Enlarge image

Substitute Form IL-1040-V Vendor

Specifications

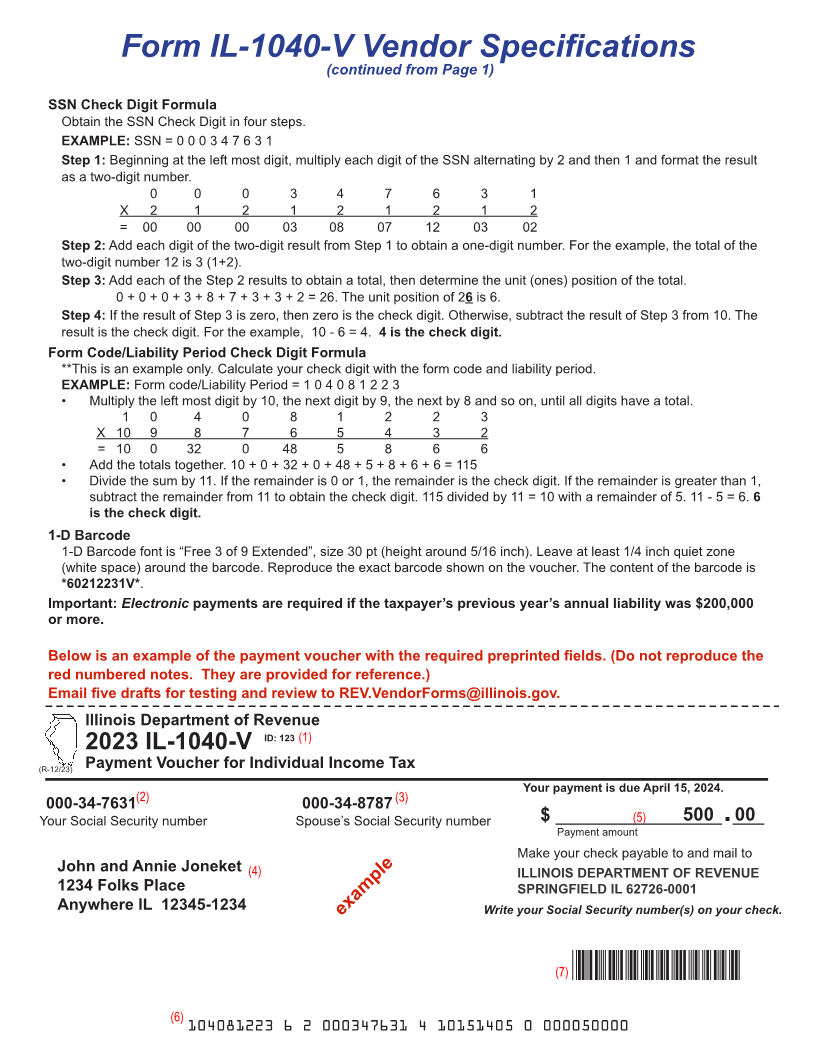

Prepare each IL-1040-V form with the following information:

(1) Software/Forms Developer ID Number

(2) Primary’s Social Security Number (SSN)

(3) Spouse’s SSN

(4) Taxpayer’s Name and Address

(5) Amount of Payment. The payment amount field must show dollars and two positions for cents. If the

payment is a whole dollar amount, zero fill the cents field to the right of the dollar amount.

(6) Scan Line (See detailed instructions below.)

(7) Barcode (See detailed instructions on the following page.)

Scan line placement and contents

The scan line must be centered, and must fall between .25 and .375 inches from the bottom edge of the form. The scan

line contains 46 positions as described below. The font for the scan line is “OCR-A Std”, size 10.

Positions within the scan line:

1-5 Form Code is always 10408

6-9 Liability Period (mmyy)

10 Space

11 Form Code/Liability Period Check Digit (See detailed instructions on the following page.)

12 Space

13 1040 Voucher ID is always 2

14 Space

15-23 Primary SSN

24 Space

25 Primary SSN Check Digit (See detailed instructions on the following page.)

26 Space

27-34 Numeric Post (See detailed instructions below.)

35 Space

36 Numeric Post Check Digit (See detailed instructions below.)

37 Space

38-46 Amount of Payment - The payment amount field must contain 7 positions for dollars

and 2 positions for cents. Zero fill the cents field to the right of the dollar amount.

Numeric Post Formula

Determine the numeric post from the first four letters of taxpayer’s last name. The numeric post is calculated by

numbering the alphabet from 1 - 26 beginning with the letter A as 01, B as 02, and so on.

Numeric post examples and special rules:

For a last name Joneket = JONE = the numeric post is 10151405

For a last name that is less than four characters, fill each ending space with 00.

Last name of Coe = COE = the numeric post is 03150500

For a last name containing an apostrophe or hyphen, omit the punctuation.

Last name of O’Connor = OCON = the numeric post is 15031514

For a last name containing a space, omit the space.

Last name of De Von = DEVO = the numeric post is 04052215

Numeric Post Check Digit Formula

EXAMPLE: Numeric post = 1 0 1 5 1 4 0 5

• Multiply the left most digit by 9, the next digit by 8 and so on, until all digits have a total.

1 0 1 5 1 4 0 5

X 9 8 7 6 5 4 3 2

= 9 0 7 30 5 16 0 10

• Add the totals together. 9 + 0 + 7 + 30 + 5 + 16 + 0 + 10 = 77

• Divide the sum by 11. If the remainder is 0 or 1, the remainder is the check digit. If the remainder is greater than 1,

subtract the remainder from 11 to obtain the check digit. 77 divided by 11 = 7 with a remainder of 0. 0 is the check

digit.

Printed by the authority of the State of Illinois, Web only - 1 copy IL-1040-V SPECS(R-12/23)