Enlarge image

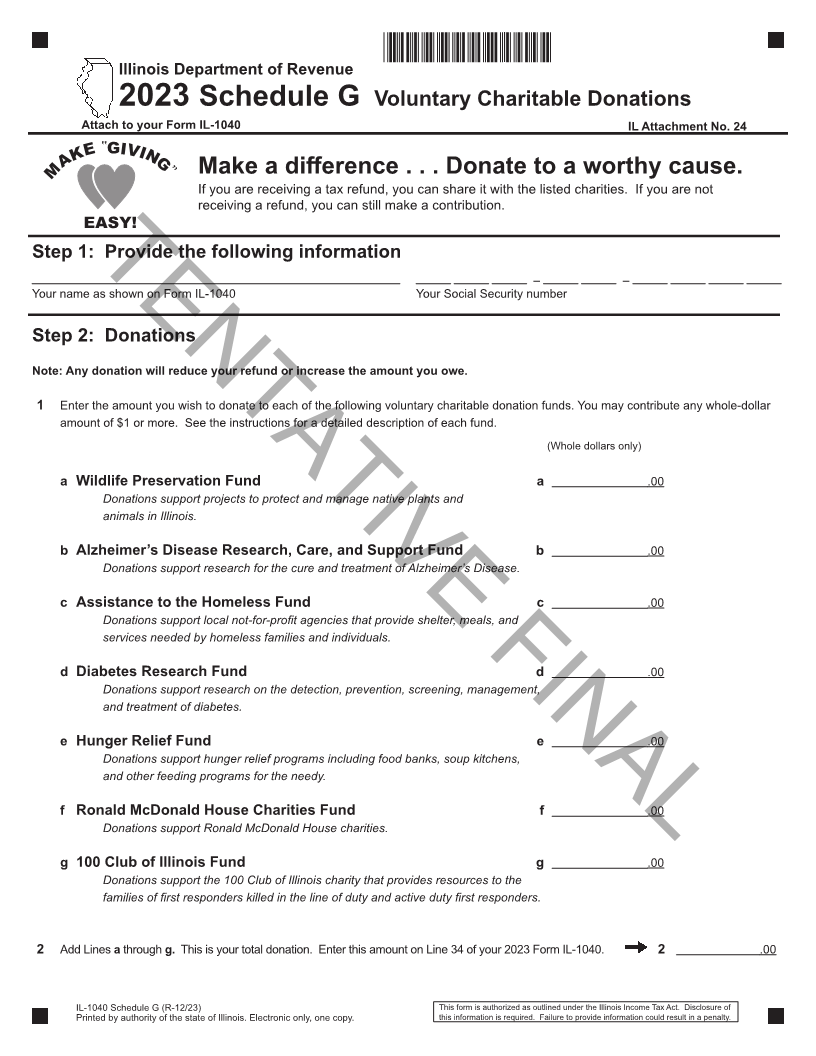

ILLINOIS DEPARTMENT OF REVENUE

DRAFT FORM

Note: The draft you are looking for begins on the next page.

Caution: DRAFT—NOT FOR FILING

This is an early release draft of an Illinois Department of Revenue (IDOR) tax form or instructions, which

IDOR is providing for substitute forms providers. Do not file draft forms and do not rely on draft forms

and instructions for filing. We incorporate all significant changes to forms posted with this coversheet.

However, unexpected issues occasionally arise, or legislation is passed—in this case, we will post a new

draft of the form to alert users that changes were made to the previously posted draft.

All forms and instructions have a page on our website at Tax Forms (illinois.gov) where you may see the

final versions once they are released. Year-end income tax forms are usually released towards the end

of January.

If you wish, you can submit comments and questions to IDOR about draft or final forms and instructions

at REV.VendorForms@illinois.gov. We will forward this information to the Office of Publications

Management, where forms and publications are administered.

IDR-1-DIS (N-08/23) Printed by authority of State of Illinois, web only –one copy.