Enlarge image

Illinois Department of Revenue

Instructions for Partnerships and S Corporations

Schedule K-1-P(1) Completing Schedule K-1-P and Schedule K-1-P(3)

What’s New for 2023?

• Investment partnerships are required to withhold an amount on behalf of their nonresident partners. As a result, Schedule K-1-P(4),

Investment Partnership Withholding Calculation for Nonresident Partners, has been created to calculate investment partnership

withholding for each of the investment partnership’s nonresident partners. Schedule K-1-P, Step 7, Line 55, is now used for both pass-

through withholding and investment partnership withholding.

General Information

What is the purpose of Schedule K-1-P and Schedule K-1-P(3)?

Schedule K-1-P —

The purpose of Schedule K-1-P, Partner’s or Shareholder’s Share of Income, Deductions, Credits, and Recapture, is for you to supply each

individual or entity who was a partner or shareholder at any time during your tax year with that individual’s or entity’s share of the amounts you

reported on your federal income tax return and your Illinois business income tax return.

For Illinois Income Tax purposes, you must give a completed Schedule K-1-P and a copy of the Schedule K-1-P(2), Partner’s and

Shareholder’s Instructions, to each partner or shareholder. This must be done by the due date, including any extended due date, of your

Form IL-1065 or Form IL-1120-ST.

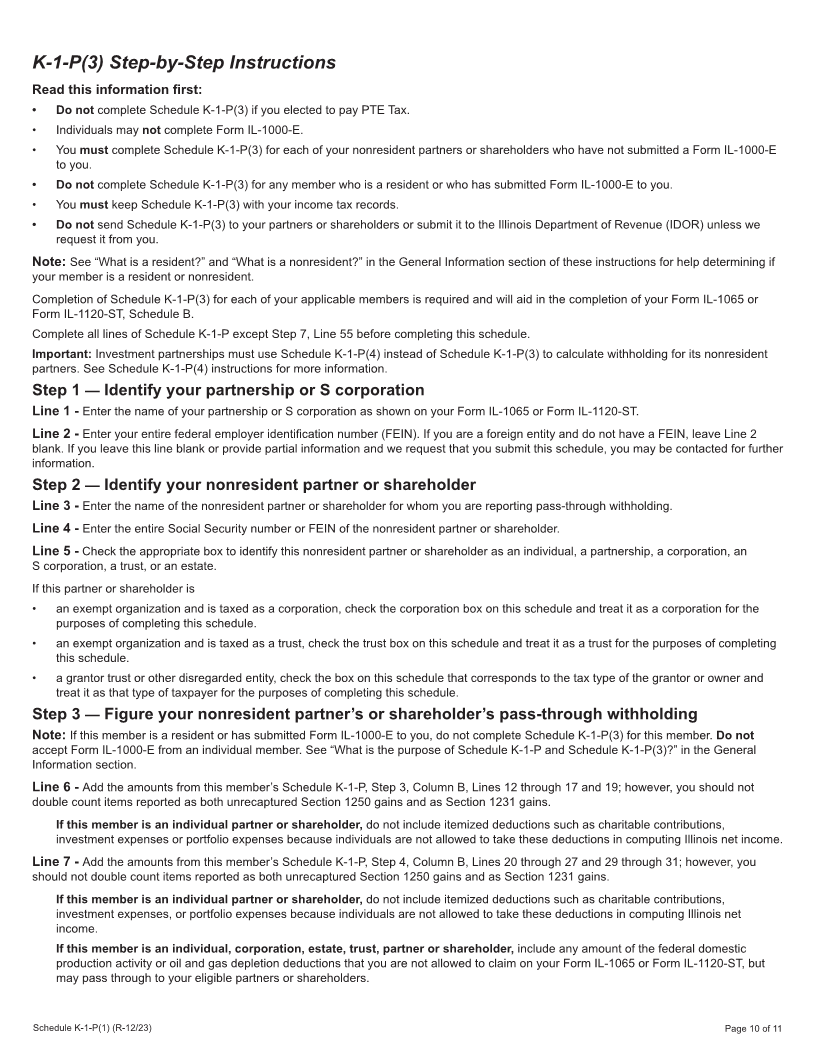

Schedule K-1-P(3) —

The purpose of Schedule K-1-P(3), Pass-through Withholding Calculation for Nonresident Members, is to calculate the required tax you must

report and pay on behalf of your nonresident partners or shareholders that receive business or nonbusiness income from your partnership or

S corporation.

Important - Investment partnerships are required to withhold an amount on behalf of their nonresident partners. To calculate investment

partnership withholding, investment partnerships must complete a Schedule K-1-P(4) for each of their nonresident partners. Investment

partnerships do not complete Schedule K-1-P(3) for any of their partners.

Do not complete Schedule K-1-P(3) for any of your members if you elect to pay Pass-through entity (PTE) Tax.

You are required to report and pay tax on behalf of your members if

• you are an S corporation or partnership with an Illinois filing obligation, and

• you have business or nonbusiness income distributable to Illinois nonresident partners or shareholders who have not provided you with

Form IL-1000-E, Certificate of Exemption for Pass-through Withholding.

Do not accept Form IL-1000-E from an individual member. Individuals may not make the pass-through withholding exemption election. You

are required to report and pay tax on behalf of your nonresident individual members.

You must complete a Schedule K-1-P(3) for each such member. The pass-through withholding amount calculated on Schedule K-1-P(3) will

be reported to each applicable member on the Schedule K-1-P you issue to them. Each member’s amounts from each Schedule K-1-P(3) you

complete must also be reported to the Illinois Department of Revenue (IDOR) on your Schedule B.

For Illinois Income Tax purposes, you must complete Schedule K-1-P(3) to calculate the amount of pass-through withholding for each of your

applicable members and keep the schedule with your income tax records. Do not submit Schedule K-1-P(3) with your income tax return.

You must send us your Schedule K-1-P(3) if we request them.

Do not attach any Schedule K-1-P that you complete and issue to your partners or shareholders or any Schedule K-1-P(3) you

complete to your Form IL-1065 or Form IL-1120-ST. However, you must

• keep a copy of each Schedule K-1-P and Schedule K-1-P(3) available for inspection by our authorized agents and employees, and

• attach any Schedule K-1-P issued to you by another partnership or S corporation, as described in Schedule K-1-P(2).

What is a resident?

A resident is

• an individual who is present in Illinois for other than a temporary or transitory purpose;

• an individual who is absent from Illinois for a temporary or transitory purpose but who is domiciled in Illinois;

• the estate of a decedent who at his or her death was domiciled in Illinois;

• a trust created by a will of a decedent who at his or her death was domiciled in Illinois; or

• an irrevocable trust, whose grantor was domiciled in Illinois at the time the trust became irrevocable. For purposes of this definition, a

trust is irrevocable to the extent that the grantor is not treated as the owner of the trust under Internal Revenue Code (IRC) Sections 671

through 678.

Schedule K-1-P(1) (R-12/23) Printed by the authority of the state of Illinois - electronic only - one copy. Page 1 of 11