- 4 -

Enlarge image

|

*66112233V*

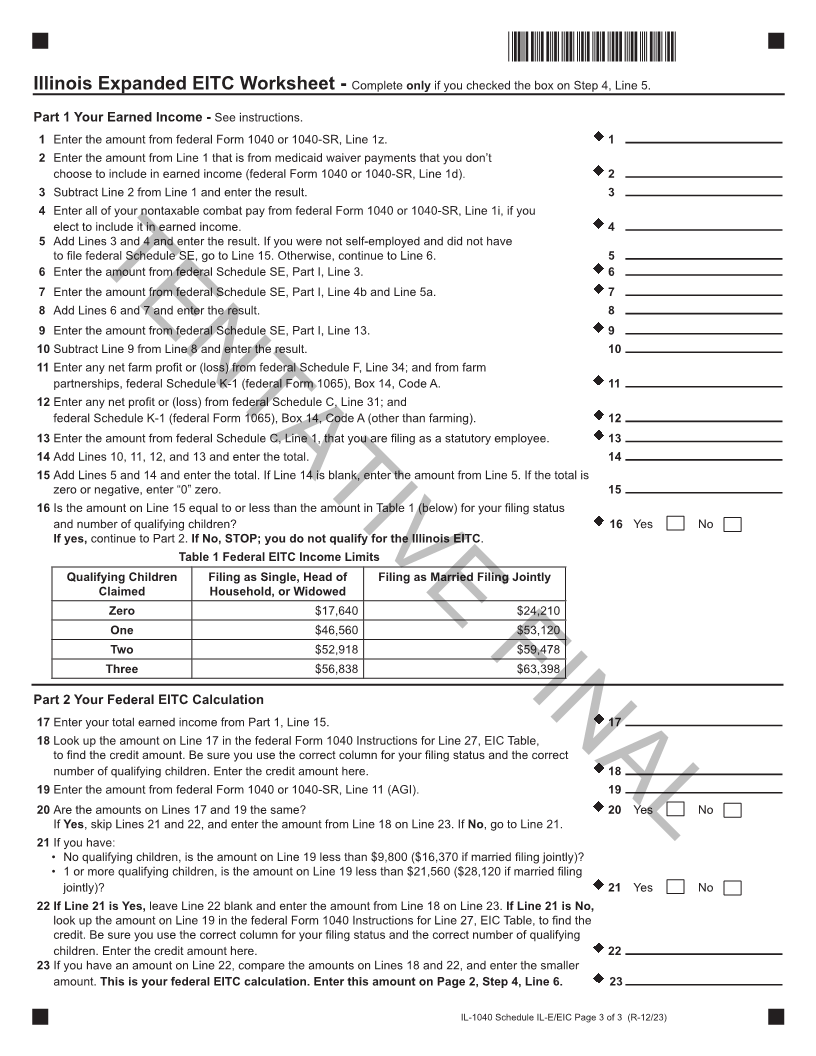

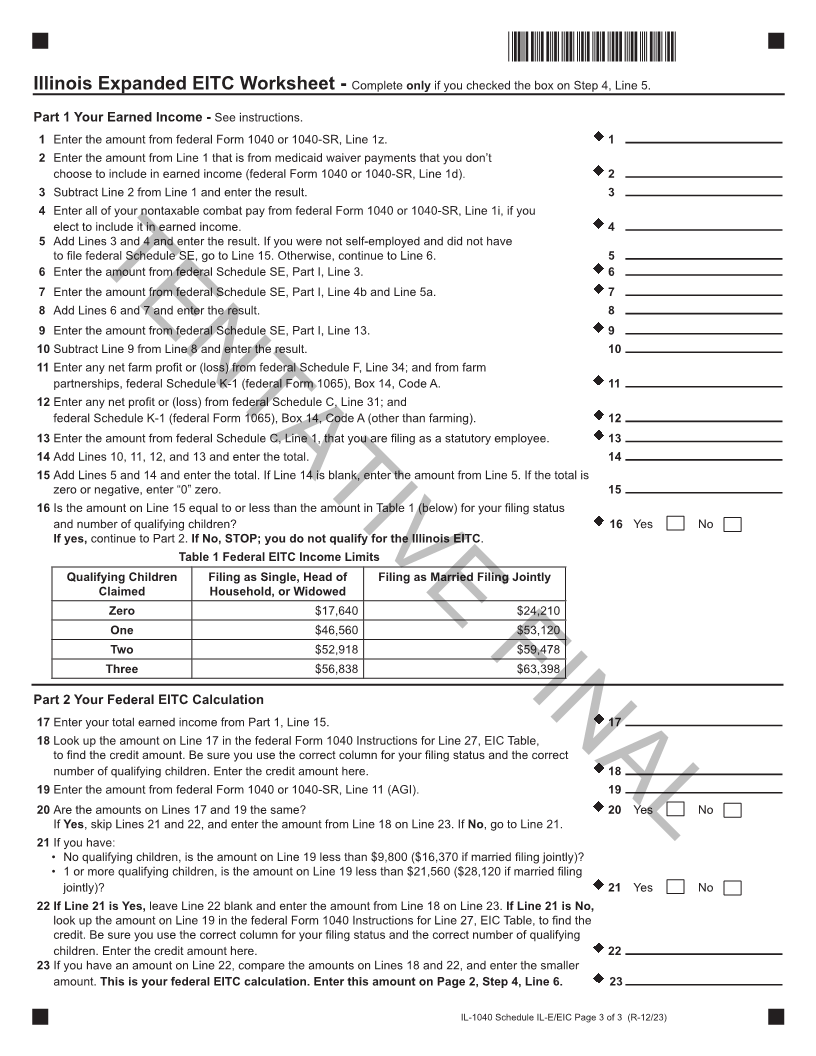

Illinois Expanded EITC Worksheet - Complete only if you checked the box on Step 4, Line 5.

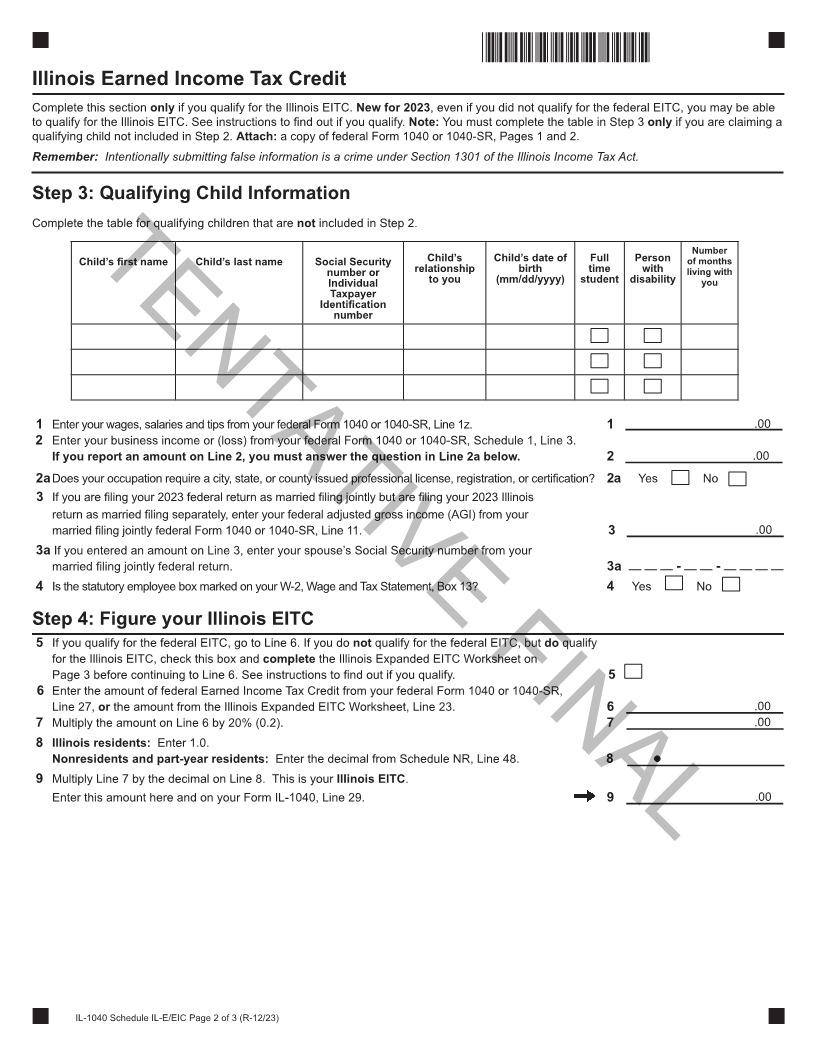

Part 1 Your Earned Income - See instructions.

1 Enter the amount from federal Form 1040 or 1040-SR, Line 1z. 1

2 Enter the amount from Line 1 that is from medicaid waiver payments that you don’t

choose to include in earned income (federal Form 1040 or 1040-SR, Line 1d). 2

3 Subtract Line 2 from Line 1 and enter the result. 3

4 Enter all of your nontaxable combat pay from federal Form 1040 or 1040-SR, Line 1i, if you

elect to include it in earned income. 4

5 Add Lines 3 and 4 and enter the result. If you were not self-employed and did not have

Number

to file federalof monthsSchedulePersonSE, goFullto LineChild’s15. Otherwise,date of continueChild’sto Line 6.Social Security Child’s last name 5 Child’s first name

6 EnterTENTATIVElivingthe amountwith fromwith federaltimeSchedule SE,birthPart I, Linerelationship3. number or 6 FINAL

you disability student (mm/dd/yyyy) to you Individual

7 Enter the amount from federal Schedule SE, Part I, Line 4b and Line 5a. Taxpayer 7

8 number

Add Lines 6 and 7 and enter the result. Identification 8

9 Enter the amount from federal Schedule SE, Part I, Line 13. 9

10 Subtract Line 9 from Line 8 and enter the result. 10

11 Enter any net farm profit or (loss) from federal Schedule F, Line 34; and from farm

partnerships, federal Schedule K-1 (federal Form 1065), Box 14, Code A. 11

12 Enter any net profit or (loss) from federal Schedule C, Line 31; and

federal Schedule K-1 (federal Form 1065), Box 14, Code A (other than farming). 12

13 Enter the amount from federal Schedule C, Line 1, that you are filing as a statutory employee. 13

14 Add Lines 10, 11, 12, and 13 and enter the total. 14

15 Add Lines 5 and 14 and enter the total. If Line 14 is blank, enter the amount from Line 5. If the total is

zero or negative, enter “0” zero. 15

16 Is the amount on Line 15 equal to or less than the amount in Table 1 (below) for your filing status

and number of qualifying children? 16 Yes No

If yes, continue to Part 2. If No, STOP; you do not qualify for the Illinois EITC.

Table 1 Federal EITC Income Limits

Qualifying Children Filing as Single, Head of Filing as Married Filing Jointly

Claimed Household, or Widowed

Zero $17,640 $24,210

One $46,560 $53,120

Two $52,918 $59,478

Three $56,838 $63,398

Part 2 Your Federal EITC Calculation

17 Enter your total earned income from Part 1, Line 15. 17

18 Look up the amount on Line 17 in the federal Form 1040 Instructions for Line 27, EIC Table,

to find the credit amount. Be sure you use the correct column for your filing status and the correct

number of qualifying children. Enter the credit amount here. 18

19 Enter the amount from federal Form 1040 or 1040-SR, Line 11 (AGI). 19

20 Are the amounts on Lines 17 and 19 the same? 20 Yes No

If Yes, skip Lines 21 and 22, and enter the amount from Line 18 on Line 23. If No, go to Line 21.

21 If you have:

• No qualifying children, is the amount on Line 19 less than $9,800 ($16,370 if married filing jointly)?

• 1 or more qualifying children, is the amount on Line 19 less than $21,560 ($28,120 if married filing

jointly)? 21 Yes No

22 If Line 21 is Yes, leave Line 22 blank and enter the amount from Line 18 on Line 23. If Line 21 is No,

look up the amount on Line 19 in the federal Form 1040 Instructions for Line 27, EIC Table, to find the

credit. Be sure you use the correct column for your filing status and the correct number of qualifying

children. Enter the credit amount here. 22

23 If you have an amount on Line 22, compare the amounts on Lines 18 and 22, and enter the smaller

amount.This is your federal EITC calculation. Enter this amount on Page 2, Step 4, Line 6. 23

IL-1040 Schedule IL-E/EIC Page 3 of 3 (R-12/23)

|