- 2 -

Enlarge image

|

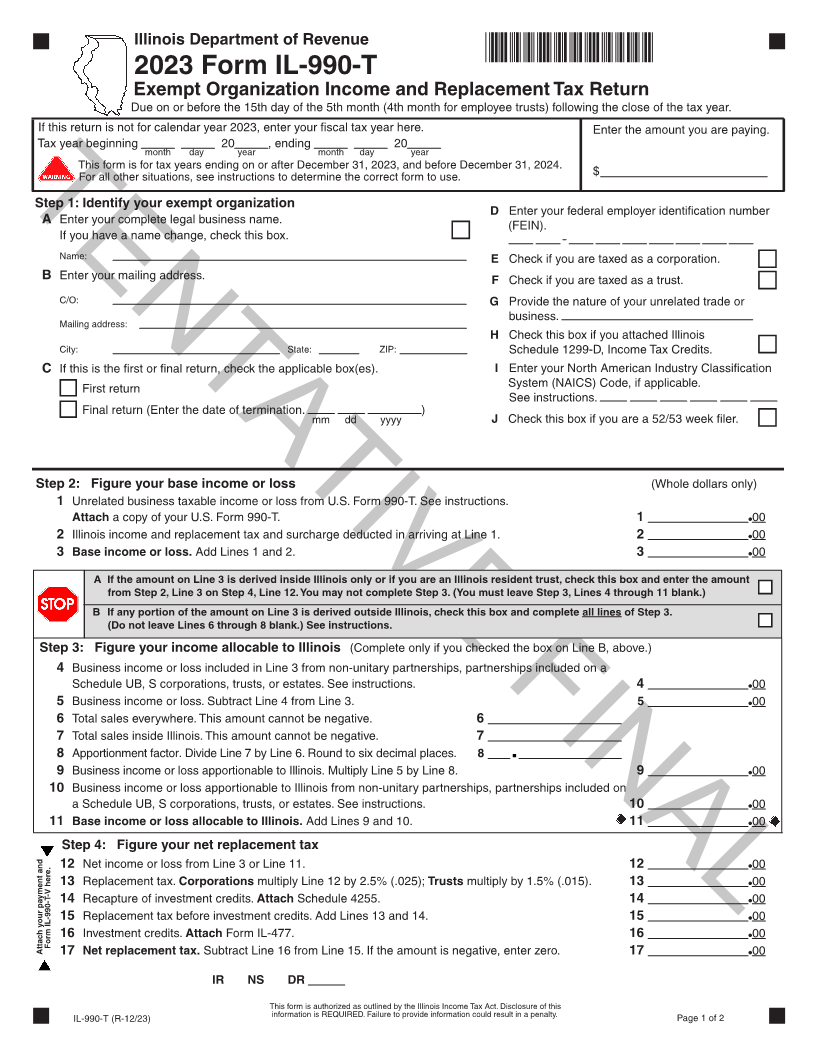

Illinois Department of Revenue

*31712231V*

2023 Form IL-990-T

Exempt Organization Income and Replacement Tax Return

Due on or before the 15th day of the 5th month (4th month for employee trusts) following the close of the tax year.

If this return is not for calendar year 2023, enter your fiscal tax year here. Enter the amount you are paying.

Tax year beginning month day 20year , ending month day 20year

This form is for tax years ending on or after December 31, 2023, and before December 31, 2024. $

For all other situations, see instructions to determine the correct form to use.

Step 1: Identify your exempt organization

D Enter your federal employer identification number

TENTATIVE A Enter your complete legal business name. (FEIN). FINAL

If you have a name change, check this box.

Name: E Check if you are taxed as a corporation.

B Enter your mailing address. F Check if you are taxed as a trust.

C/O: G Provide the nature of your unrelated trade or

business.

Mailing address:

HCheck this box if you attached Illinois

City: State: ZIP: Schedule 1299-D, Income Tax Credits.

C If this is the first or final return, check the applicable box(es). I Enter your North American Industry Classification

System (NAICS) Code, if applicable.

First return See instructions.

Final return (Enter the date of termination. mm dd yyyy ) J Check this box if you are a 52/53 week filer.

Step 2: Figure your base income or loss (Whole dollars only)

1 Unrelated business taxable income or loss from U.S. Form 990-T. See instructions.

Attach a copy of your U.S. Form 990-T. 1 00

2 Illinois income and replacement tax and surcharge deducted in arriving at Line 1. 2 00

3 Base income or loss. Add Lines 1 and 2. 3 00

A If the amount on Line 3 is derived inside Illinois only or if you are an Illinois resident trust, check this box and enter the amount

from Step 2, Line 3 on Step 4, Line 12. You may not complete Step 3. (You must leave Step 3, Lines 4 through 11 blank.)

B If any portion of the amount on Line 3 is derived outside Illinois, check this box and complete all lines of Step 3.

(Do not leave Lines 6 through 8 blank.) See instructions.

Step 3: Figure your income allocable to Illinois (Complete only if you checked the box on Line B, above.)

4 Business income or loss included in Line 3 from non-unitary partnerships, partnerships included on a

Schedule UB, S corporations, trusts, or estates. See instructions. 4 00

5 Business income or loss. Subtract Line 4 from Line 3. 5 00

6 Total sales everywhere. This amount cannot be negative. 6

7 Total sales inside Illinois. This amount cannot be negative. 7

8 Apportionment factor. Divide Line 7 by Line 6. Round to six decimal places. 8

9 Business income or loss apportionable to Illinois. Multiply Line 5 by Line 8. 9 00

10 Business income or loss apportionable to Illinois from non-unitary partnerships, partnerships included on

a Schedule UB, S corporations, trusts, or estates. See instructions. 10 00

11 Base income or loss allocable to Illinois. Add Lines 9 and 10. 11 00

Step 4: Figure your net replacement tax

12 Net income or loss from Line 3 or Line 11. 12 00

13 Replacement tax. Corporations multiply Line 12 by 2.5% (.025); Trusts multiply by 1.5% (.015). 13 00

14 Recapture of investment credits. Attach Schedule 4255. 14 00

15 Replacement tax before investment credits. Add Lines 13 and 14. 15 00

16 Investment credits. Attach Form IL-477. 16 00

Attach your payment and Form IL-990-T-V here.

17 Net replacement tax. Subtract Line 16 from Line 15. If the amount is negative, enter zero. 17 00

IR NS DR

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

IL-990-T (R-12/23) information is REQUIRED. Failure to provide information could result in a penalty. Page 1 of 2

|