Enlarge image

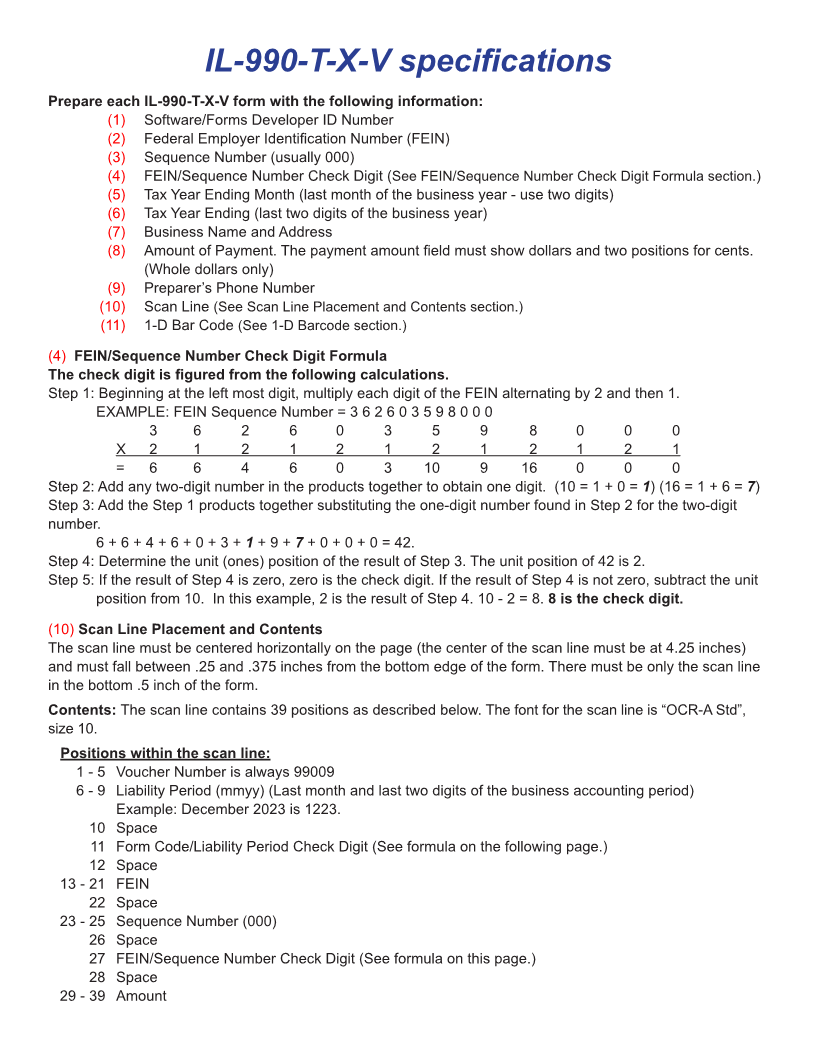

IL-990-T-X-V specifications

Prepare each IL-990-T-X-V form with the following information:

(1) Software/Forms Developer ID Number

(2) Federal Employer Identification Number (FEIN)

(3) Sequence Number (usually 000)

(4) FEIN/Sequence Number Check Digit (See FEIN/Sequence Number Check Digit Formula section.)

(5) Tax Year Ending Month (last month of the business year - use two digits)

(6) Tax Year Ending (last two digits of the business year)

(7) Business Name and Address

(8) Amount of Payment. The payment amount field must show dollars and two positions for cents.

(Whole dollars only)

(9) Preparer’s Phone Number

(10) Scan Line (See Scan Line Placement and Contents section.)

(11) 1-D Bar Code (See 1-D Barcode section.)

(4) FEIN/Sequence Number Check Digit Formula

The check digit is figured from the following calculations.

Step 1: Beginning at the left most digit, multiply each digit of the FEIN alternating by 2 and then 1.

EXAMPLE: FEIN Sequence Number = 3 6 2 6 0 3 5 9 8 0 0 0

3 6 2 6 0 3 5 9 8 0 0 0

X 2 1 2 1 2 1 2 1 2 1 2 1

= 6 6 4 6 0 3 10 9 16 0 0 0

Step 2: Add any two-digit number in the products together to obtain one digit. (10 = 1 + 0 = 1) (16 = 1 + 6 = 7)

Step 3: Add the Step 1 products together substituting the one-digit number found in Step 2 for the two-digit

number.

6 + 6 + 4 + 6 + 0 + 3 + 1+ 9 + 7+ 0 + 0 + 0 = 42.

Step 4: Determine the unit (ones) position of the result of Step 3. The unit position of 42 is 2.

Step 5: If the result of Step 4 is zero, zero is the check digit. If the result of Step 4 is not zero, subtract the unit

position from 10. In this example, 2 is the result of Step 4. 10 - 2 = 8. 8 is the check digit.

(10) Scan Line Placement and Contents

The scan line must be centered horizontally on the page (the center of the scan line must be at 4.25 inches)

and must fall between .25 and .375 inches from the bottom edge of the form. There must be only the scan line

in the bottom .5 inch of the form.

Contents: The scan line contains 39 positions as described below. The font for the scan line is “OCR-A Std”,

size 10.

Positions within the scan line:

1 - 5 Voucher Number is always 99009

6 - 9 Liability Period (mmyy) (Last month and last two digits of the business accounting period)

Example: December 2023 is 1223.

10 Space

11 Form Code/Liability Period Check Digit (See formula on the following page.)

12 Space

13 - 21 FEIN

22 Space

23 - 25 Sequence Number (000)

26 Space

27 FEIN/Sequence Number Check Digit (See formula on this page.)

28 Space

29 - 39 Amount