Enlarge image

Illinois Department of Revenue

IL-1040-ES Estimated Income Tax Payments for Individuals 2024

Am I required to make estimated income tax payments?

You must make estimated income tax payments if you reasonably expect your 2024 tax liability to exceed $1,000 after subtracting your Illinois

withholding, pass-through withholding, and tax credits for

• income tax paid to other states,

• Illinois Property Tax paid,

• education expenses,

• the Volunteer Emergency Worker Credit,

• the Earned Income Credit,

• pass-through entity tax credit, and

• Schedule 1299-C, Income Tax Subtractions and Credits (for individuals).

You will likely need to make estimated payments if your income is either fully or partially exempt from Illinois withholding.

Complete the Estimated Tax Worksheet to figure your estimated tax and to determine if you are required to make estimated tax payments. If

you plan to file a joint income tax return, you must figure your estimated tax on your joint income.

If you determine that you are required to make estimated payments, you should pay 100 percent of the tax. If your income changes during the

year, you should complete the amended worksheet.

Note: If you do not receive your income evenly throughout the year or if you must begin making estimated payments in midyear, see

Form IL-2210, Computation of Penalties for Individuals, for further details on annualizing your income.

When are my payments due?

Your first estimated payment is due by April 15, 2024. You may either pay all of your estimated tax at that time or pay your estimated tax in

four equal installments that are due on April 15, 2024; June 17, 2024; September 16, 2024; and January 15, 2025.

Note: If you file on a fiscal-year basis, please adjust all the due dates to correspond to your tax year.

Are there any exceptions?

You do not have to make estimated payments if you are

• 65 years or older and permanently living in a nursing home or

• a farmer. We consider you a farmer if at least two-thirds of your total federal gross income is from farming.

What if I do not make my payments?

You may be assessed a late-payment penalty if you do not pay the required estimated payments on time. We will apply each payment to the

earliest due date until that liability is paid, unless you provide specific instructions to apply it to another period. However, if you pay at least 90

percent of this year’s tax or at least 100 percent of last year’s tax in four equal timely installments, you may not be subject to this penalty.

For more information about penalties and interest, see Publication 103, Penalties and Interest for Illinois Taxes.

What if I need additional assistance?

If you need additional assistance,

• visit our website at tax.illinois.gov,

• call 1 800 732-8866 or 217 782-3336 (TDD, telecommunications device for the deaf, at 1 800 544-5304),

• write to us at Illinois Department of Revenue, P.O. Box 19044, Springfield, Illinois 62794-9044, or

• visit a regional office.

Our office hours are 8:00 a.m. to 5:00 p.m. (Springfield office) and 8:30 a.m. to 5:00 p.m. (all other regional offices), Monday through Friday.

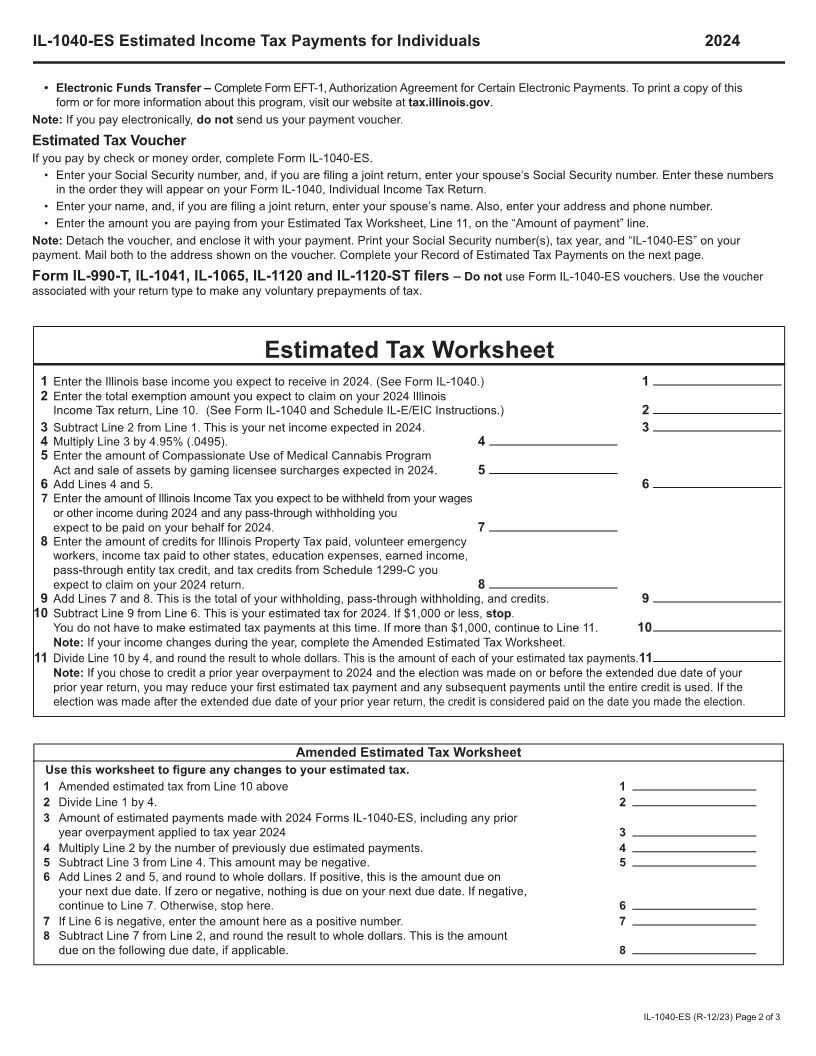

Estimated Tax Worksheet

Complete the Estimated Tax Worksheet to figure your estimated tax and the amount of any required payments.

If your income changes during the tax year,

• refigure the Estimated Tax Worksheet based on your changes. Enter the refigured amount from Line 10 on your Amended Estimated Tax

Worksheet, Line 1.

• follow the Amended Estimated Tax Worksheet instructions for Lines 2 through 8.

Note: Fiscal-year taxpayers – Please adjust the due dates to correspond to your tax year.

Electronic Payment Options

If you determine that you must make estimated tax payments, we encourage you to use one of the following electronic payment options:

• Online – Visit our website at mytax.illinois.gov to have your payment taken from your checking or savings account. You will

need your IL-PIN (Illinois Personal Identification Number).

• Credit Card – Use your MasterCard, Discover, American Express, or Visa. The credit card service provider will assess a convenience

fee. Have your credit card ready and visit our website or call one of the following:

• ACI Payments, Inc. athttps://tax.illinois.gov/individuals/pay/aci.html or by phone at 1 833 747-1434.

• payILtax athttps://www.paystatetax.com/IL or pay by phone at 1 888 9-PAY-ILS (1 888 972-9457).

• Link2Gov/FIS at https://www.iltaxpayment.com/ or by phone at 1 877 57-TAXES (1 877 578-2937).

IL-1040-ES (R-12/23) Page 1 of 3

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

Printed by authority of the State of Illinois, web only, 1. this information is required. Failure to provide information could result in a penalty.