- 3 -

Enlarge image

|

Enter identification number from Line 7.

_______________________________ *33012222V*

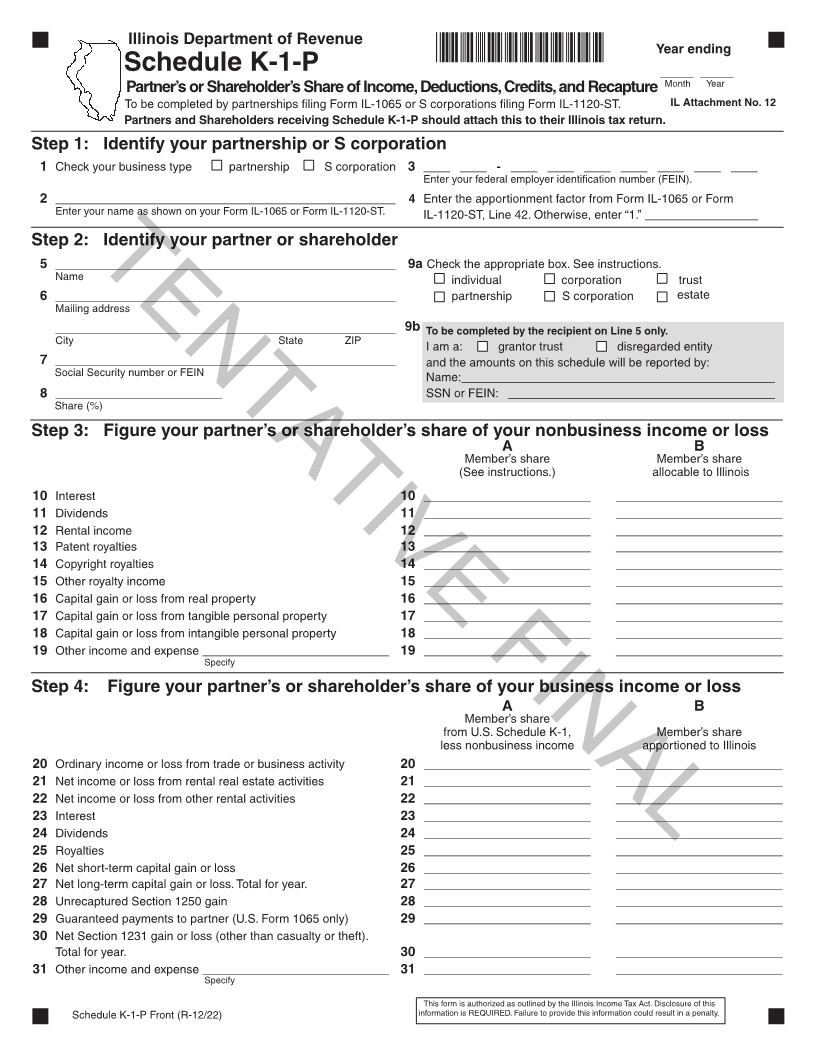

Step 5: Figure your partner’s or shareholder’s share of Illinois additions and subtractions

K-1-P Recipient: Before using the information provided in Step 5, you must read

Schedule K-1-P(2) to correctly report the amounts listed in Columns A and B. A B

Member’s share from Member’s share apportioned or

Additions Form IL-1065 or IL-1120-ST allocated to Illinois

32 Federally tax-exempt interest income 32_________________________ _________________________

33 Illinois taxes and surcharge deducted. See instructions. 33 _________________________ _________________________

34 Illinois Special Depreciation addition 34 _________________________ _________________________

35 Related-Party Expenses addition 35 _________________________ _________________________

36 Distributive share of additions 36 _________________________ _________________________

37 Other additions (from Illinois Schedule M for businesses) 37 _________________________ _________________________

Subtractions

38 a Interest from U.S. Treasury obligations (business income) 38a _________________________ _________________________

b Interest from U.S. Treasury obligations (nonbusiness income) 38b _________________________ _________________________

39 RiverTENTATIVEEdge Redevelopment Zone Dividend subtraction 39 _________________________ _________________________FINAL

40 High Impact Business Dividend subtraction 40 _________________________ _________________________

41 Contribution subtraction (Form IL-1120-ST filers only) 41 _________________________ _________________________

42 River Edge Redevelopment Zone Interest subtraction

(Form IL-1120-ST financial organizations only) 42 _________________________ _________________________

43 High Impact Business within a Foreign Trade Zone Interest

subtraction (Form IL-1120-ST financial organizations only) 43 _________________________ _________________________

44 Illinois Special Depreciation subtraction 44 _________________________ _________________________

45 Related-Party Expenses subtraction 45 _________________________ _________________________

46 Distributive share of subtractions 46 _________________________ _________________________

47 Other subtractions (from Illinois Schedule M for businesses) 47 _________________________ _________________________

Step 6: Figure your partner’s or shareholder’s (except a corporate partner or shareholder)

share of your Illinois August 1, 1969, appreciation amounts

A B

Member’s share from Illinois Member’s share apportioned or

Schedule F (Form IL-1065 or IL-1120-ST) allocated to Illinois

48 Section 1245 and 1250 gain 48 _________________________ _________________________

49 Section 1231 gain 49 _________________________ _________________________

50 Section 1231 gain less casualty and theft gain. See instructions. 50 _________________________ _________________________

51 Capital gain 51 _________________________ _________________________

Step 7: Figure your partner’s or shareholder’s share of your Illinois credits, recapture,

pass-through withholding, pass-through entity tax credit, and federal income subject to

surcharge Member’s share Member’s share

Credit from Illinois tax from Illinois tax

52 Illinois Income Tax Credits Code return return

a Film Production Services 5000 52a _____________ 53 Other credits

b Enterprise Zone Investment 5080 52b _____________ a Pass-through Entity (PTE) Tax Credit

c Enterprise Zone Construction Jobs 5120 52c _____________ See instructions. 53a _____________

d High Impact Business Construction Jobs 5160 52d _____________ b Replacement Tax Investment Credits

e Affordable Housing Donations 5260 52e ____________ See instructions. 53b _____________

f EDGE 5300 52f _____________ 54 Recapture

g New Construction EDGE 5320 52g _____________ a Enterprise Zone or River Edge

Redevelopment Zone

h Research and Development 5340 52h _____________ Investment Credit recapture 54a _____________

i Wages Paid to Ex-Felons 5380 52i _____________ b REV Illinois Investment Credit

j Student-Assistance Contributions 5420 52j _____________ recapture 54b _____________

k Angel Investment 5460 52k _____________ c Replacement Tax Investment Credit

l New Markets Development 5500 52l _____________ recapture 54c _____________

mRiver Edge Historic Preservation 5540 52m _____________ d Additional income tax credit

n River Edge Construction Jobs 5560 52n _____________ recapture 54d _____________

o Live Theater Production 5580 52o _____________ 55 Pass-through withholding

See instructions. 55 _____________

p Hospital 5620 52p _____________ 56 Federal income attributable to

q Invest in Kids 5660 52q _____________ transactions subject to the

r Data Center Construction Employment 5820 52r _____________ Compassionate Use of Medical

s Apprenticeship Education Expense 0160 52s _____________ Cannabis Program Act surcharge.

t Historic Preservation 1030 52t _____________ See instructions. 56 _____________

u REV Illinois Investment 5230 52u _____________ 57 Federal income attributable to the

v Agritourism Liability Insurance 5440 52v _____________ sale or exchange of assets by a

w Recovery and Mental Health 0180 52w _____________ gaming licensee surcharge.

See instructions. 57 _____________

x Other income tax credits __________________ 52x _____________

Schedule K-1-P Back (R-12/22) Printed by the authority of the state of Illinois - electronic only - one copy.

|