- 3 -

Enlarge image

|

*60412232V*

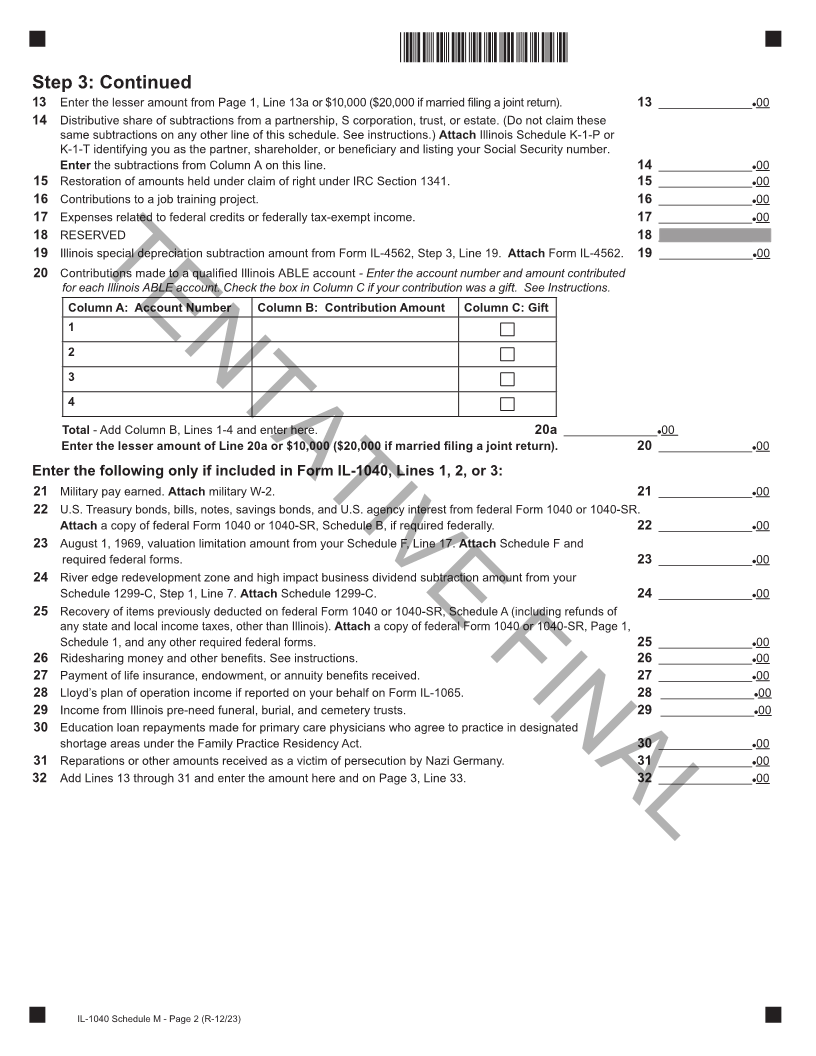

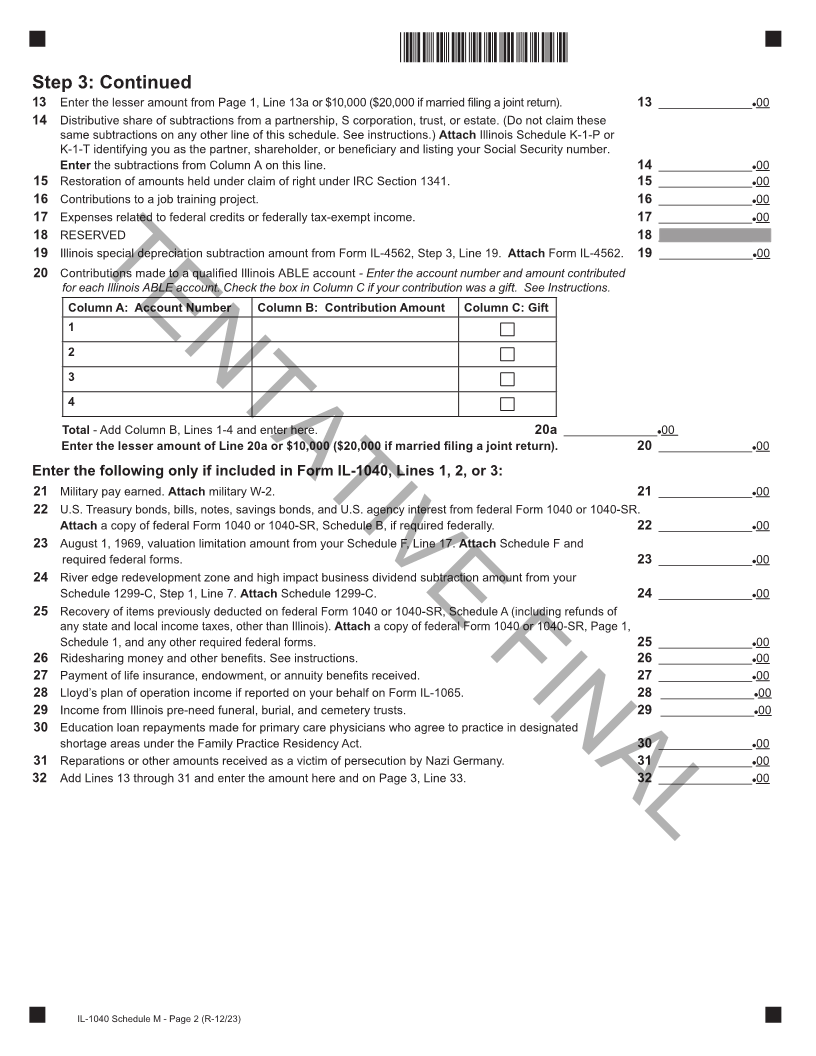

Step 3: Continued

13 Enter the lesser amount from Page 1, Line 13a or $10,000 ($20,000 if married filing a joint return). 13 ______________ 00

14 Distributive share of subtractions from a partnership, S corporation, trust, or estate. (Do not claim these

same subtractions on any other line of this schedule. See instructions.) Attach Illinois Schedule K-1-P or

K-1-T identifying you as the partner, shareholder, or beneficiary and listing your Social Security number.

Enter the subtractions from Column A on this line. 14 ______________ 00

15 Restoration of amounts held under claim of right under IRC Section 1341. 15 ______________ 00

16 Contributions to a job training project. 16 ______________ 00

17 Expenses related to federal credits or federally tax-exempt income. 17 ______________ 00

18 RESERVED 18 ______________ 00

19 Illinois special depreciation subtraction amount from Form IL-4562, Step 3, Line 19. Attach Form IL-4562. 19 ______________ 00

20 ContributionsTENTATIVEmade to a qualified Illinois ABLE account - Enter the account number and amount contributedFINAL

for each Illinois ABLE account. Check the box in Column C if your contribution was a gift. See Instructions.

Column A: Account Number Column B: Contribution Amount Column C: Gift

1

2

3

4

Total - Add Column B, Lines 1-4 and enter here. 20a ______________ 00

Enter the lesser amount of Line 20a or $10,000 ($20,000 if married filing a joint return). 20 ______________ 00

Enter the following only if included in Form IL-1040, Lines 1, 2, or 3:

21 Military pay earned. Attach military W-2. 21 ______________ 00

22 U.S. Treasury bonds, bills, notes, savings bonds, and U.S. agency interest from federal Form 1040 or 1040-SR .

Attach a copy of federal Form 1040 or 1040-SR, Schedule B, if required federally. 22 ______________ 00

23 August 1, 1969, valuation limitation amount from your Schedule F, Line 17. Attach Schedule F and

required federal forms. 23 ______________ 00

24 River edge redevelopment zone and high impact business dividend subtraction amount from your

Schedule 1299-C, Step 1, Line 7. Attach Schedule 1299-C. 24 ______________ 00

25 Recovery of items previously deducted on federal Form 1040 or 1040-SR, Schedule A (including refunds of

any state and local income taxes, other than Illinois). Attach a copy of federal Form 1040 or 1040-SR, Page 1,

Schedule 1, and any other required federal forms. 25 ______________ 00

26 Ridesharing money and other benefits. See instructions. 26 ______________ 00

27 Payment of life insurance, endowment, or annuity benefits received. 27 ______________ 00

28 Lloyd’s plan of operation income if reported on your behalf on Form IL-1065. 28 ______________ 00

29 Income from Illinois pre-need funeral, burial, and cemetery trusts. 29 ______________ 00

30 Education loan repayments made for primary care physicians who agree to practice in designated

shortage areas under the Family Practice Residency Act. 30 ______________ 00

31 Reparations or other amounts received as a victim of persecution by Nazi Germany. 31 ______________ 00

32 Add Lines 13 through 31 and enter the amount here and on Page 3, Line 33. 32 ______________ 00

IL-1040 Schedule M - Page 2 (R-12/23)

|