- 2 -

Enlarge image

|

*61312231V*

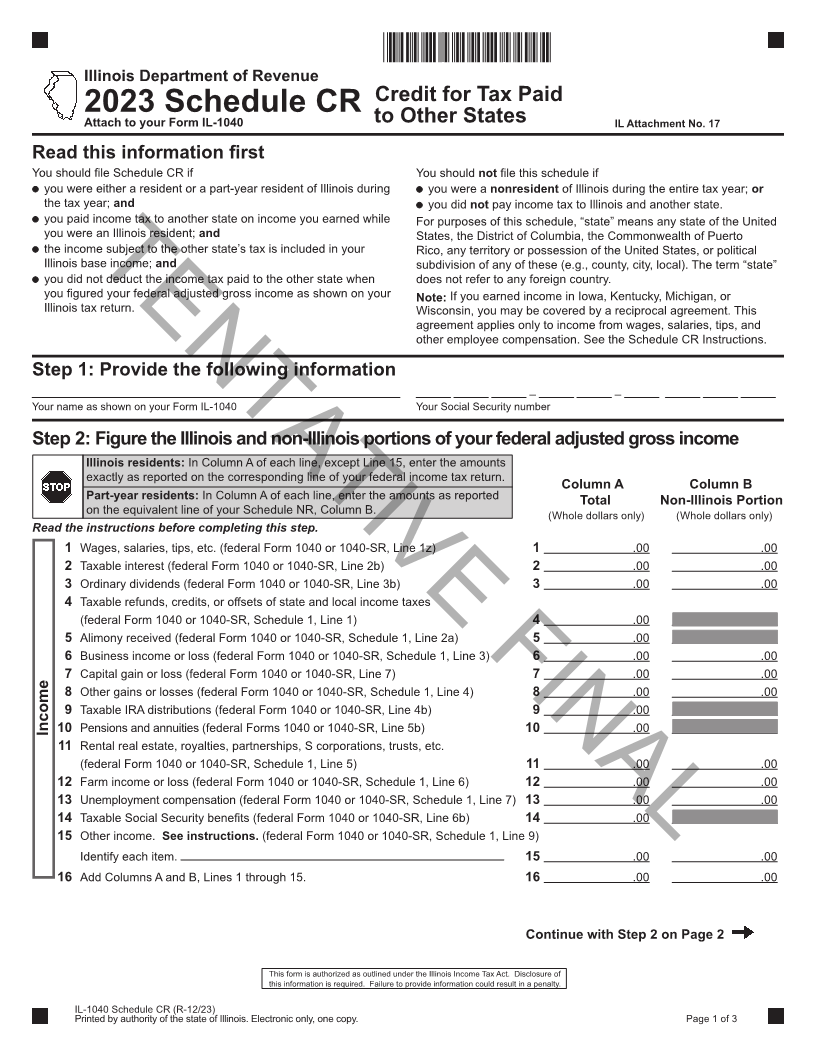

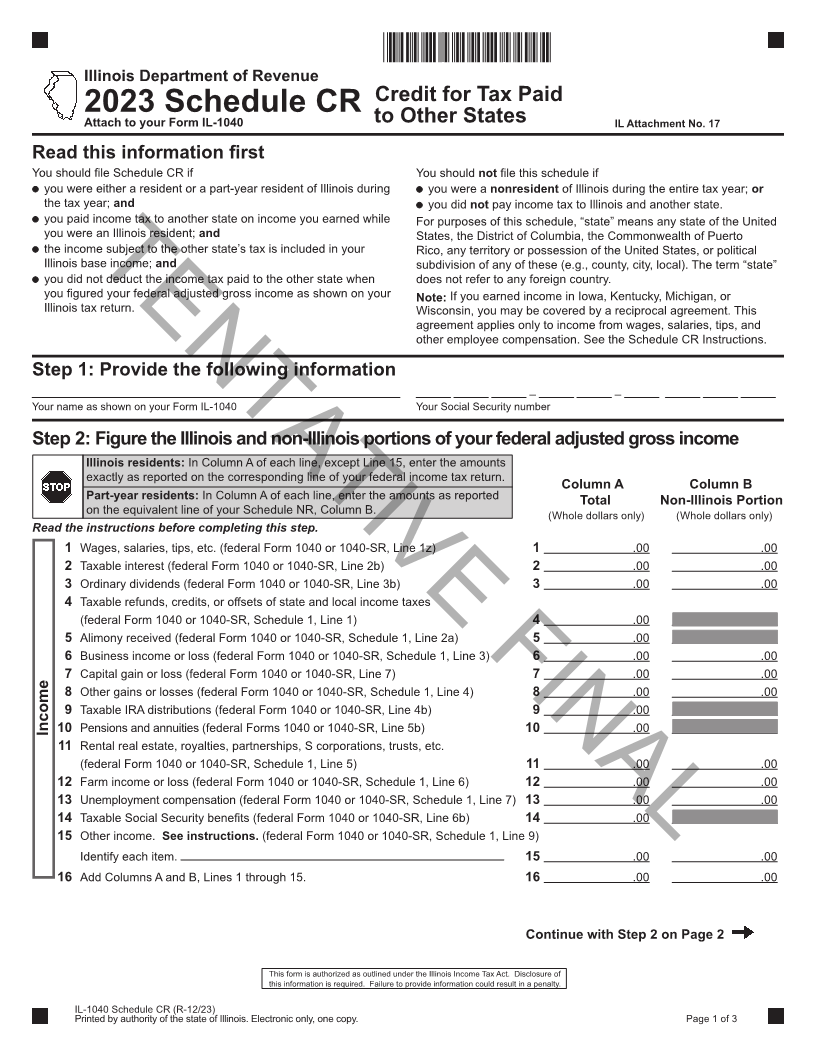

Illinois Department of Revenue

Credit for Tax Paid

2023 Schedule CR

Attach to your Form IL-1040 to Other States IL Attachment No. 17

Read this information first

You should file Schedule CR if You should not file this schedule if

you were either a resident or a part‑year resident of Illinois during you were a nonresident of Illinois during the entire tax year; or

the tax year; and you did not pay income tax to Illinois and another state.

you paid income tax to another state on income you earned while For purposes of this schedule, “state” means any state of the United

you were an Illinois resident; and States, the District of Columbia, the Commonwealth of Puerto

the income subject to the other state’s tax is included in your Rico, any territory or possession of the United States, or political

Illinois base income; and subdivision of any of these (e.g., county, city, local). The term “state”

you didTENTATIVEnot deduct the income tax paid to the other state when does not refer to any foreign country. FINAL

you figured your federal adjusted gross income as shown on your Note: If you earned income in Iowa, Kentucky, Michigan, or

Illinois tax return. Wisconsin, you may be covered by a reciprocal agreement. This

agreement applies only to income from wages, salaries, tips, and

other employee compensation. See the Schedule CR Instructions.

Step 1: Provide the following information

– –

Your name as shown on your Form IL‑1040 Your Social Security number

Step 2: Figure the Illinois and non-Illinois portions of your federal adjusted gross income

Illinois residents: In Column A of each line, except Line 15, enter the amounts

exactly as reported on the corresponding line of your federal income tax return.

Column A Column B

Part-year residents: In Column A of each line, enter the amounts as reported Total Non-Illinois Portion

on the equivalent line of your Schedule NR, Column B. (Whole dollars only) (Whole dollars only)

Read the instructions before completing this step.

1 Wages, salaries, tips, etc. (federal Form 1040 or 1040‑SR, Line 1z) 1 .00 .00

2 Taxable interest (federal Form 1040 or 1040‑SR, Line 2b) 2 .00 .00

3 Ordinary dividends (federal Form 1040 or 1040‑SR, Line 3b) 3 .00 .00

4 Taxable refunds, credits, or offsets of state and local income taxes

(federal Form 1040 or 1040‑SR, Schedule 1, Line 1) 4 .00 .00

5 Alimony received (federal Form 1040 or 1040‑SR, Schedule 1, Line 2a) 5 .00 .00

6 Business income or loss (federal Form 1040 or 1040‑SR, Schedule 1, Line 3) 6 .00 .00

7 Capital gain or loss (federal Form 1040 or 1040‑SR, Line 7) 7 .00 .00

8 Other gains or losses (federal Form 1040 or 1040‑SR, Schedule 1, Line 4) 8 .00 .00

9 Taxable IRA distributions (federal Form 1040 or 1040‑SR, Line 4b) 9 .00 .00

Income 10 Pensions and annuities (federal Forms 1040 or 1040‑SR, Line 5b) 10 .00 .00

11 Rental real estate, royalties, partnerships, S corporations, trusts, etc.

(federal Form 1040 or 1040‑SR, Schedule 1, Line 5) 11 .00 .00

12 Farm income or loss (federal Form 1040 or 1040‑SR, Schedule 1, Line 6) 12 .00 .00

13 Unemployment compensation (federal Form 1040 or 1040‑SR, Schedule 1, Line 7) 13 .00 .00

14 Taxable Social Security benefits (federal Form 1040 or 1040-SR, Line 6b) 14 .00 .00

15 Other income. See instructions. (federal Form 1040 or 1040‑SR, Schedule 1, Line 9)

Identify each item. 15 .00 .00

16 Add Columns A and B, Lines 1 through 15. 16 .00 .00

Continue with Step 2 on Page 2

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

this information is required. Failure to provide information could result in a penalty.

IL‑1040 Schedule CR (R‑12/23)

Printed by authority of the state of Illinois. Electronic only, one copy. Page 1 of 3

|