- 2 -

Enlarge image

|

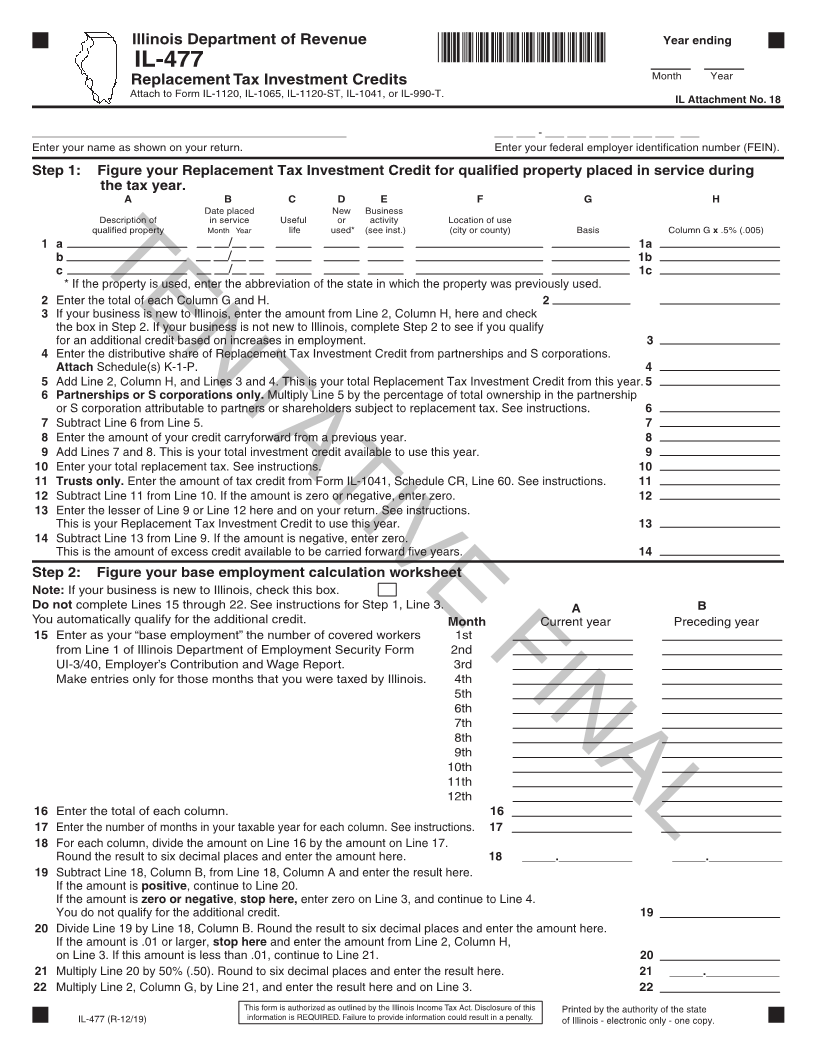

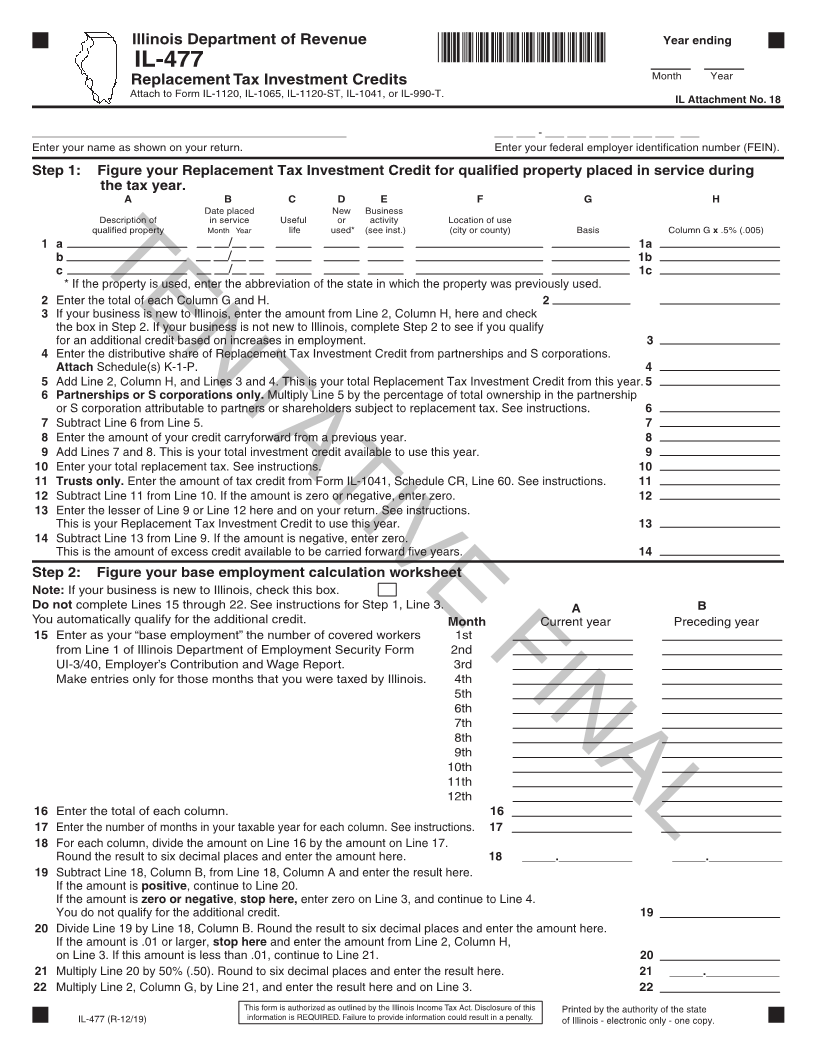

Illinois Department of Revenue Year ending

*31612191V*

IL-477 ___ ___

Replacement Tax Investment Credits Month Year

Attach to Form IL-1120, IL-1065, IL-1120-ST, IL-1041, or IL-990-T.

IL Attachment No. 18

__________________________________________________ ___ ___ - ___ ___ ___ ___ ___ ___ ___

Enter your name as shown on your return. Enter your federal employer identification number (FEIN).

Step 1: Figure your Replacement Tax Investment Credit for qualified property placed in service during

the tax year.

A B C D E F G H

Date placed New Business

Description of in service Useful or activity Location of use

qualified property Month Year life used* (see inst.) (city or county) Basis Column G x.5% (.005)

1 a 1a

b 1b

c TENTATIVE FINAL 1c

* If the property is used, enter the abbreviation of the state in which the property was previously used.

2 Enter the total of each Column G and H. 2

3 If your business is new to Illinois, enter the amount from Line 2, Column H, here and check

the box in Step 2. If your business is not new to Illinois, complete Step 2 to see if you qualify

for an additional credit based on increases in employment. 3

4 Enter the distributive share of Replacement Tax Investment Credit from partnerships and S corporations.

Attach Schedule(s) K-1-P. 4

5 Add Line 2, Column H, and Lines 3 and 4. This is your total Replacement Tax Investment Credit from this year. 5

6 Partnerships or S corporations only. Multiply Line 5 by the percentage of total ownership in the partnership

or S corporation attributable to partners or shareholders subject to replacement tax. See instructions. 6

7 Subtract Line 6 from Line 5. 7

8 Enter the amount of your credit carryforward from a previous year. 8

9 Add Lines 7 and 8. This is your total investment credit available to use this year. 9

10 Enter your total replacement tax. See instructions. 10

11 Trusts only. Enter the amount of tax credit from Form IL-1041, Schedule CR, Line 60. See instructions. 11

12 Subtract Line 11 from Line 10. If the amount is zero or negative, enter zero. 12

13 Enter the lesser of Line 9 or Line 12 here and on your return. See instructions.

This is your Replacement Tax Investment Credit to use this year. 13

14 Subtract Line 13 from Line 9. If the amount is negative, enter zero.

This is the amount of excess credit available to be carried forward five years. 14

Step 2: Figure your base employment calculation worksheet

Note: If your business is new to Illinois, check this box.

Do not complete Lines 15 through 22. See instructions for Step 1, Line 3. A B

You automatically qualify for the additional credit. Month Current year Preceding year

15 Enter as your “base employment” the number of covered workers 1st

from Line 1 of Illinois Department of Employment Security Form 2nd

UI-3/40, Employer’s Contribution and Wage Report. 3rd

Make entries only for those months that you were taxed by Illinois. 4th

5th

6th

7th

8th

9th

10th

11th

12th

16 Enter the total of each column. 16

17 Enter the number of months in your taxable year for each column. See instructions. 17

18 For each column, divide the amount on Line 16 by the amount on Line 17.

Round the result to six decimal places and enter the amount here. 18 _____.___________ _____.___________

19 Subtract Line 18, Column B, from Line 18, Column A and enter the result here.

If the amount is positive, continue to Line 20.

If the amount is zero or negative,stop here, enter zero on Line 3, and continue to Line 4.

You do not qualify for the additional credit. 19

20 Divide Line 19 by Line 18, Column B. Round the result to six decimal places and enter the amount here.

If the amount is .01 or larger, stop hereand enter the amount from Line 2, Column H,

on Line 3. If this amount is less than .01, continue to Line 21. 20

21 Multiply Line 20 by 50% (.50). Round to six decimal places and enter the result here. 21 _____.___________

22 Multiply Line 2, Column G, by Line 21, and enter the result here and on Line 3. 22

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this Printed by the authority of the state

IL-477 (R-12/19) information is REQUIRED. Failure to provide information could result in a penalty. of Illinois - electronic only - one copy.

|