- 2 -

Enlarge image

|

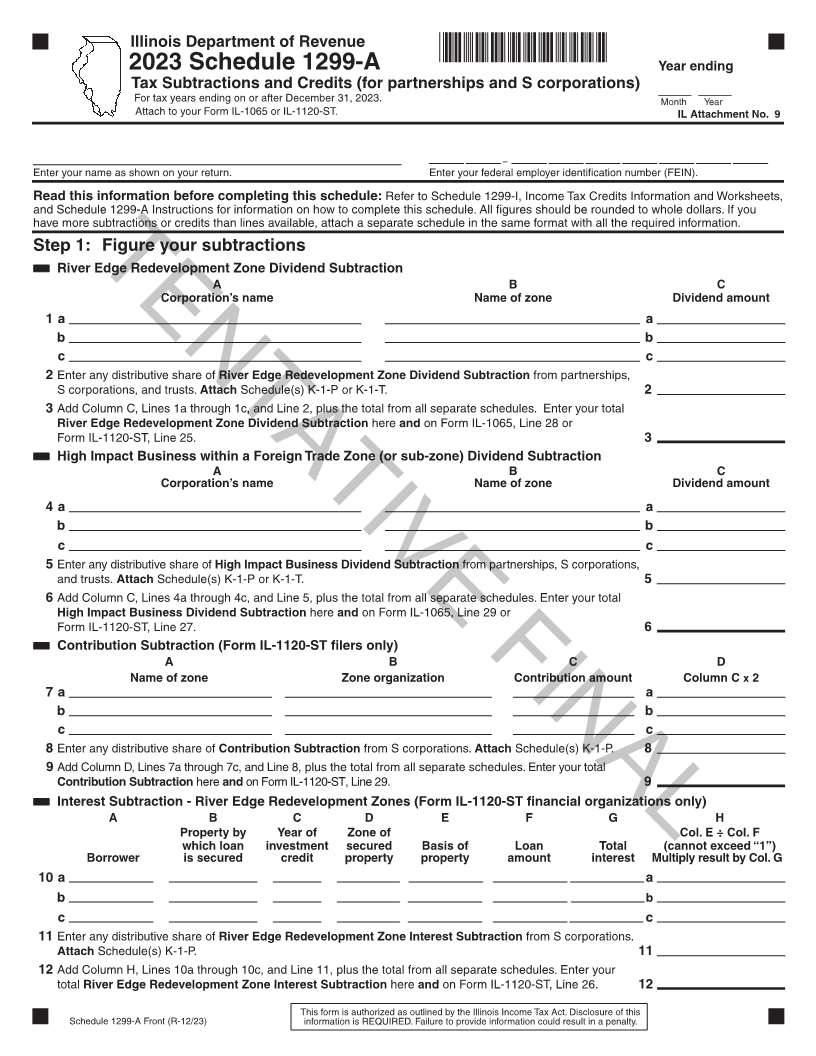

Illinois Department of Revenue

*34012231V*

2023 Schedule 1299-A Year ending

Tax Subtractions and Credits (for partnerships and S corporations) _____ _____

For tax years ending on or after December 31, 2023. Month Year

Attach to your Form IL-1065 or IL-1120-ST.

IL Attachment No. 9

–

Enter your name as shown on your return. Enter your federal employer identification number (FEIN).

Read this information before completing this schedule: Refer to Schedule 1299-I, Income Tax Credits Information and Worksheets,

and Schedule 1299-A Instructions for information on how to complete this schedule. All figures should be rounded to whole dollars. If you

have more subtractions or credits than lines available, attach a separate schedule in the same format with all the required information.

Step 1: Figure your subtractions

RiverTENTATIVEEdge Redevelopment Zone Dividend Subtraction FINAL

A B C

Corporation’s name Name of zone Dividend amount

1 a a

b b

c c

2 Enter any distributive share of River Edge Redevelopment Zone Dividend Subtraction from partnerships,

S corporations, and trusts. Attach Schedule(s) K-1-P or K-1-T. 2

3 Add Column C, Lines 1a through 1c, and Line 2, plus the total from all separate schedules. Enter your total

River Edge Redevelopment Zone Dividend Subtraction here and on Form IL-1065, Line 28 or

Form IL-1120-ST, Line 25. 3

High Impact Business within a Foreign Trade Zone (or sub-zone) Dividend Subtraction

A B C

Corporation’s name Name of zone Dividend amount

4 a a

b b

c c

5 Enter any distributive share of High Impact Business Dividend Subtraction from partnerships, S corporations,

and trusts. Attach Schedule(s) K-1-P or K-1-T. 5

6 Add Column C, Lines 4a through 4c, and Line 5, plus the total from all separate schedules. Enter your total

High Impact Business Dividend Subtraction here and on Form IL-1065, Line 29 or

Form IL-1120-ST, Line 27. 6

Contribution Subtraction (Form IL-1120-ST filers only)

A B C D

Name of zone Zone organization Contribution amount Column C x 2

7 a a

b b

c c

8 Enter any distributive share of Contribution Subtraction from S corporations. Attach Schedule(s) K-1-P. 8

9 Add Column D, Lines 7a through 7c, and Line 8, plus the total from all separate schedules. Enter your total

Contribution Subtraction here and on Form IL-1120-ST, Line 29. 9

Interest Subtraction - River Edge Redevelopment Zones (Form IL-1120-ST financial organizations only)

A B C D E F G H

Property by Year of Zone of Col. E ÷ Col. F

which loan investment secured Basis of Loan Total (cannot exceed “1”)

Borrower is secured credit property property amount interest Multiply result by Col. G

10 a a

b b

c c

11 Enter any distributive share of River Edge Redevelopment Zone Interest Subtraction from S corporations.

Attach Schedule(s) K-1-P. 11

12 Add Column H, Lines 10a through 10c, and Line 11, plus the total from all separate schedules. Enter your

total River Edge Redevelopment Zone Interest Subtraction here and on Form IL-1120-ST, Line 26. 12

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

Schedule 1299-A Front (R-12/23) information is REQUIRED. Failure to provide information could result in a penalty.

|