Enlarge image

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

EFT‑1 Authorization Agreement for Certain Electronic Payments

Read this information first: Complete this form ONLY if you 1) want to pay amounts owed to the Illinois Department of

Revenue using pay-by-phone debit or cigarette tax stamp purchase debit; or 2) are changing previously submitted information

about one of the methods of payment listed above.

Note: For most taxes, electronic payments can be made easily using MyTax Illinois available at mytax.illinois.gov. Do not

complete Form EFT-1 if you pay using MyTax Illinois.

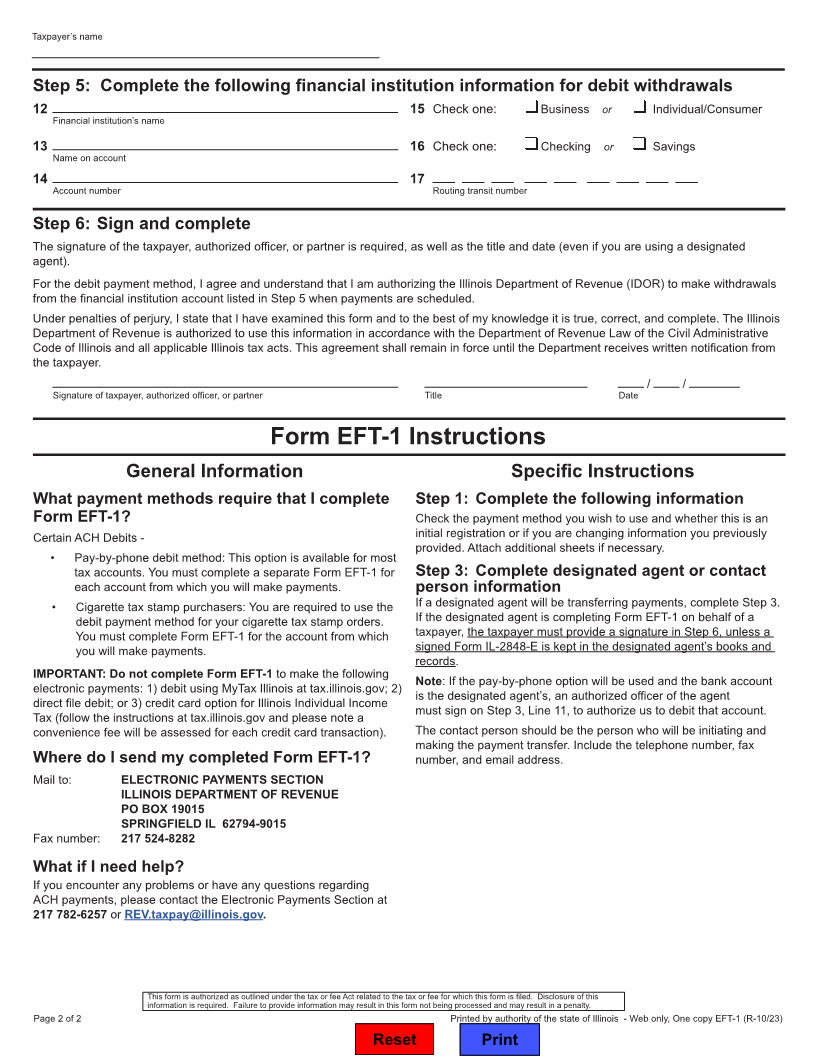

Step 1: Complete the following information

1 Check the payment method you wish to use. 2 If amending a previously submitted Form EFT-1

Pay-by-phone debit a Write the effective date of the change / /

Cigarette tax stamp purchase debit b Reason for amending:

Step 2: Identify yourself

3 5 ‑

Taxpayer’s name Federal employer identification number (FEIN)

4 6 ‑ ‑

Address Social Security number (SSN)

City State ZIP

Step 3: Complete designated agent or contact person information

7 9 ( ) ( )

Designated agent’s or contact person’s name Telephone Fax

8 10

Address Email address

11

City State ZIP Signature authorization (authorized officer of designated agent or contact person)

Step 4: Check the taxes for which you wish to authorize these payments

Illinois income taxes: Excise taxes:

Individual Income Tax Cigarette Tax Stamp Purchase

Illinois Account ID number Illinois Account ID number

Withholding Income Tax Electricity Dist. and Inv Cap Tax

Illinois Account ID number Illinois Account ID number

Business Income Tax Electricity Excise Tax

Illinois Account ID number Illinois Account ID number

Sales taxes: Gas Revenue/Gas Use Tax

Illinois Account ID number

Sales/Use Tax & E911 Surcharge Hotel Operators Occupation Tax

Illinois Account ID number Illinois Account ID number

Chicago Soft Drink Tax Liquor Tax - Airline

Illinois Account ID number Illinois Account ID number

County Motor Fuel Tax Liquor Tax - Importer/MFTR/Dist

Illinois Account ID number Illinois Account ID number

MPEA Food and Beverage Tax Liquor Tax - Direct Wine Shipper

Illinois Account ID number Illinois Account ID number

Prepaid Sales Tax (motor fuel) Telecommunications Excise Tax

Illinois Account ID number Illinois Account ID number

Automobile Renting Tax Telecom Infrastruct. Maint Fee

Illinois Account ID number Illinois Account ID number

Tobacco Products Tax

(not for Cigarette Tax Stamps) Illinois Account ID number

Page 1 of 2 Continue to Page 2