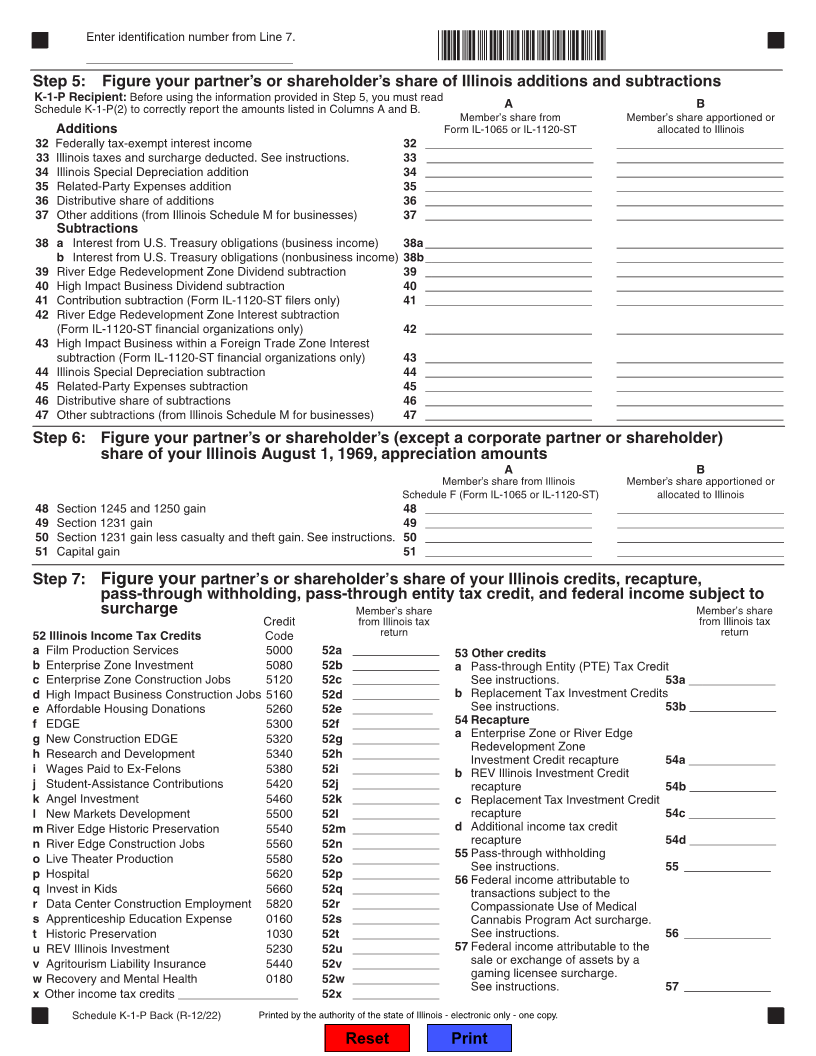

Enlarge image

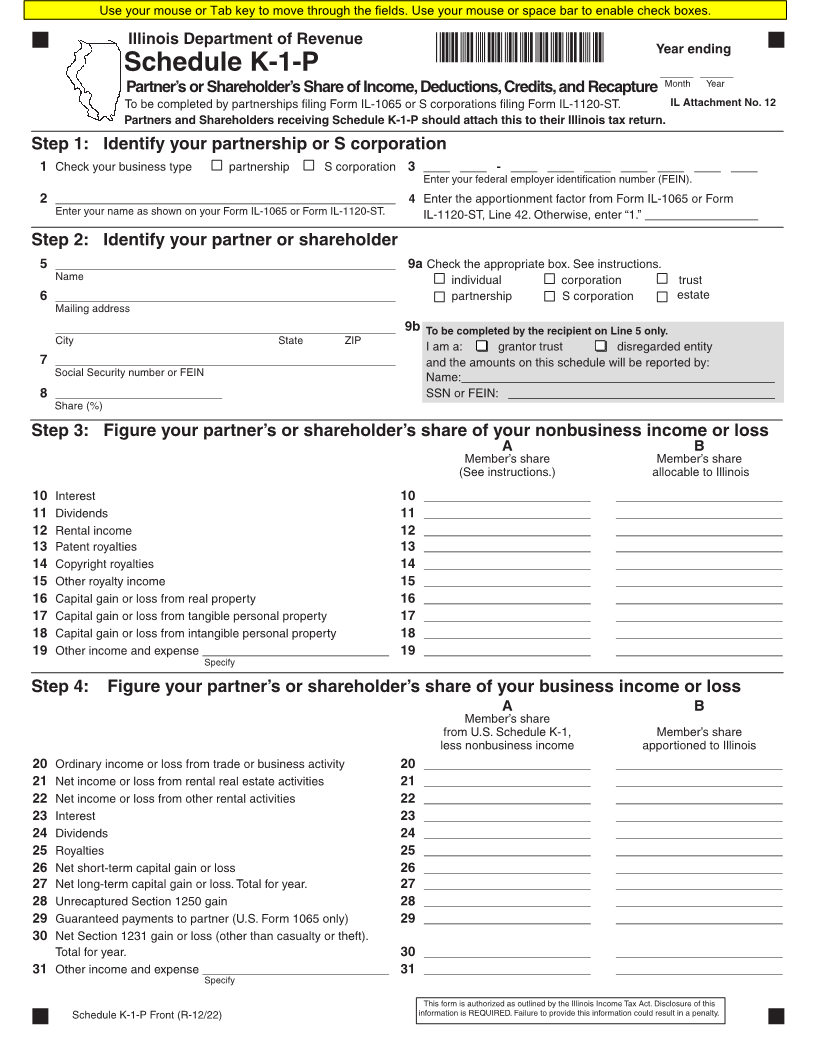

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

*33012221W* Year ending

Schedule K-1-P _____ _____

Partner’s or Shareholder’s Share of Income, Deductions, Credits, and Recapture Month Year

To be completed by partnerships filing Form IL-1065 or S corporations filing Form IL-1120-ST. IL Attachment No. 12

Partners and Shareholders receiving Schedule K-1-P should attach this to their Illinois tax return.

Step 1: Identify your partnership or S corporation

1 Check your business type partnership S corporation 3 ____ ____ - ____ ____ ____ ____ ____ ____ ____

Enter your federal employer identification number (FEIN).

2 ___________________________________________________ 4 Enter the apportionment factor from Form IL-1065 or Form

Enter your name as shown on your Form IL-1065 or Form IL-1120-ST. IL-1120-ST, Line 42. Otherwise, enter “1.” _________________

Step 2: Identify your partner or shareholder

5 ___________________________________________________ 9a Check the appropriate box. See instructions.

Name individual corporation trust

6 ___________________________________________________ partnership S corporation estate

Mailing address

___________________________________________________ 9b To be completed by the recipient on Line 5 only.

City State ZIP

I am a: grantor trust disregarded entity

7 ___________________________________________________ and the amounts on this schedule will be reported by:

Social Security number or FEIN Name:_______________________________________________

8 _________________________ SSN or FEIN: ________________________________________

Share (%)

Step 3: Figure your partner’s or shareholder’s share of your nonbusiness income or loss

A B

Member’s share Member’s share

(See instructions.) allocable to Illinois

10 Interest 10 _________________________ _________________________

11 Dividends 11 _________________________ _________________________

12 Rental income 12 _________________________ _________________________

13 Patent royalties 13 _________________________ _________________________

14 Copyright royalties 14 _________________________ _________________________

15 Other royalty income 15 _________________________ _________________________

16 Capital gain or loss from real property 16 _________________________ _________________________

17 Capital gain or loss from tangible personal property 17 _________________________ _________________________

18 Capital gain or loss from intangible personal property 18 _________________________ _________________________

19 Other income and expense ____________________________ 19 _________________________ _________________________

Specify

Step 4: Figure your partner’s or shareholder’s share of your business income or loss

A B

Member’s share

from U.S. Schedule K-1, Member’s share

less nonbusiness income apportioned to Illinois

20 Ordinary income or loss from trade or business activity 20 _________________________ _________________________

21 Net income or loss from rental real estate activities 21 _________________________ _________________________

22 Net income or loss from other rental activities 22 _________________________ _________________________

23 Interest 23 _________________________ _________________________

24 Dividends 24 _________________________ _________________________

25 Royalties 25 _________________________ _________________________

26 Net short-term capital gain or loss 26 _________________________ _________________________

27 Net long-term capital gain or loss. Total for year. 27 _________________________ _________________________

28 Unrecaptured Section 1250 gain 28 _________________________ _________________________

29 Guaranteed payments to partner (U.S. Form 1065 only) 29 _________________________ _________________________

30 Net Section 1231 gain or loss (other than casualty or theft).

Total for year. 30 _________________________ _________________________

31 Other income and expense ____________________________ 31 _________________________ _________________________

Specify

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

Schedule K-1-P Front (R-12/22) information is REQUIRED. Failure to provide this information could result in a penalty.