- 2 -

Enlarge image

|

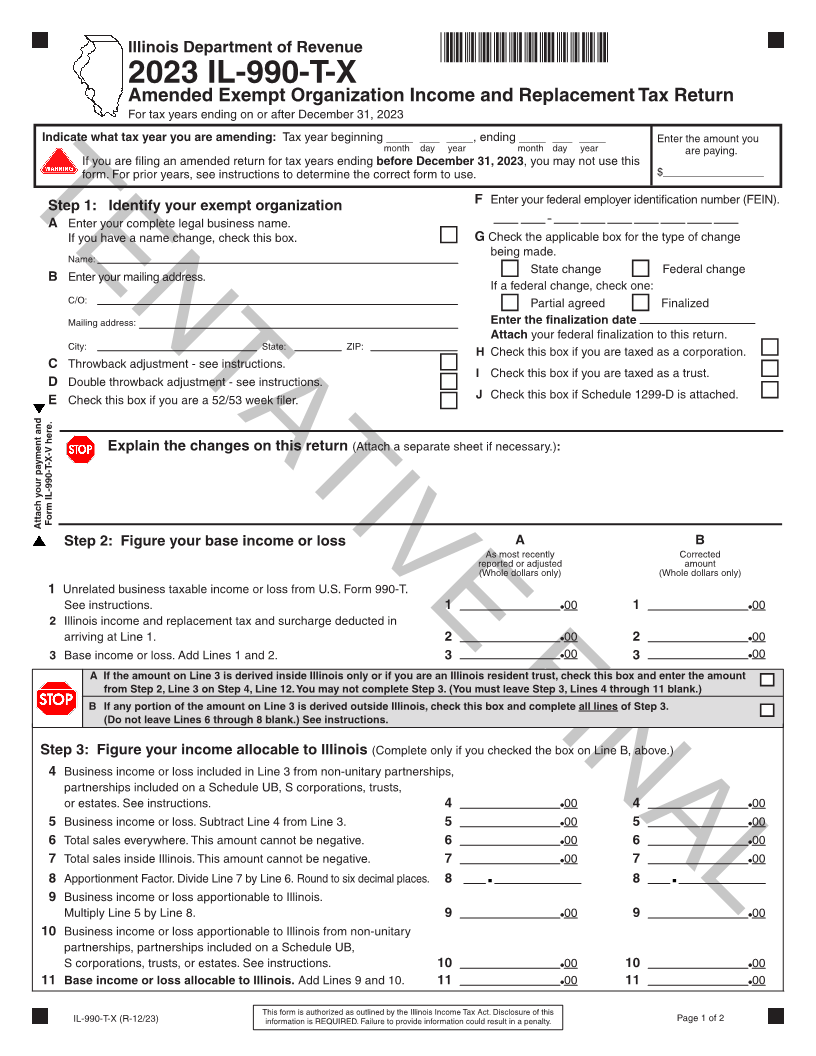

Illinois Department of Revenue *31812231V*

2023 IL-990-T-X

Amended Exempt Organization Income and Replacement Tax Return

For tax years ending on or after December 31, 2023

Indicate what tax year you are amending: Tax year beginning ____ ___ ____, ending ____ ___ ____ Enter the amount you

month day year month day year are paying.

If you are filing an amended return for tax years ending before December 31, 2023, you may not use this

form. For prior years, see instructions to determine the correct form to use. $_________________

F Enter your federal employer identification number (FEIN).

Step 1: Identify your exempt organization

TENTATIVE FINAL

A Enter your complete legal business name.

If you have a name change, check this box. G Check the applicable box for the type of change

being made.

Name:

State change Federal change

B Enter your mailing address.

If a federal change, check one:

C/O: Partial agreed Finalized

Enter the finalization date

Mailing address:

Attach your federal finalization to this return.

City: State: ZIP:

H Check this box if you are taxed as a corporation.

C Throwback adjustment - see instructions.

I Check this box if you are taxed as a trust.

D Double throwback adjustment - see instructions.

E Check this box if you are a 52/53 week filer. J Check this box if Schedule 1299-D is attached.

(Attach a separate sheet if necessary.):

Explain the changes on this return

Attach your payment and Form IL-990-T-X-V here. Step 2: Figure your base income or loss A B

As most recently Corrected

reported or adjusted amount

(Whole dollars only) (Whole dollars only)

1 Unrelated business taxable income or loss from U.S. Form 990-T.

See instructions. 1 00 1 00

2 Illinois income and replacement tax and surcharge deducted in

arriving at Line 1. 2 00 2 00

3 Base income or loss. Add Lines 1 and 2. 3 00 3 00

A If the amount on Line 3 is derived inside Illinois only or if you3 are an Illinois resident trust, check this box and enter the amount

from Step 2, Line 3 on Step 4, Line 12. You may not complete Step 3. (You must leave Step 3, Lines 4 through 11 blank.)

B If any portion of the amount on Line 3 is derived outside Illinois, check this box and complete all lines of Step 3.

(Do not leave Lines 6 through 8 blank.) See instructions.

Step 3: Figure your income allocable to Illinois (Complete only if you checked the box on Line B, above.)

4 Business income or loss included in Line 3 from non-unitary partnerships,

partnerships included on a Schedule UB, S corporations, trusts,

or estates. See instructions. 4 00 4 00

5 Business income or loss. Subtract Line 4 from Line 3. 5 00 5 00

6 Total sales everywhere. This amount cannot be negative. 6 00 6 00

7 Total sales inside Illinois. This amount cannot be negative. 7 00 7 00

8 Apportionment Factor. Divide Line 7 by Line 6. Round to six decimal places. 8 8

9 Business income or loss apportionable to Illinois.

Multiply Line 5 by Line 8. 9 00 9 00

10 Business income or loss apportionable to Illinois from non-unitary

partnerships, partnerships included on a Schedule UB,

S corporations, trusts, or estates. See instructions. 10 00 10 00

11 Base income or loss allocable to Illinois. Add Lines 9 and 10. 11 00 11 00

IL-990-T-X (R-12/23) This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this Page 1 of 2

information is REQUIRED. Failure to provide information could result in a penalty.

|