- 2 -

Enlarge image

|

*61612231V*

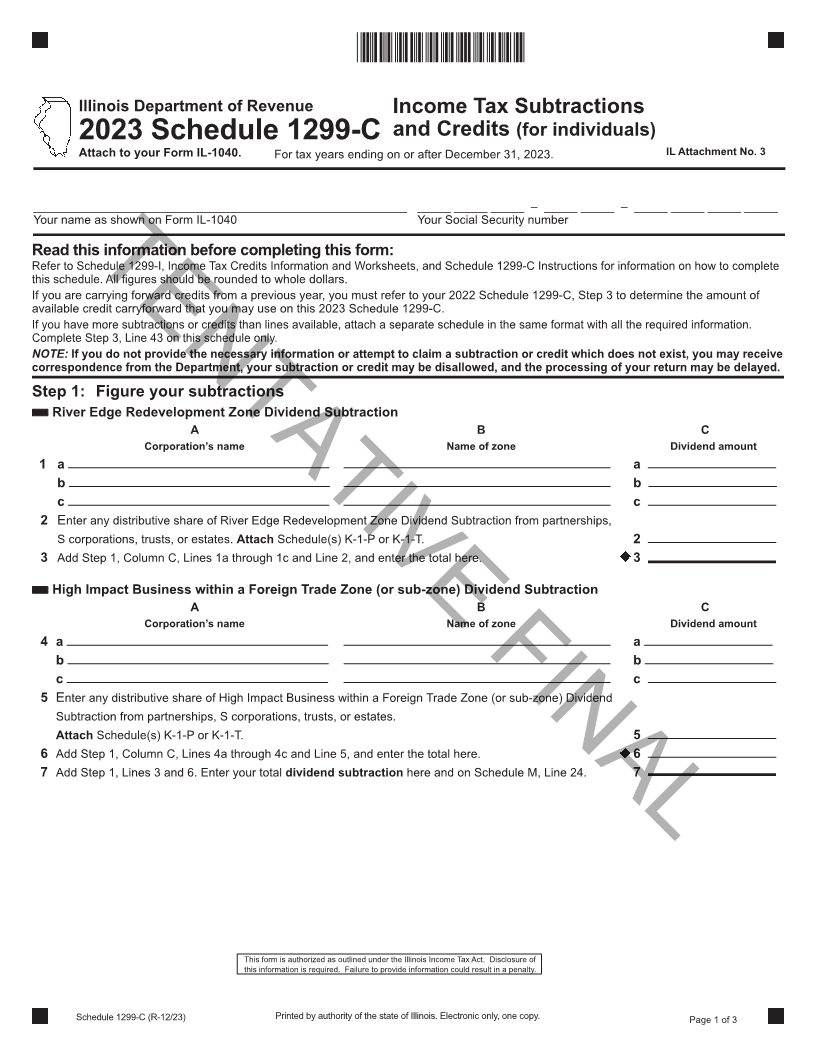

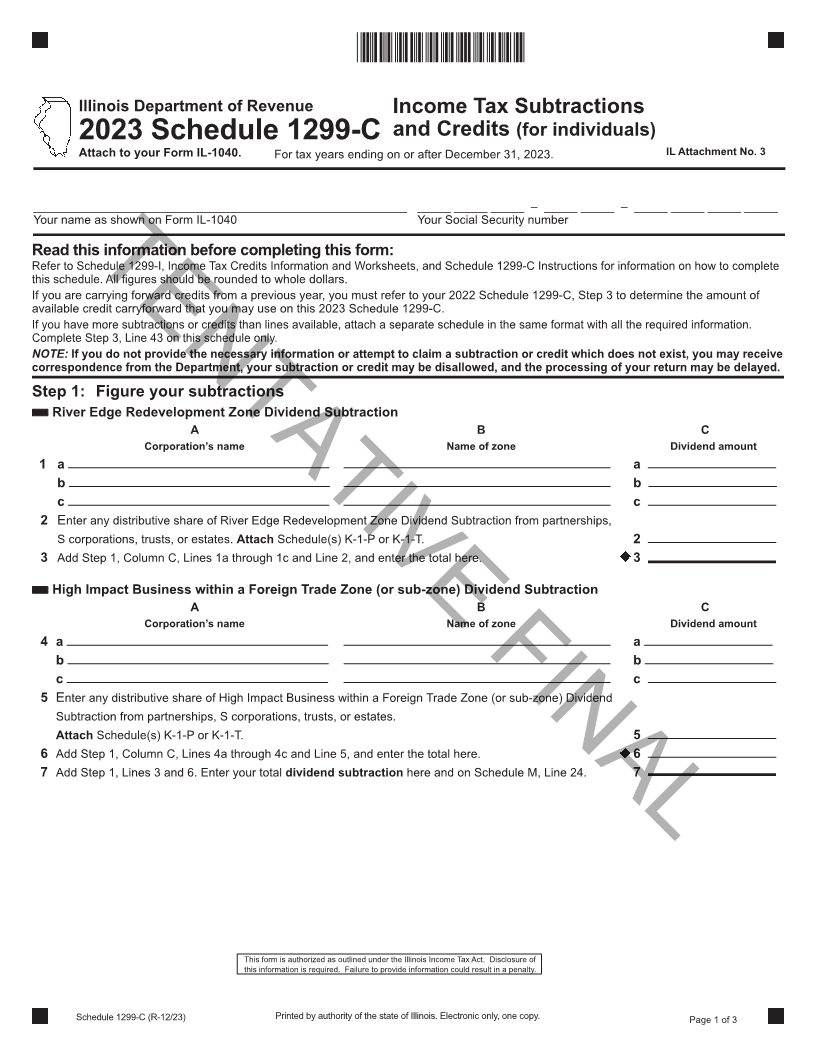

Illinois Department of Revenue Income Tax Subtractions

and Credits (for individuals)

2023 Schedule 1299-C

Attach to your Form IL-1040. For tax years ending on or after December 31, 2023. IL Attachment No. 3

________________________________________________________ _____ _____ _____ – _____ _____ – _____ _____ _____ _____

Your name as shown on Form IL-1040 Your Social Security number

Read this information before completing this form:

Refer to Schedule 1299-I, Income Tax Credits Information and Worksheets, and Schedule 1299-C Instructions for information on how to complete

this schedule.TENTATIVEAll figures should berounded to whole dollars. FINAL

If you are carrying forward credits from a previous year, you must refer to your 2022 Schedule 1299-C, Step 3 to determine the amount of

available credit carryforward that you may use on this 2023 Schedule 1299-C.

If you have more subtractions or credits than lines available, attach a separate schedule in the same format with all the required information.

Complete Step 3, Line 43 on this schedule only.

NOTE: If you do not provide the necessary information or attempt to claim a subtraction or credit which does not exist, you may receive

correspondence from the Department, your subtraction or credit may be disallowed, and the processing of your return may be delayed.

Step 1: Figure your subtractions

River Edge Redevelopment Zone Dividend Subtraction

A B C

Corporation’s name Name of zone Dividend amount

1 a a

b b

c c

2 Enter any distributive share of River Edge Redevelopment Zone Dividend Subtraction from partnerships,

S corporations, trusts, or estates. Attach Schedule(s) K-1-P or K-1-T. 2

3 Add Step 1, Column C, Lines 1a through 1c and Line 2, and enter the total here. 3

High Impact Business within a Foreign Trade Zone (or sub-zone) Dividend Subtraction

A B C

Corporation’s name Name of zone Dividend amount

4 a a

b b

c c

5 Enter any distributive share of High Impact Business within a Foreign Trade Zone (or sub-zone) Dividend

Subtraction from partnerships, S corporations, trusts, or estates.

Attach Schedule(s) K-1-P or K-1-T. 5

6 Add Step 1, Column C, Lines 4a through 4c and Line 5, and enter the total here. 6

7 Add Step 1, Lines 3 and 6. Enter your total dividend subtraction here and on Schedule M, Line 24. 7

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

this information is required. Failure to provide information could result in a penalty.

Schedule 1299-C (R-12/23) Printed by authority of the state of Illinois. Electronic only, one copy. Page 1 of 3

|