a detailed statement if you have merged losses.

49 Income after NLD. Subtract Line 48 from Line 47. 49 00

50 Enter the amount from Step 5, Line 35. 50 00

51 Divide Line 47 by Line 50. Round the result to six decimal places. This figure cannot be greater than one. 51

TENTATIVE 52 Exemption allowance. See instructions before completing. 52 FINAL00

53 Net income. Subtract Line 52 from Line 49. 53 00

Step 8: Figure the taxes, withholding, and penalty you owe

54 Replacement tax. Multiply Line 53 by 1.5% (.015). 54 00

55 Recapture of investment credits. Attach Schedule 4255. 55 00

56 Replacement tax before investment credits. Add Lines 54 and 55. 56 00

57 Investment credits. Attach Form IL-477. 57 00

58 Net replacement tax. Subtract Line 57 from Line 56. If the amount is negative, enter zero. 58 00

59 Withholding. See instructions.

a Pass-through withholding you owe on behalf of your members. Enter

the amount from Schedule B, Section A, Line 5. Attach Schedule B. 59a 00

b Investment partnership withholding. 59b 00

Total Withholding. Add Lines 59a and 59b. 59 00

60 Pass-through entity income. See instructions. 60 00

61 Pass-through entity tax. Multiply Line 60 by 4.95% (.0495). 61 00

62 Total net replacement tax, withholding, and pass-through entity tax you owe. Add Lines 58, 59, and 61. 62 00

63 Underpayment of estimated tax penalty from Form IL-2220. See instructions. 63 00

64 Total taxes, withholding, entity tax, and penalty. Add Lines 62 and 63. 64 00

Step 9: Figure your refund or balance due

65 Payments. See instructions.

a Credits from previous overpayments. 65a 00

b Total payments made before the date this return is filed. 65b 00

c Pass-through withholding reported to you.

Attach Schedule(s) K-1-P or K-1-T. 65c 00

d Illinois income tax withholding. Attach Form(s) W-2G. 65d 00

66 Total payments. Add Lines 65a through 65d. 66 00

67 Overpayment. If Line 66 is greater than Line 64, subtract Line 64 from Line 66. 67 00

68 Amount to be credited forward. See instructions. 68 00

Check this box and attach a detailed statement if this carryforward is going to a different FEIN.

69 Refund. Subtract Line 68 from Line 67. This is the amount to be refunded. 69 00

70 Complete to direct deposit your refund

Routing Number Checking or Savings

Account Number

71 Tax Due. If Line 64 is greater than Line 66, subtract Line 66 from Line 64. This is the amount you owe. 71 00

Enter the amount of your payment on the top of Page 1 in the space provided.

Step 10: Sign below - Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

Sign Check if the Department

Here ( ) may discuss this return with the

Signature of partner Date (mm/dd/yyyy) Title Phone paid preparer shown in this step.

Check if

Paid Print/Type paid preparer’s name Paid preparer’s signature Date (mm/dd/yyyy) self-employed Paid Preparer’s PTIN

Preparer

Firm’s name Firm’s FEIN

Use Only

Firm’s address Firm’s phone ( )

If a payment is enclosed, mail your Form IL-1065 to: If a payment is not enclosed, mail your Form IL-1065 to:

ILLINOIS DEPARTMENT OF REVENUE ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19053 PO BOX 19031

SPRINGFIELD IL 62794-9053 SPRINGFIELD IL 62794-9031

IL-1065 (R-12/23) Page 3 of 5

|