- 2 -

Enlarge image

|

*77612211V*

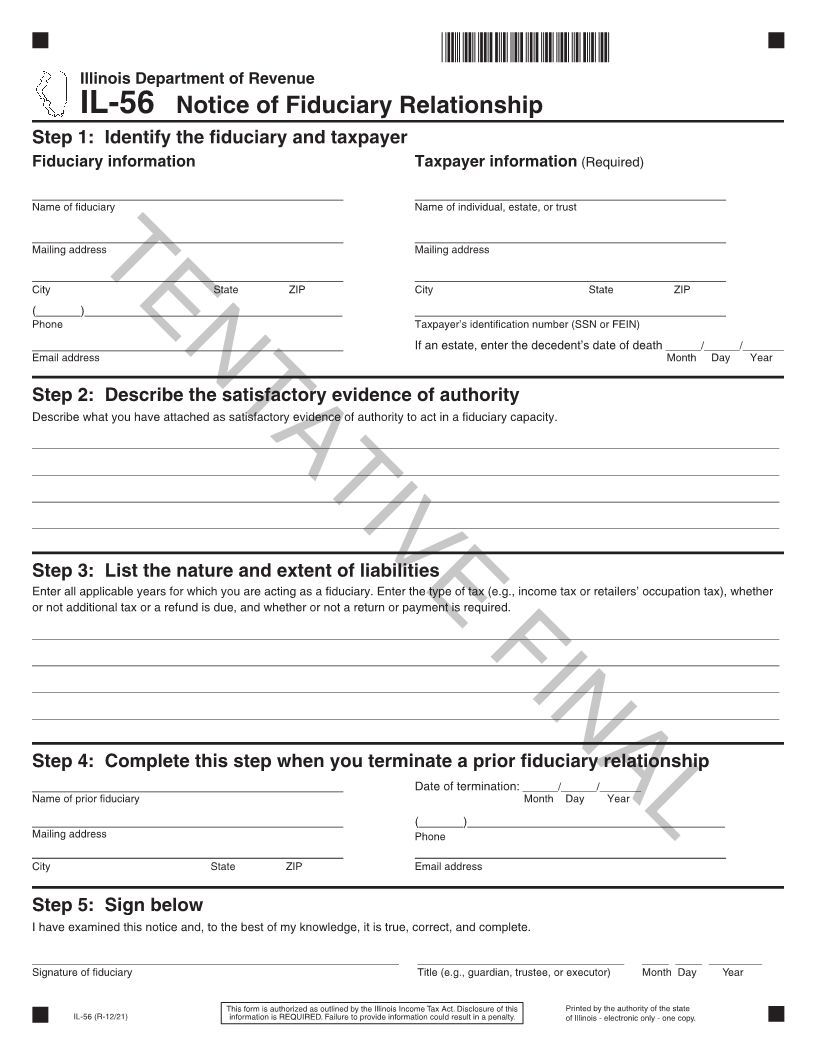

Illinois Department of Revenue

IL-56 Notice of Fiduciary Relationship

Step 1: Identify the fiduciary and taxpayer

Fiduciary information Taxpayer information (Required)

___________________________________ ___________________________________

Name of fiduciary Name of individual, estate, or trust

___________________________________ ___________________________________

Mailing address Mailing address

___________________________________TENTATIVE FINAL___________________________________

City State ZIP City State ZIP

(_____)_____________________________ ___________________________________

Phone Taxpayer’s identification number (SSN or FEIN)

___________________________________ If an estate, enter the decedent’s date of death ______/______/_______

Email address Month Day Year

Step 2: Describe the satisfactory evidence of authority

Describe what you have attached as satisfactory evidence of authority to act in a fiduciary capacity.

________________________________________________________________________________________________________________

________________________________________________________________________________________________________________

________________________________________________________________________________________________________________

________________________________________________________________________________________________________________

Step 3: List the nature and extent of liabilities

Enter all applicable years for which you are acting as a fiduciary. Enter the type of tax (e.g., income tax or retailers’ occupation tax), whether

or not additional tax or a refund is due, and whether or not a return or payment is required.

________________________________________________________________________________________________________________

________________________________________________________________________________________________________________

________________________________________________________________________________________________________________

________________________________________________________________________________________________________________

Step 4: Complete this step when you terminate a prior fiduciary relationship

___________________________________ Date of termination: ______/______/_______

Name of prior fiduciary Month Day Year

___________________________________ (_____)_____________________________

Mailing address Phone

___________________________________ ___________________________________

City State ZIP Email address

Step 5: Sign below

I have examined this notice and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________ _______________________________ ____ ____ ________

Signature of fiduciary Title (e.g., guardian, trustee, or executor) Month Day Year

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this Printed by the authority of the state

IL-56 (R-12/21) information is REQUIRED. Failure to provide information could result in a penalty. of Illinois - electronic only - one copy.

|