Enlarge image

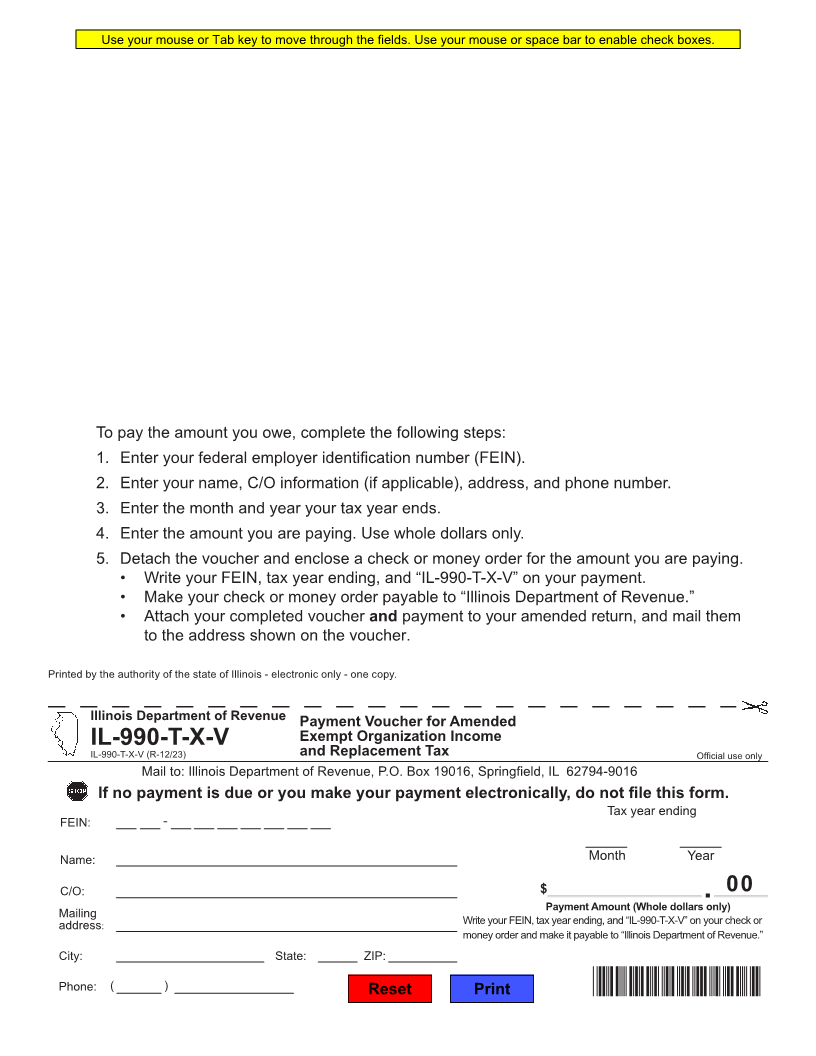

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

To pay the amount you owe, complete the following steps:

1. Enter your federal employer identification number (FEIN).

2. Enter your name, C/O information (if applicable), address, and phone number.

3. Enter the month and year your tax year ends.

4. Enter the amount you are paying. Use whole dollars only.

5. Detach the voucher and enclose a check or money order for the amount you are paying.

• Write your FEIN, tax year ending, and “IL-990-T-X-V” on your payment.

• Make your check or money order payable to “Illinois Department of Revenue.”

• Attach your completed voucher and payment to your amended return, and mail them

to the address shown on the voucher.

Printed by the authority of the state of Illinois - electronic only - one copy.

Illinois Department of Revenue Payment Voucher for Amended

Exempt Organization Income

IL-990-T-X-V

IL-990-T-X-V (R-12/23) and Replacement Tax Official use only

Mail to: Illinois Department of Revenue, P.O. Box 19016, Springfield, IL 62794-9016

If no payment is due or you make your payment electronically, do not file this form.

Tax year ending

FEIN:

Name: Month Year

C/O: $ 00

Payment Amount (Whole dollars only)

Mailing Write your FEIN, tax year ending, and “IL-990-T-X-V” on your check or

address:

money order and make it payable to “Illinois Department of Revenue.”

City: State: ZIP:

Phone: ( ) Reset Print *64612231W*