Enlarge image

Illinois Department of Revenue

Use for tax year ending on or after

December 31, 2023, and before

December 31, 2024.

IL-990-T Instructions 2023

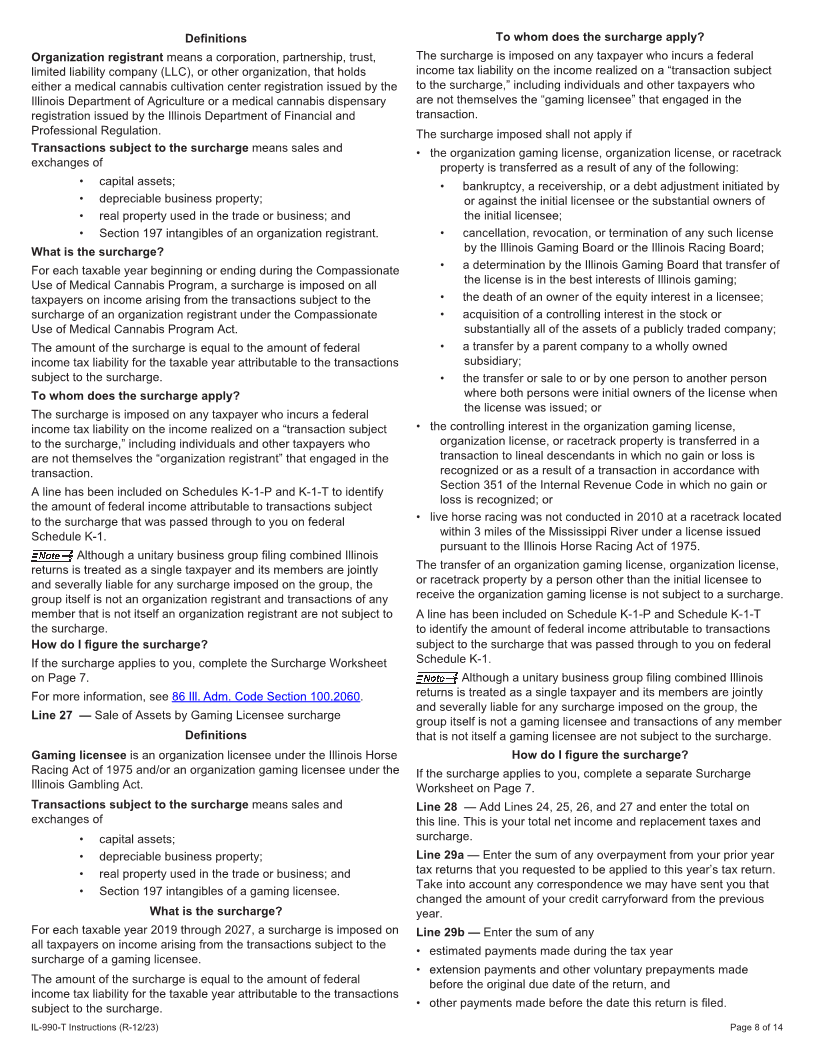

What’s New? Table of Contents

• The address change checkbox has been removed from Step 1, What’s New? ........................................................ 1

Line B, of the Form IL-990-T.

• Income Tax Credits -- Information about all the credits can be General Information ............................................ 1

found in Schedule 1299-I.

• The following credits have updated expiration dates: Specific Instructions ........................................... 5

• Historic Preservation tax credit (Credit Code 1030) - ending

on or before December 31, 2028

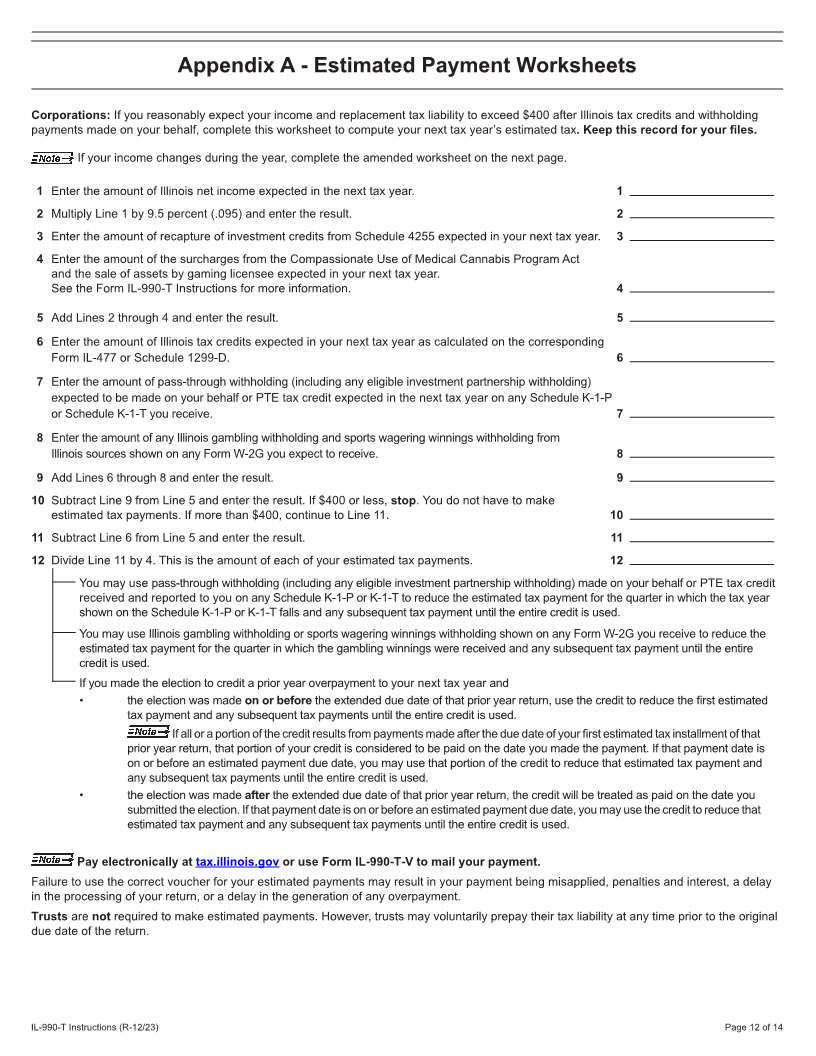

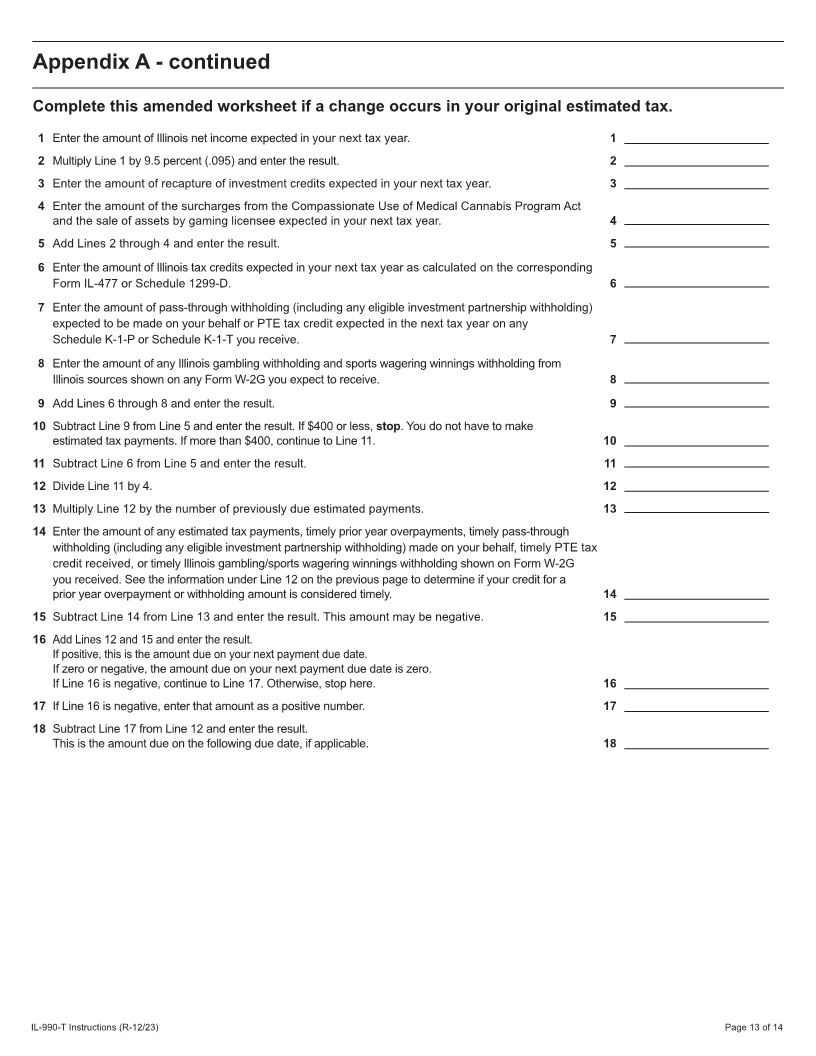

Appendix A - Estimated Payment

• New Markets Development tax credit (Credit Code 5500) -

Worksheets ........................................................ 12

ending on or before June 30, 2031

• No new credits will be issued for the:

Appendix B - Extension Payment

• Agritourism Liability Insurance income tax credit (Credit

Code 5440) for tax years ending after December 31, 2023 Worksheet .......................................................... 14

• Invest in Kids credit (Credit Code 5660) for tax years ending

after December 31, 2023

• Illinois business payment vouchers are no longer year specific.

To avoid processing delays, taxpayers submitting paper business

vouchers to the Illinois Department of Revenue should ensure

that the month and year of their filing period are entered on each

voucher. Do not enter your estimated payment due date.

General Information

Who must file Form IL-990-T? How do I register my business?

You must file Form IL-990-T if you are an organization exempt from If you are required to file Form IL-990-T, you should register with

federal income tax under Section 501(a) of the Internal Revenue IDOR. Registering with IDOR prior to filing your return ensures

Code (IRC) with unrelated business taxable income under IRC that your tax returns are accurately processed. You may register

Section 512, and • online with MyTax Illinois, our free online account management

• have net income as defined under the Illinois Income Tax Act program for taxpayers;

(IITA); or • by completing Form REG-1, Illinois Business Registration

• are a resident or qualified to do business in the state of Illinois Application, and mailing it to the address on the form; or

and are required to file U.S. Form 990-T, Exempt Organization • by visiting a regional office.

Business Income Tax Return (regardless of net income or loss). Visit our website at tax.illinois.gov for more information.

What forms must I use? Registering with IDOR prior to filing your return ensures that your

tax returns are accurately processed.

In general, you must use forms prescribed by the Illinois Department

of Revenue (IDOR). Separate statements not on forms provided Your identification numbers as an Illinois business taxpayer are

or approved by IDOR will not be accepted and you will be asked your federal employer identification number (FEIN) and your Illinois

for appropriate documentation. Failure to comply with this account number.

requirement may result in failure to file penalties, a delay in When should I file?

the processing of your return, or a delay in the generation Your Illinois filing due date is the same as your federal filing due

of any overpayment. Additionally, failure to submit appropriate date. In general, Form IL-990-T is due on or before the 15th day

documentation when requested may result in a referral to our Audit of the 5th month following the close of the tax year. If you are an

Bureau for compliance action. employee trust as described in IRC Section 401(a), you must file

Exempt organizations must complete Form IL-990-T. Do not Form IL-990-T on or before the 15th day of the 4th month following

send a computer printout with line numbers and dollar amounts the close of the tax year.

attached to a blank copy of the return. Computer generated printouts

are not acceptable, even if they are in the same format as IDOR’s Automatic extension —

forms. Computer generated forms from an IDOR-approved software If you are classified federally as a

developer are acceptable. • corporation, we grant you an automatic extension of time to file

Form IL-990-T (R-12/23) is for tax year ending on or your annual return of seven months.

after December 31, 2023, and before December 31, 2024. For

tax year ending on or after December 31, 2022 and before trust, we grant you an automatic extension of time to file your

•

annual return of six months.

December 31, 2023, use the 2022 form. Using the wrong form will

delay the processing of your return. See 86 Ill. Adm. Code 100.5020 for more information.

IL-990-T Instructions (R-12/23) Printed by the authority of the state of Illinois. - electronic only - one copy. Page 1 of 14