Enlarge image

Substitute Form IL-1040-ES Vendor

Specifications

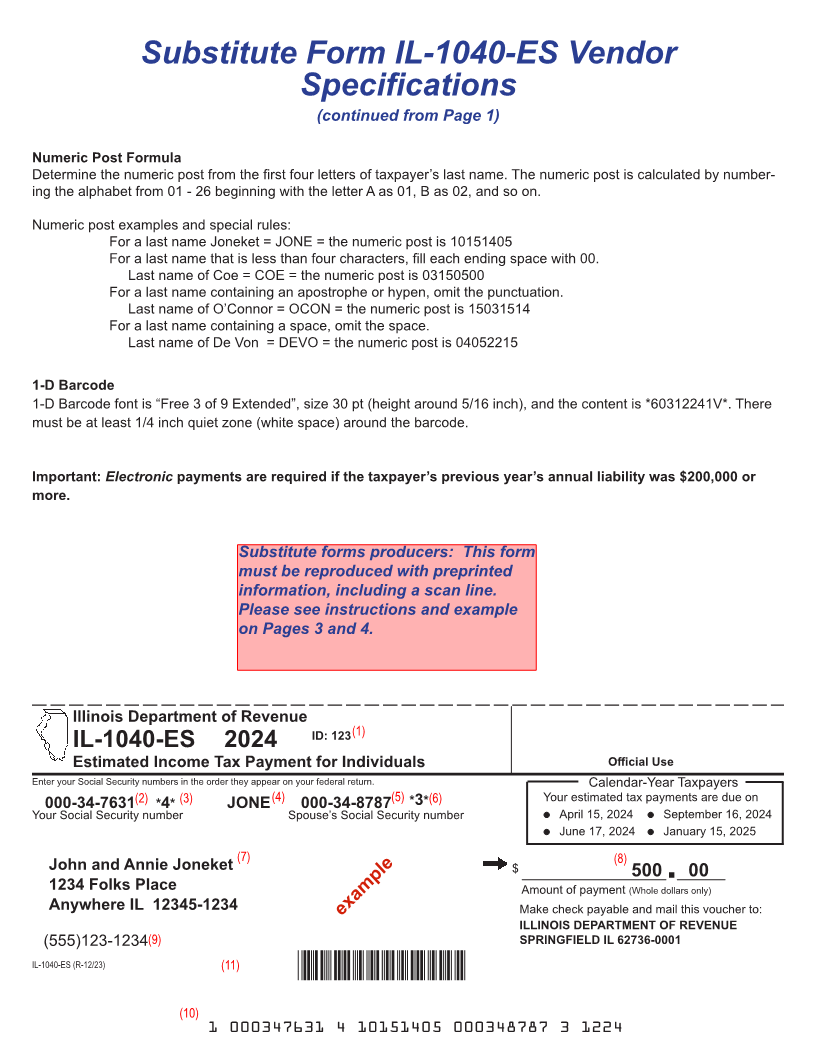

Prepare each IL-1040-ES form with the following information:

(1) Software/Forms Developer ID Number

(2) Primary’s Social Security Number (SSN)

(3) Primary SSN Check Digit (See detailed instructions below.)

(4) Taxpayers’ Post - The first four letters of the taxpayer’s last name.

(5) Spouse’s SSN

(6) Spouse SSN Check Digit (See detailed instructions below.)

(7) Taxpayer’s Name and Address

(8) Amount of Payment. The payment amount field must show dollars and two positions for cents.

If the payment is a whole dollar amount, zero fill the cents field to the right of the dollar amount.

(9) Daytime Phone Number

(10) Scan Line (See detailed instructions below.)

(11) Barcode (See detailed instructions on the following page.)

SSN Check Digit Formula

The check digit is figured from the following calculations.

EXAMPLE: SSN = 0 0 0 3 4 7 6 3 1

Step 1: Beginning at the left most digit, multiply each digit of the SSN alternating by 2 and then 1.

0 0 0 3 4 7 6 3 1

X 2 1 2 1 2 1 2 1 2

= 0 0 0 3 8 7 12 3 2

Step 2: Add any two digit number in the products together to obtain one digit. (12 = 1 + 2 = )3

Step 3: Add the Step 1 products together substituting the one-digit number found in Step 2 for the two-digit number.

0 + 0 + 0 + 3 + 8 + 7 + 3 + 3 + 2 = 26.

Step 4: Determine the unit (ones) position of the result of Step 3. The unit position of 26 is 6.

Step 5: If the result of Step 4 is zero, then zero is the check digit. Otherwise, subtract the unit position from 10. For

the example, 10 - 6 = 4. 4 is the check digit.

Scan Line Placement and Contents

The scan line must be centered horizontally on the page (the center of the scan line must be at 4.25 inches) and

must fall between .25 and .375 inches from the bottom edge of the form. There must be only the scan line in the

bottom .5 inch of the form.

Contents: The scan line contains 39 positions as described below. The font for the scan line is “OCR-A Std”, size 10.

Positions within the scan line:

1 Voucher Number is always 1

2 Space

3 - 11 Primary’s SSN

12 Space

13 Primary SSN Check Digit (See formula above.)

14 Space

15 - 22 Numeric Post (See formula on next page.)

23 Space

24 - 32 Spouse’s SSN

33 Space

34 Spouse SSN Check Digit (See formula above.)

35 Space

36 - 39 Account Period Ending (APE). Fill with the last month and year of the tax year being paid (mmyy).

Example: December 2024 is 1224. Use the same APE for each estimated payment for the account.

Printed by the authority of the State of Illinois, Web only - 1 copy IL-1040-ES SPECS (R-12/23)