- 2 -

Enlarge image

|

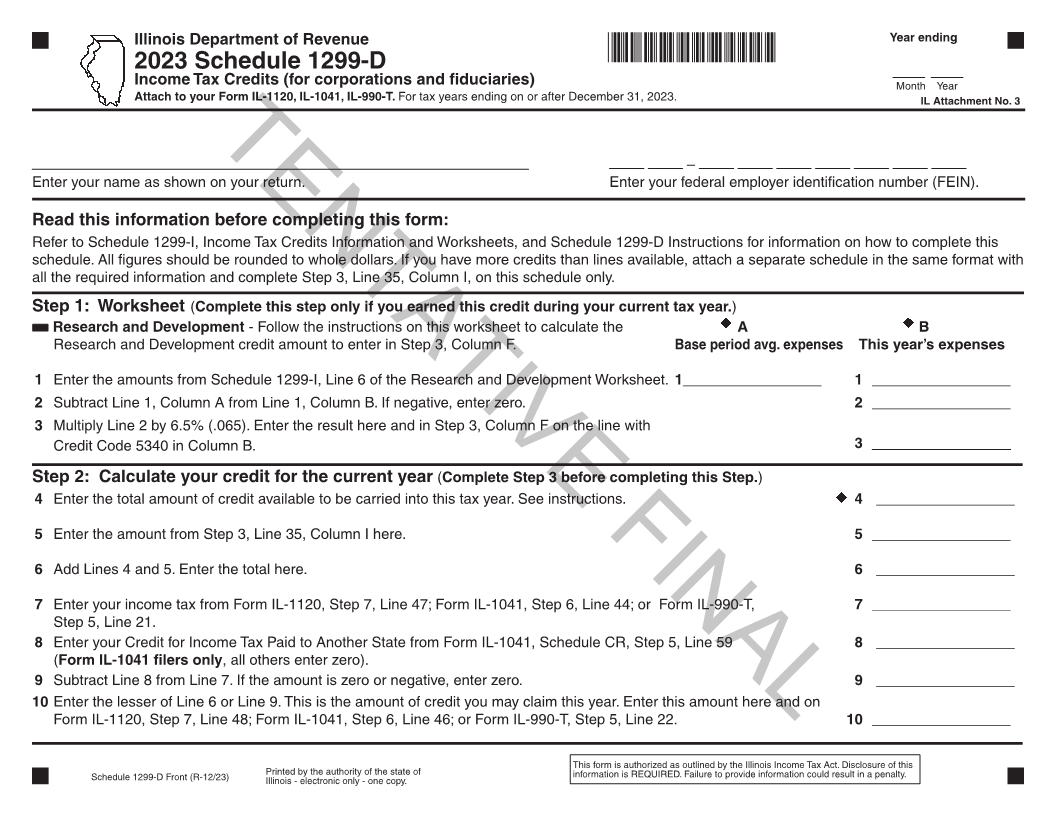

Illinois Department of Revenue Year ending

*64012231V*

2023 Schedule 1299-D

Income Tax Credits (for corporations and fiduciaries) Month Year

Attach to your Form IL-1120, IL-1041, IL-990-T. For tax years ending on or after December 31, 2023. IL Attachment No. 3

TENTATIVE FINAL

–

Enter your name as shown on your return. Enter your federal employer identification number (FEIN).

Read this information before completing this form:

Refer to Schedule 1299-I, Income Tax Credits Information and Worksheets, and Schedule 1299-D Instructions for information on how to complete this

schedule. All figures should be rounded to whole dollars. If you have more credits than lines available, attach a separate schedule in the same format with

all the required information and complete Step 3, Line 35, Column I, on this schedule only.

Step 1: Worksheet (Complete this step only if you earned this credit during your current tax year.)

Research and Development - Follow the instructions on this worksheet to calculate the A B

Research and Development credit amount to enter in Step 3, Column F. Base period avg. expenses This year’s expenses

1 Enter the amounts from Schedule 1299-I, Line 6 of the Research and Development Worksheet. 1_________________ 1 _________________

2 Subtract Line 1, Column A from Line 1, Column B. If negative, enter zero. 2 _________________

3 Multiply Line 2 by 6.5% (.065). Enter the result here and in Step 3, Column F on the line with

Credit Code 5340 in Column B. 3 _________________

Step 2: Calculate your credit for the current year (Complete Step 3 before completing this Step.)

4 Enter the total amount of credit available to be carried into this tax year. See instructions. 4 _________________

5 Enter the amount from Step 3, Line 35, Column I here. 5 _________________

6 Add Lines 4 and 5. Enter the total here. 6 _________________

7 Enter your income tax from Form IL-1120, Step 7, Line 47; Form IL-1041, Step 6, Line 44; or Form IL-990-T, 7 _________________

Step 5, Line 21.

8 Enter your Credit for Income Tax Paid to Another State from Form IL-1041, Schedule CR, Step 5, Line 59 8 _________________

(Form IL-1041 filers only, all others enter zero).

9 Subtract Line 8 from Line 7. If the amount is zero or negative, enter zero. 9 _________________

10 Enter the lesser of Line 6 or Line 9. This is the amount of credit you may claim this year. Enter this amount here and on

Form IL-1120, Step 7, Line 48; Form IL-1041, Step 6, Line 46; or Form IL-990-T, Step 5, Line 22. 10 _________________

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

Schedule 1299-D Front (R-12/23) Printed by the authority of the state of information is REQUIRED. Failure to provide information could result in a penalty.

Illinois - electronic only - one copy.

|