Enlarge image

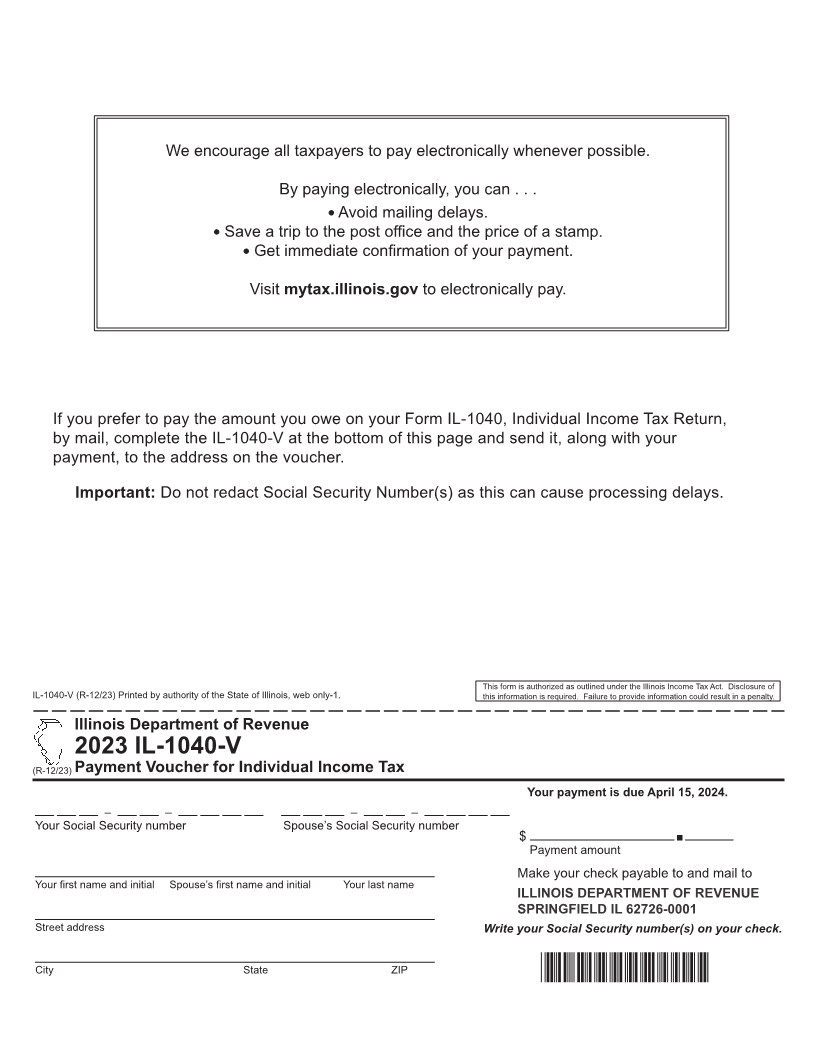

We encourage all taxpayers to pay electronically whenever possible.

By paying electronically, you can . . .

Avoid mailing delays.

Save a trip to the post office and the price of a stamp.

Get immediate confirmation of your payment.

Visit mytax.illinois.gov to electronically pay.

If you prefer to pay the amount you owe on your Form IL-1040, Individual Income Tax Return,

by mail, complete the IL-1040-V at the bottom of this page and send it, along with your

payment, to the address on the voucher.

Important: Do not redact Social Security Number(s) as this can cause processing delays.

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

IL-1040-V (R-12/23) Printed by authority of the State of Illinois, web only-1. this information is required. Failure to provide information could result in a penalty.

Illinois Department of Revenue

2023 IL-1040-V

(R-12/23) Payment Voucher for Individual Income Tax

Your payment is due April 15, 2024.

– – – –

Your Social Security number Spouse’s Social Security number

$

Payment amount .

Make your check payable to and mail to

Your first name and initial Spouse’s first name and initial Your last name

ILLINOIS DEPARTMENT OF REVENUE

SPRINGFIELD IL 62726-0001

Street address Write your Social Security number(s) on your check.

City State ZIP *60212231V*