- 4 -

Enlarge image

|

*63612233V*

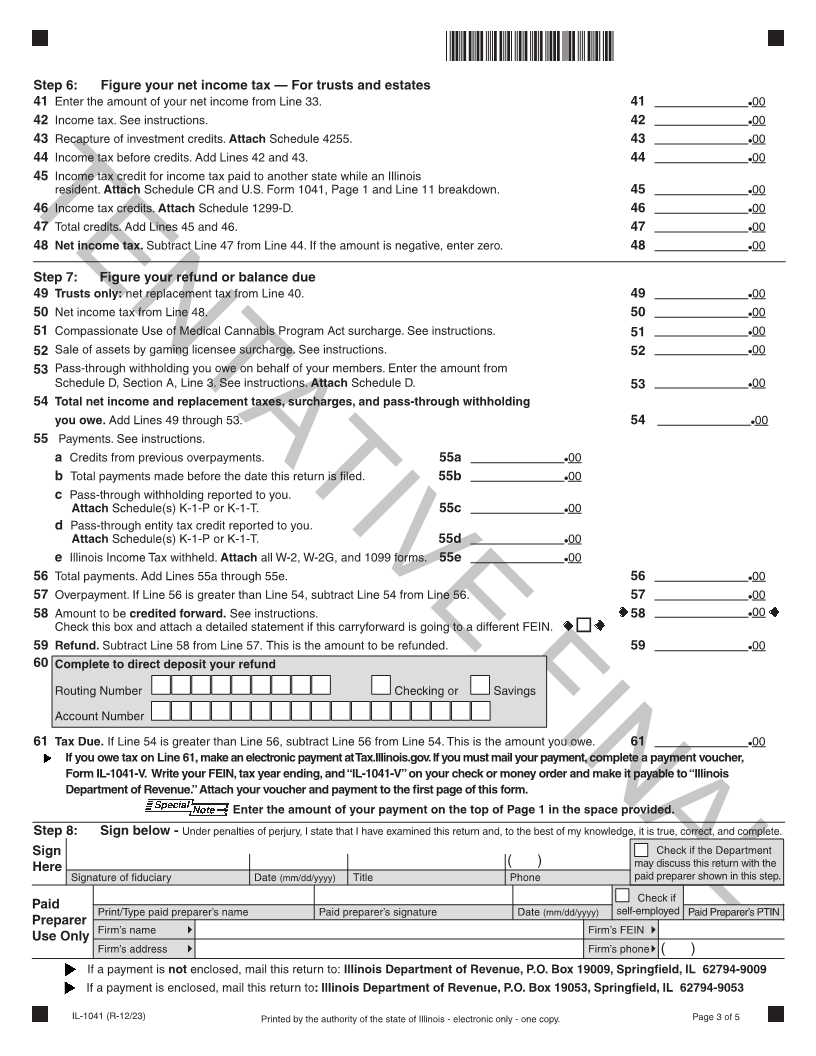

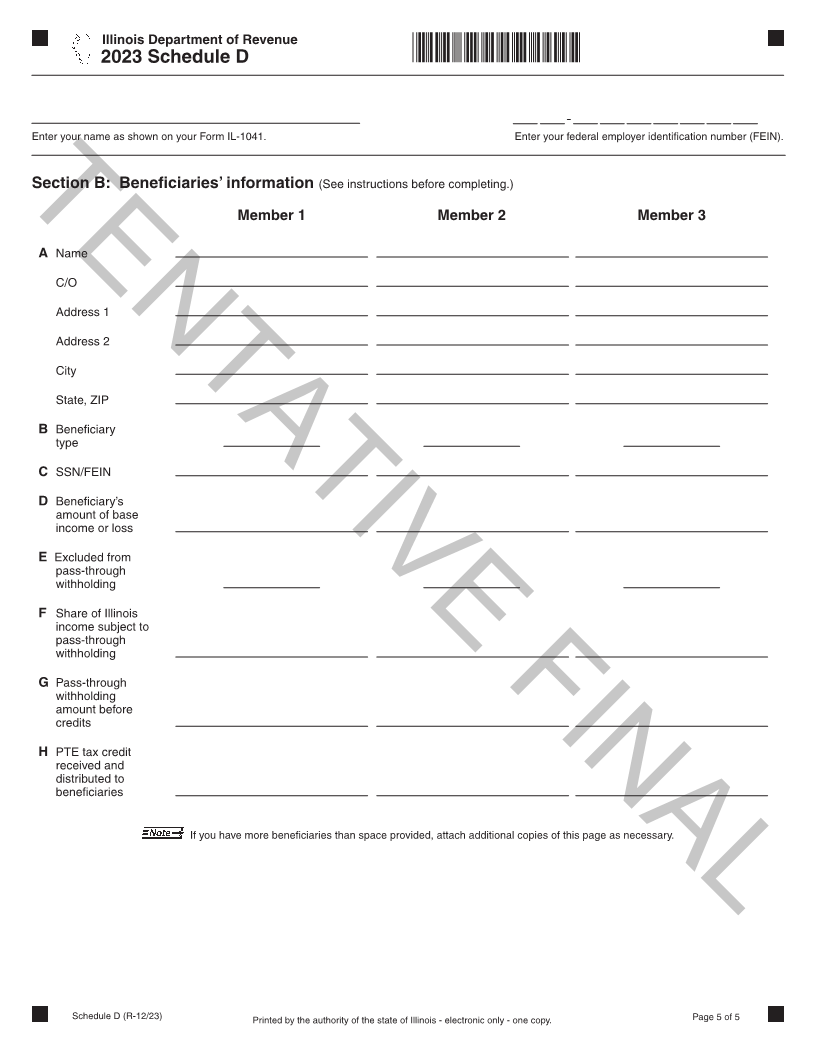

Step 6: Figure your net income tax — For trusts and estates

41 Enter the amount of your net income from Line 33. 41 00

42 Income tax. See instructions. 42 00

43 Recapture of investment credits. Attach Schedule 4255. 43 00

44 Income tax before credits. Add Lines 42 and 43. 44 00

45 Income tax credit for income tax paid to another state while an Illinois

resident. Attach Schedule CR and U.S. Form 1041, Page 1 and Line 11 breakdown. 45 00

46 Income tax credits. Attach Schedule 1299-D. 46 00

TENTATIVE FINAL

47 Total credits. Add Lines 45 and 46. 47 00

48 Net income tax. Subtract Line 47 from Line 44. If the amount is negative, enter zero. 48 00

Step 7: Figure your refund or balance due

49 Trusts only: net replacement tax from Line 40. 49 00

50 Net income tax from Line 48. 50 00

51 Compassionate Use of Medical Cannabis Program Act surcharge. See instructions. 51 00

52 Sale of assets by gaming licensee surcharge. See instructions. 52 00

53 Pass-through withholding you owe on behalf of your members. Enter the amount from

Schedule D, Section A, Line 3. See instructions. Attach Schedule D. 53 00

54 Total net income and replacement taxes, surcharges, and pass-through withholding

you owe. Add Lines 49 through 53. 54 00

55 Payments. See instructions.

a Credits from previous overpayments. 55a 00

b Total payments made before the date this return is filed. 55b 00

c Pass-through withholding reported to you.

Attach Schedule(s) K-1-P or K-1-T. 55c 00

d Pass-through entity tax credit reported to you.

Attach Schedule(s) K-1-P or K-1-T. 55d 00

e Illinois Income Tax withheld. Attach all W-2, W-2G, and 1099 forms. 55e 00

56 Total payments. Add Lines 55a through 55e. 56 00

57 Overpayment. If Line 56 is greater than Line 54, subtract Line 54 from Line 56. 57 00

58 Amount to be credited forward. See instructions. 58 00

Check this box and attach a detailed statement if this carryforward is going to a different FEIN.

59 Refund. Subtract Line 58 from Line 57. This is the amount to be refunded. 59 00

60 Complete to direct deposit your refund

Routing Number Checking or Savings

Account Number

61 Tax Due. If Line 54 is greater than Line 56, subtract Line 56 from Line 54. This is the amount you owe. 61 00

If you owe tax on Line 61, make an electronic payment at Tax.Illinois.gov. If you must mail your payment, complete a payment voucher,

Form IL-1041-V. Write your FEIN, tax year ending, and “IL-1041-V” on your check or money order and make it payable to “Illinois

Department of Revenue.” Attach your voucher and payment to the first page of this form.

Enter the amount of your payment on the top of Page 1 in the space provided.

Step 8: Sign below - Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

Sign Check if the Department

Here ( ) may discuss this return with the

Signature of fiduciary Date (mm/dd/yyyy) Title Phone paid preparer shown in this step.

Check if

Paid Print/Type paid preparer’s name Paid preparer’s signature Date (mm/dd/yyyy) self-employed Paid Preparer’s PTIN

Preparer

Firm’s name Firm’s FEIN

Use Only

Firm’s address Firm’s phone ( )

If a payment is not enclosed, mail this return to: Illinois Department of Revenue, P.O. Box 19009, Springfield, IL 62794-9009

If a payment is enclosed, mail this return to: Illinois Department of Revenue, P.O. Box 19053, Springfield, IL 62794-9053

IL-1041 (R-12/23) Printed by the authority of the state of Illinois - electronic only - one copy. Page 3 of 5

|