- 2 -

Enlarge image

|

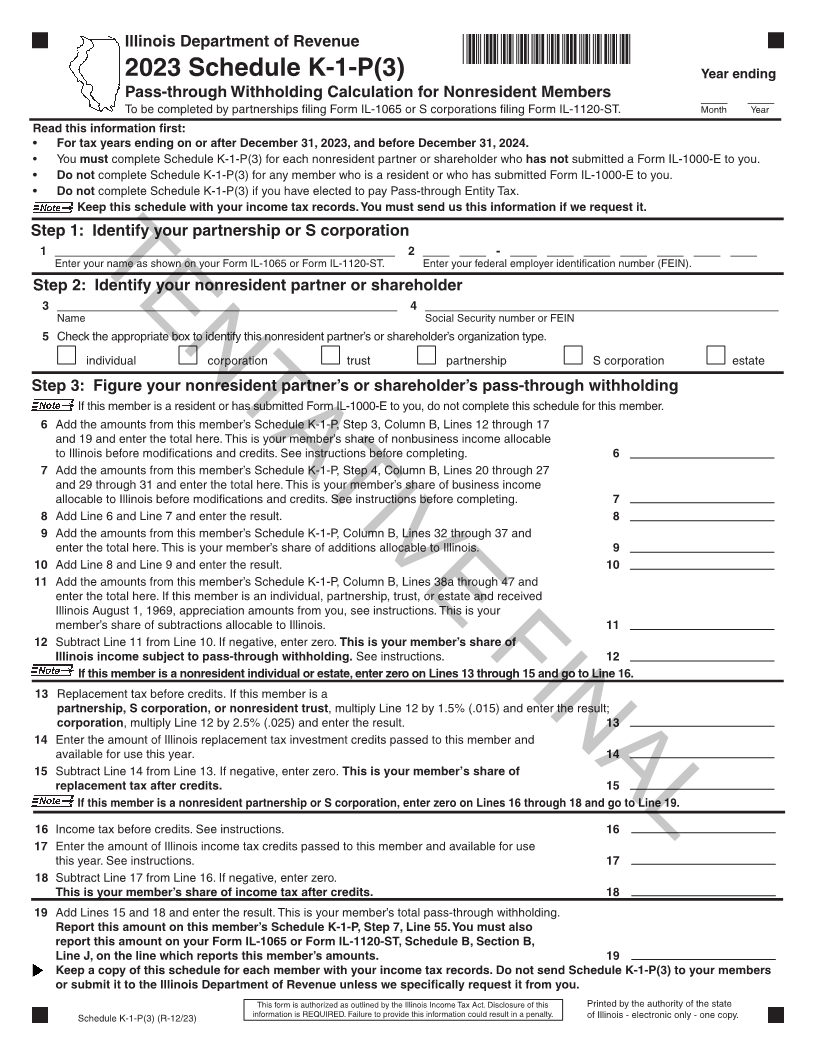

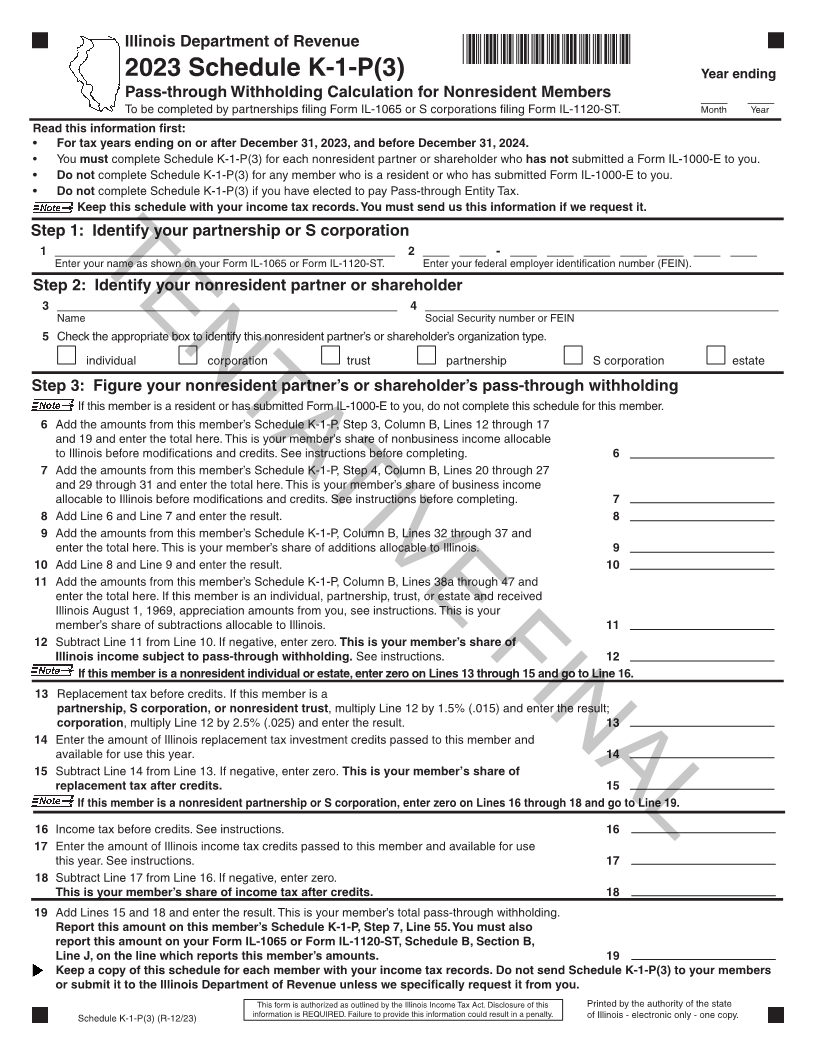

Illinois Department of Revenue

*78112231V*

2023 Schedule K-1-P(3) Year ending

Pass-through Withholding Calculation for Nonresident Members ____ ____

To be completed by partnerships filing Form IL-1065 or S corporations filing Form IL-1120-ST. Month Year

Read this information first:

• For tax years ending on or after December 31, 2023, and before December 31, 2024.

• You must complete Schedule K-1-P(3) for each nonresident partner or shareholder who has not submitted a Form IL-1000-E to you.

• Do not complete Schedule K-1-P(3) for any member who is a resident or who has submitted Form IL-1000-E to you.

• Do not complete Schedule K-1-P(3) if you have elected to pay Pass-through Entity Tax.

Keep this schedule with your income tax records. You must send us this information if we request it.

Step 1: Identify your partnership or S corporation

1 ___________________________________________________ 2 ____ ____ - ____ ____ ____ ____ ____ ____ ____

Enter your name as shown on your Form IL-1065 or Form IL-1120-ST. Enter your federal employer identification number (FEIN).

TENTATIVE FINAL

Step 2: Identify your nonresident partner or shareholder

3 ___________________________________________________ 4 _____________________________________________________

Name Social Security number or FEIN

5 Check the appropriate box to identify this nonresident partner’s or shareholder’s organization type.

individual corporation trust partnership S corporation estate

Step 3: Figure your nonresident partner’s or shareholder’s pass-through withholding

If this member is a resident or has submitted Form IL-1000-E to you, do not complete this schedule for this member.

6 Add the amounts from this member’s Schedule K-1-P, Step 3, Column B, Lines 12 through 17

and 19 and enter the total here. This is your member’s share of nonbusiness income allocable

to Illinois before modifications and credits. See instructions before completing. 6

7 Add the amounts from this member’s Schedule K-1-P, Step 4, Column B, Lines 20 through 27

and 29 through 31 and enter the total here. This is your member’s share of business income

allocable to Illinois before modifications and credits. See instructions before completing. 7

8 Add Line 6 and Line 7 and enter the result. 8

9 Add the amounts from this member’s Schedule K-1-P, Column B, Lines 32 through 37 and

enter the total here. This is your member’s share of additions allocable to Illinois. 9

10 Add Line 8 and Line 9 and enter the result. 10

11 Add the amounts from this member’s Schedule K-1-P, Column B, Lines 38a through 47 and

enter the total here. If this member is an individual, partnership, trust, or estate and received

Illinois August 1, 1969, appreciation amounts from you, see instructions. This is your

member’s share of subtractions allocable to Illinois. 11

12 Subtract Line 11 from Line 10. If negative, enter zero. This is your member’s share of

Illinois income subject to pass-through withholding. See instructions. 12

If this member is a nonresident individual or estate, enter zero on Lines 13 through 15 and go to Line 16.

13 Replacement tax before credits. If this member is a

partnership, S corporation, or nonresident trust, multiply Line 12 by 1.5% (.015) and enter the result;

corporation, multiply Line 12 by 2.5% (.025) and enter the result. 13

14 Enter the amount of Illinois replacement tax investment credits passed to this member and

available for use this year. 14

15 Subtract Line 14 from Line 13. If negative, enter zero. This is your member’s share of

replacement tax after credits. 15

If this member is a nonresident partnership or S corporation, enter zero on Lines 16 through 18 and go to Line 19.

16 Income tax before credits. See instructions. 16

17 Enter the amount of Illinois income tax credits passed to this member and available for use

this year. See instructions. 17

18 Subtract Line 17 from Line 16. If negative, enter zero.

This is your member’s share of income tax after credits. 18

19 Add Lines 15 and 18 and enter the result. This is your member’s total pass-through withholding.

Report this amount on this member’s Schedule K-1-P, Step 7, Line 55. You must also

report this amount on your Form IL-1065 or Form IL-1120-ST, Schedule B, Section B,

Line J, on the line which reports this member’s amounts. 19

Keep a copy of this schedule for each member with your income tax records. Do not send Schedule K-1-P(3) to your members

or submit it to the Illinois Department of Revenue unless we specifically request it from you.

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this Printed by the authority of the state

Schedule K-1-P(3) (R-12/23) information is REQUIRED. Failure to provide this information could result in a penalty. of Illinois - electronic only - one copy.

|