Enlarge image

Illinois Department of Revenue

2023 Schedule 1299-D Instructions

General Information

Complete this schedule if you are filing Form IL-1120, Corporation Income and Replacement Tax Return, Form IL-1041, Fiduciary Income and

Replacement Tax Return, or Form IL-990-T, Exempt Organization Income and Replacement Tax Return, and are entitled to any of the credits

listed on Schedule 1299-I, Income Tax Credits Information and Worksheets.

This schedule must be completed if you earned credits this year even if you are not using the credits to offset current tax liability.

If you receive more than one of the same eligible credit code with the same expiration date, you should add all amounts for that credit code

and enter the total on the corresponding line on Schedule 1299-D, Step 3, Column F.

If you are filing an Illinois combined unitary return, complete one Illinois Schedule 1299-D for the entire group. For each credit, you will need

to complete at least one row on Schedule 1299-D, Step 3 for each unitary group member who received the credit.

For example, unitary group member A (FEIN 12-3456789) earned $300 of Film Production Services credit during the tax year ending

12/31/23. Member B (FEIN 98-7654321) earned $400 of Film Production Services credit during the year ending 12/31/23. Complete

Schedule 1299-D, Step 3 as follows:

• enter “2028-12” in Column A, “5000” in Column B, “2023-12” in Column C, “12-3456789” in Column D, and “$300” in Columns F and I

• enter “2028-12” in Column A, “5000” in Column B, “2023-12” in Column C, “98-7654321” in Column D, and “$400” in Columns F and I

See Example 1 below.

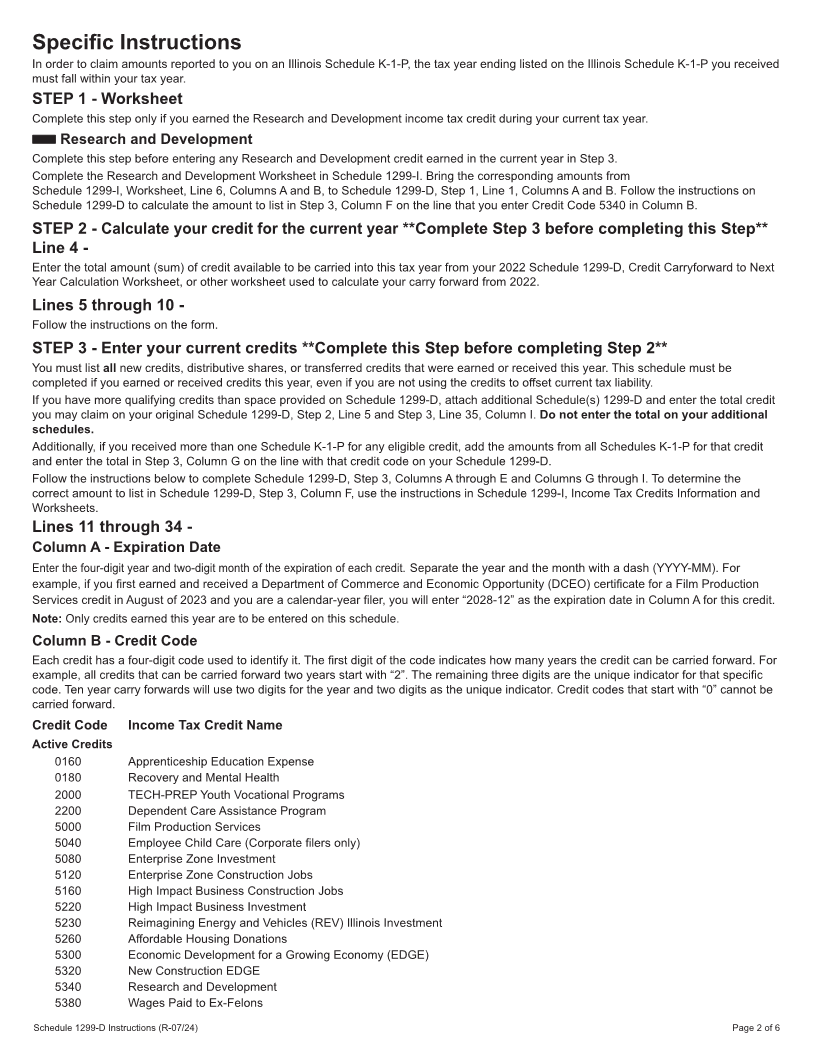

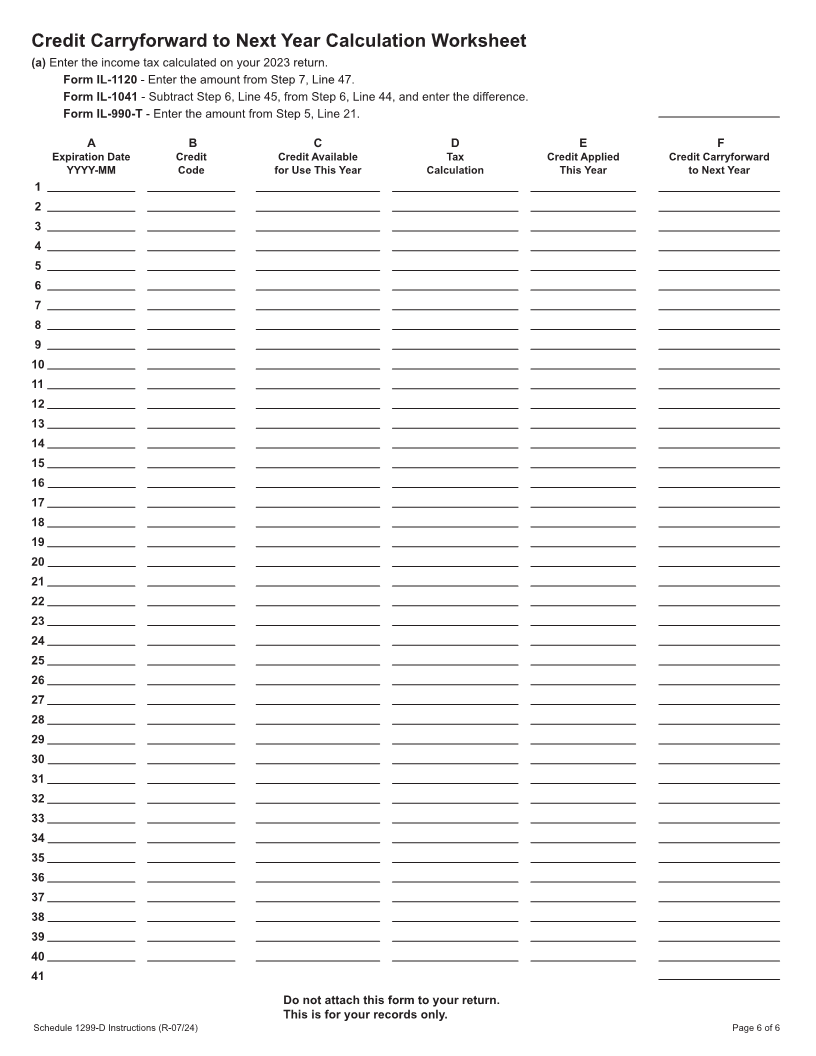

Example 1

A B C D E F G H I

Expiration Credit Credit Unitary Certificate Credit Distributive Transferred Total

Date Code Earned Member Number Amount Share Credit Credit Credits

YYYY-MM YYYY-MM FEIN Earned from K-1-P Amount (F + G + H)

2028-12 5000 2023-12 12-3456789 $300 0 0 $300

2028-12 5000 2023-12 98-7654321 $400 0 0 $400

EXAMPLE

What must I attach?

If applicable, you must attach

• Schedule(s) K-1-P, Partner’s or Shareholder’s Share of Income, Deductions, Credits, and Recapture, received from a partnership or

S corporation,

• certificates issued by the Department of Commerce and Economic Opportunity (DCEO),

• certificates issued by the Illinois Department of Natural Resources (DNR),

• certificates issued by the Illinois Department of Agriculture (IDOA),

• certificates issued by the Illinois Department of Human Services (DHS),

• proof that credit was issued by the Illinois Housing Development Authority or the City of Chicago, and

• any other documents, including transfer documentation, required by the Illinois Department of Revenue (IDOR) and noted in these

instructions or Schedule 1299-I.

Note: Specific information about what to attach to your Schedule 1299-D can be found in Schedule 1299-I.

Failure to follow these instructions and attach required documentation will result in one or more of the following: a delay in the

processing of your return, the disallowance of the credit, or the issuance of correspondence from IDOR. You also may be required

to submit further information to support your filing.

Should I round?

You must round the dollar amounts on Schedule 1299-D to whole-dollar amounts. To do this, you should drop any amount less than 50 cents

and increase any amount of 50 cents or more to the next higher dollar.

What if I need additional assistance or forms?

• For assistance, forms, or schedules, visit our website at tax.illinois.gov or scan the QR code provided.

• Write us at:

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19001

SPRINGFIELD IL 62794-9001

• Call 1 800 732-8866 or 217 782-3336 (TTY at 1 800 544-5304).

• Visit a taxpayer assistance office - 8:00 a.m. to 5:00 p.m. (Springfield office) and 8:30 a.m. to 5:00 p.m.

(all other offices), Monday through Friday.

Printed by the authority of the state of Illinois - electronic only - one copy.

Schedule 1299-D Instructions (R-07/24) Page 1 of 6