- 2 -

Enlarge image

|

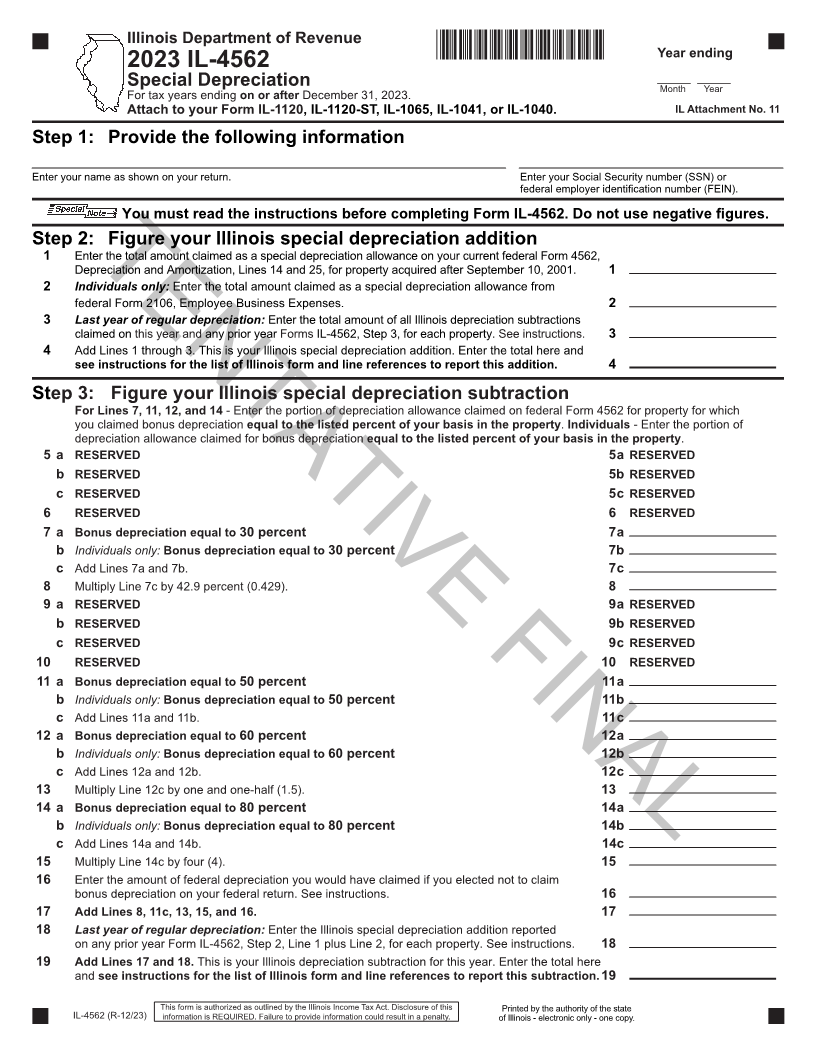

Illinois Department of Revenue

*62212231V* Year ending

2023 IL-4562

_____ _____

Special Depreciation Month Year

For tax years ending on or after December 31, 2023.

Attach to your Form IL-1120, IL-1120-ST, IL-1065, IL-1041, or IL-1040. IL Attachment No. 11

Step 1: Provide the following information

Enter your name as shown on your return. Enter your Social Security number (SSN) or

federal employer identification number (FEIN).

You must read the instructions before completing Form IL-4562. Do not use negative figures.

Step 2: Figure your Illinois special depreciation addition

1 Enter the total amount claimed as a special depreciation allowance on your current federal Form 4562,

TENTATIVEDepreciation and Amortization, Lines 14 and 25, for property acquired after September 10, 2001. 1 FINAL

2 Individuals only: Enter the total amount claimed as a special depreciation allowance from

federal Form 2106, Employee Business Expenses. 2

3 Last year of regular depreciation: Enter the total amount of all Illinois depreciation subtractions

claimed on this year and any prior year Forms IL-4562, Step 3, for each property. See instructions. 3

4 Add Lines 1 through 3. This is your Illinois special depreciation addition. Enter the total here and

see instructions for the list of Illinois form and line references to report this addition. 4

Step 3: Figure your Illinois special depreciation subtraction

For Lines 7, 11, 12, and 14 - Enter the portion of depreciation allowance claimed on federal Form 4562 for property for which

you claimed bonus depreciation equal to the listed percent of your basis in the property.Individuals - Enter the portion of

depreciation allowance claimed for bonus depreciation equal to the listed percent of your basis in the property.

5 a RESERVED 5 a RESERVED

b RESERVED 5 b RESERVED

c RESERVED 5 c RESERVED

6 RESERVED 6 RESERVED

7 a Bonus depreciation equal to 30 percent 7 a

b Individuals only: Bonus depreciation equal to 30 percent 7 b

c Add Lines 7a and 7b. 7 c

8 Multiply Line 7c by 42.9 percent (0.429). 8

9 a RESERVED 9 a RESERVED

b RESERVED 9 b RESERVED

c RESERVED 9 c RESERVED

10 RESERVED 10 RESERVED

11 a Bonus depreciation equal to 50 percent 11 a

b Individuals only: Bonus depreciation equal to 50 percent 11 b

c Add Lines 11a and 11b. 11 c

12 a Bonus depreciation equal to 60 percent 12 a

b Individuals only: Bonus depreciation equal to 60 percent 12 b

c Add Lines 12a and 12b. 12 c

13 Multiply Line 12c by one and one-half (1.5). 13

14 a Bonus depreciation equal to 80 percent 14 a

b Individuals only: Bonus depreciation equal to 80 percent 14 b

c Add Lines 14a and 14b. 14c

15 Multiply Line 14c by four (4). 15

16 Enter the amount of federal depreciation you would have claimed if you elected not to claim

bonus depreciation on your federal return. See instructions. 16

17 Add Lines 8, 11c, 13, 15, and 16. 17

18 Last year of regular depreciation: Enter the Illinois special depreciation addition reported

on any prior year Form IL-4562, Step 2, Line 1 plus Line 2, for each property. See instructions. 18

19 Add Lines 17 and 18. This is your Illinois depreciation subtraction for this year. Enter the total here

and see instructions for the list of Illinois form and line references to report this subtraction. 19

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this Printed by the authority of the state

IL-4562 (R-12/23) information is REQUIRED. Failure to provide information could result in a penalty. of Illinois - electronic only - one copy.

|